Penghitungan Biaya Produksi, HPP, dan Menetapkan Harga Jual

Summary

TLDRThis video guides viewers through the process of calculating production costs, determining the selling price, and calculating both gross and net profit. The presenter explains how to compute the cost of production (HPP) using examples from a culinary business (ayam geprek) and a digital printing service. Additionally, viewers learn the importance of market research in setting appropriate selling prices and the necessity of calculating operational costs. The video also covers how to calculate gross profit by using simple formulas and real-life business scenarios, helping entrepreneurs better understand financial management for small businesses.

Takeaways

- 😀 The importance of calculating production costs (HPP) to determine accurate pricing and profitability in a business.

- 😀 HPP represents the cost of producing a product or service, including materials, labor, and other direct expenses.

- 😀 To calculate HPP, divide total production costs by the number of units produced.

- 😀 Conducting market research is vital before setting a selling price to ensure competitiveness while covering costs.

- 😀 A business should aim for at least a 33% gross profit margin to ensure sustainability and profitability.

- 😀 Operational costs, such as salaries, utilities, and transportation, must be accounted for separately from production costs.

- 😀 Gross profit is calculated by subtracting HPP from the selling price and multiplying by the number of units sold.

- 😀 To calculate net profit, subtract total operational costs from the gross profit.

- 😀 Proper management of operational costs (e.g., rent, employee salaries, and materials) is essential to maintain profitability.

- 😀 Entrepreneurs should regularly review both gross and net profits to assess business health and make adjustments as needed.

Q & A

What is the purpose of calculating the cost of production (HPP)?

-The purpose of calculating the cost of production (HPP) is to determine the exact cost spent on producing goods or services. This helps to understand how much money is invested in making a product, ensuring better pricing decisions and cost management.

How is the price of a product determined according to the script?

-The price of a product should be determined based on market surveys, considering the highest and lowest prices of similar products. The price can be set near the market price or at the lowest price, with value-added features justifying a higher price.

What factors are included in the calculation of the operational costs of a business?

-Operational costs include employee wages, rent, utilities (such as electricity and water), transportation costs, and other daily business expenses like materials, packaging, and miscellaneous costs.

What is the formula for calculating gross profit?

-The formula for calculating gross profit is: Gross Profit = (Selling Price - HPP) * Number of Sales per Day.

How can a business determine its selling price based on production costs?

-A business can determine the selling price by calculating the cost of production (HPP) and adding a desired profit margin. For example, if the HPP is $6,000 and the desired selling price is $9,000, the profit would be $3,000 or 33%.

Why is it risky to set the profit margin too low?

-Setting a profit margin too low (below 10%) is risky because it may not cover the operational costs, leaving the business vulnerable. A higher profit margin ensures that the business can cover its expenses and still make a reasonable profit.

What are the key components of calculating net profit?

-Net profit is calculated by subtracting operational costs from gross profit. This final amount reflects the actual earnings after all business expenses, including taxes, are deducted.

How can a business owner calculate the net profit of their business?

-A business owner can calculate net profit by subtracting total operational costs from the total gross profit earned in a given period (usually monthly). For example, if the gross profit is $18,000 and operational costs are $13,700, the net profit would be $4,300.

What is the importance of managing operational costs in a business?

-Managing operational costs is crucial for maintaining profitability. By accurately accounting for all operational expenses, a business can make informed decisions about pricing, sales targets, and the allocation of resources, ensuring long-term sustainability.

Can the pricing strategy for food businesses differ from service businesses? If so, how?

-Yes, the pricing strategy for food businesses can differ from service businesses. While food businesses typically focus on material costs and per-product profit, service businesses focus more on the value added through services and may have different pricing models, such as hourly rates or package deals.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

X KD4 Harga Pokok Produksi - Menghitung Harga Pokok Produksi, Harga Jual, Laba

Break Event Point atau Titik Impas - Produk Kreatif dan Kewiraushaan SMK kelas 11

LAPORAN LABA RUGI PADA PERUSAHAAN DAGANG

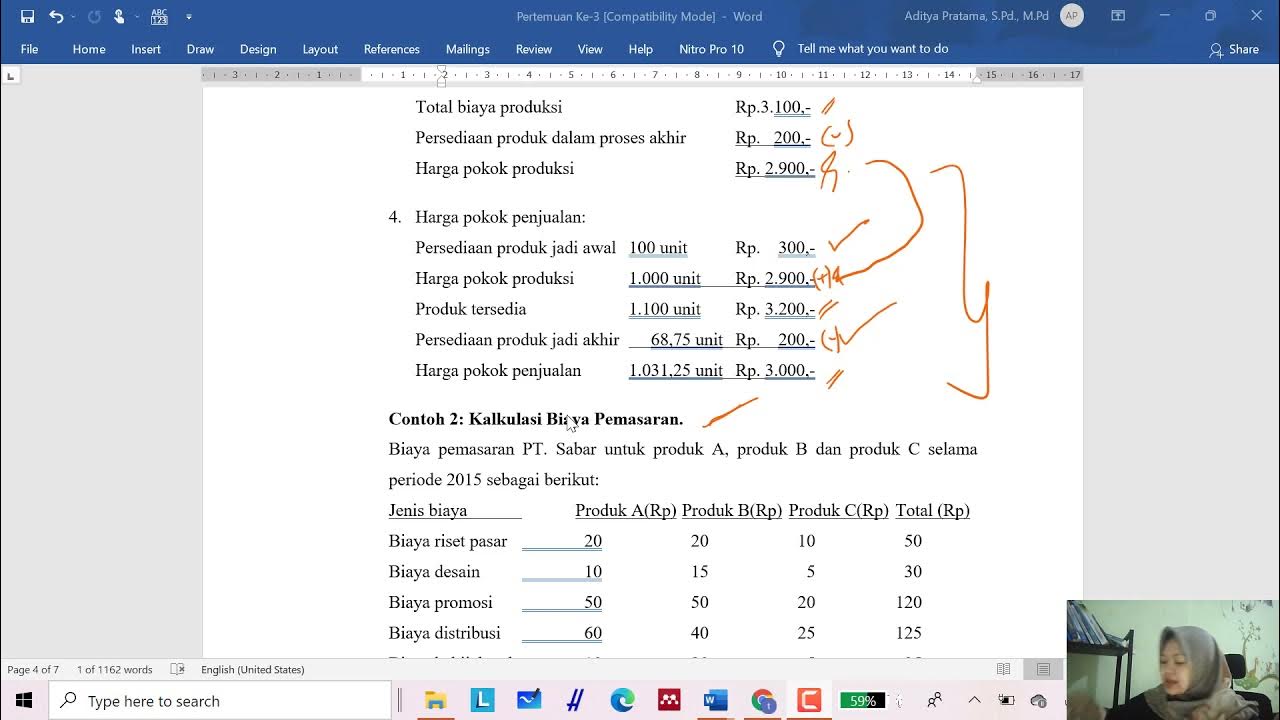

KALKULASI BIAYA DAN LABA RUGI / AKUNTANSI MANAJEMEN PERTEMUAN 3

PART 7 PEMBUATAN APLIKASI EXCEL AKUNTANSI 2023 | LABA RUGI

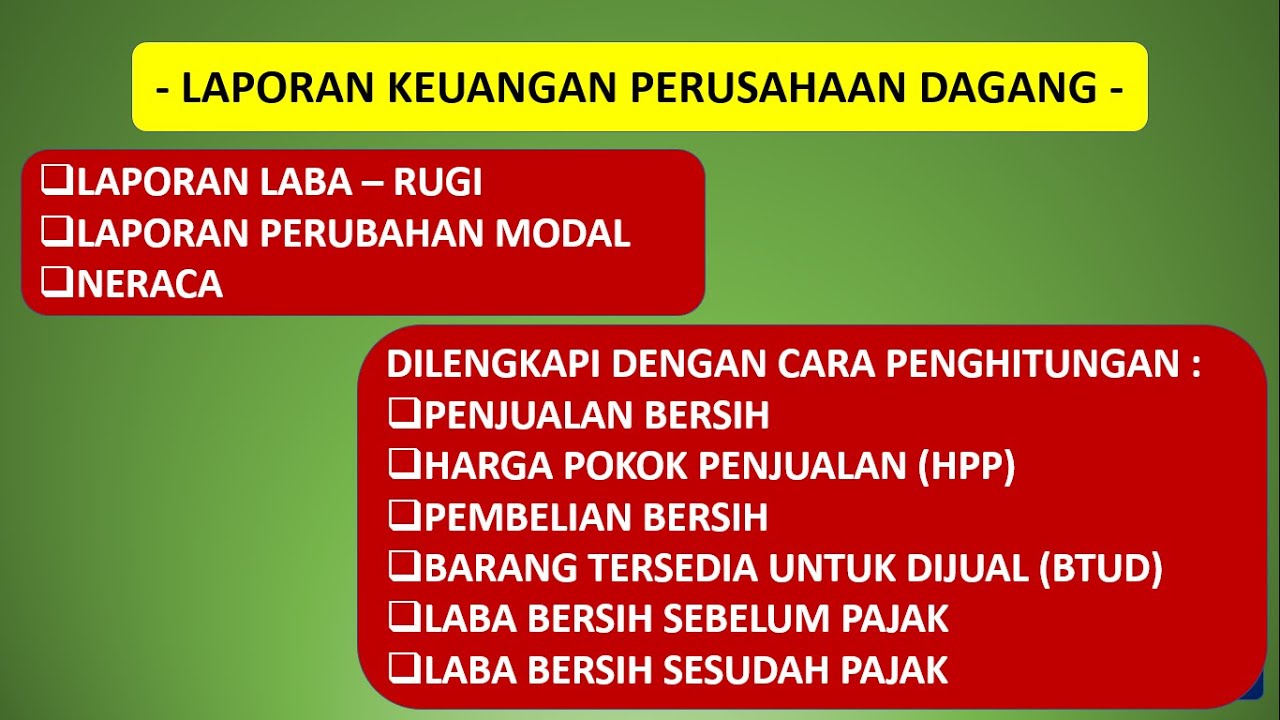

LAPORAN KEUANGAN PERUSAHAAN DAGANG

5.0 / 5 (0 votes)