Hashrate Derivatives: Explaining Forwards Contracts by Luxor Technology

Summary

TLDRLuxor Derivatives offers a suite of innovative Bitcoin mining derivatives, including Non-Deliverable and Deliverable Forward Contracts, aimed at institutional miners and firms. These contracts provide a way to hedge mining operations, stabilize cash flow, and gain exposure to Bitcoin mining without owning hardware. At the core is hashprice, a metric measuring the revenue from mining compute power. Luxor’s platform provides a liquid marketplace, helping miners and traders navigate volatility while offering transparency and educational resources. The platform enables better capital access and offers a unique investment opportunity in the mining sector.

Takeaways

- 😀 Luxor Derivatives offers Bitcoin compute power as a globally traded commodity, with a variety of derivatives products including Non-Deliverable and Deliverable Forward Contracts.

- 😀 Their markets allow institutional miners to implement hashrate hedging strategies and provide firms exposure to Bitcoin mining without needing physical hardware.

- 😀 Hashrate is a core metric for Luxor, measuring the revenue generated from a specific quantity of compute power, considering factors like block subsidy, transaction fees, network difficulty, and Bitcoin price.

- 😀 Luxor's derivatives aim to provide certainty to Bitcoin miners by allowing them to lock in revenue and gain access to capital using their hashrate.

- 😀 Miners can hedge using Luxor's derivatives, reducing the volatility of future mining rewards, which in turn improves their cost of capital and financing terms.

- 😀 Prop trading firms and hedge funds use Luxor’s products to gain exposure to Bitcoin mining without managing physical hardware.

- 😀 The contracts offered by Luxor present an alternative way for firms to generate returns and alpha, with compute power as the underlying asset.

- 😀 Luxor provides a robust and liquid marketplace for miners, market makers, and traders to participate in hashrate trading.

- 😀 Buyers and sellers agree on terms such as hashprice, daily hashrate, and contract duration, with Luxor acting as the settlement agent to ensure fairness.

- 😀 Luxor provides educational resources on hedging strategies and has a dedicated derivatives team available for guidance.

- 😀 Through Luxor’s Hashrate Order Book and OTC desk, clients can easily submit bids and get automated market notifications to make informed decisions.

Q & A

What is Luxor Derivatives?

-Luxor Derivatives is a platform that offers a suite of derivative products based on Bitcoin hashrate, including Non-Deliverable and Deliverable Forward Contracts, designed for institutional miners and investors seeking exposure to Bitcoin mining without the need to manage physical hardware.

What is hashprice, and why is it important?

-Hashprice is a metric coined by Luxor in 2019 that measures the revenue generated from a given amount of hashrate. It reflects the value miners receive for their compute power, taking into account factors such as block subsidy, transaction fees, network difficulty, and Bitcoin price.

How do Luxor’s derivatives help Bitcoin miners?

-Luxor’s derivatives, including forward contracts, allow Bitcoin miners to hedge against the volatility of mining rewards, providing them with more revenue certainty and improving their cost of capital, which in turn helps them secure better financing and debt terms.

What role does Luxor's platform play in Bitcoin mining?

-Luxor's platform acts as an intermediary between miners and market participants, enabling the buying and selling of hashrate contracts. It also ensures transparency and fairness through its settlement process, using the Bitcoin hashprice index as the underlying value.

Who are the primary participants in Luxor’s marketplace?

-The primary participants include miners looking to hedge their long hashprice exposure, market makers providing liquidity, hosting facilities, and prop traders seeking to generate alpha. This diversity of participants creates a deep and liquid marketplace.

How does Luxor’s Hashrate Order Book work?

-The Hashrate Order Book allows users to submit bids and offers for new contracts. It also features automated market notifications, helping participants make informed decisions in real-time.

How does Luxor facilitate the onboarding process for new users?

-Luxor facilitates onboarding through an ISDA (International Swaps and Derivatives Association) process, guiding users through the necessary steps to engage with hashrate forwards on the OTC (Over-The-Counter) desk.

What types of products does Luxor offer to address miners' needs?

-Luxor offers a variety of hashrate derivative products, including Non-Deliverable and Deliverable Forward Contracts. These products help miners hedge their mining operations, reducing exposure to market volatility and providing financial protection.

What advantages does Luxor provide to financial institutions?

-For financial institutions, Luxor offers innovative ways to gain exposure to the Bitcoin mining sector without the complexities of managing physical hardware. Luxor's hashrate derivatives provide a novel investment opportunity with potential for generating returns and alpha.

What is the core value proposition of Luxor Derivatives?

-The core value proposition of Luxor Derivatives is providing stability and financial protection for Bitcoin miners through innovative derivative products, while offering institutional investors a way to participate in Bitcoin mining with reduced risk and no need for physical infrastructure.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

CFA Level I Derivatives - Forward Contracts vs Futures Contracts

1. Options, Futures and Other Derivatives Ch1: Introduction Part 1

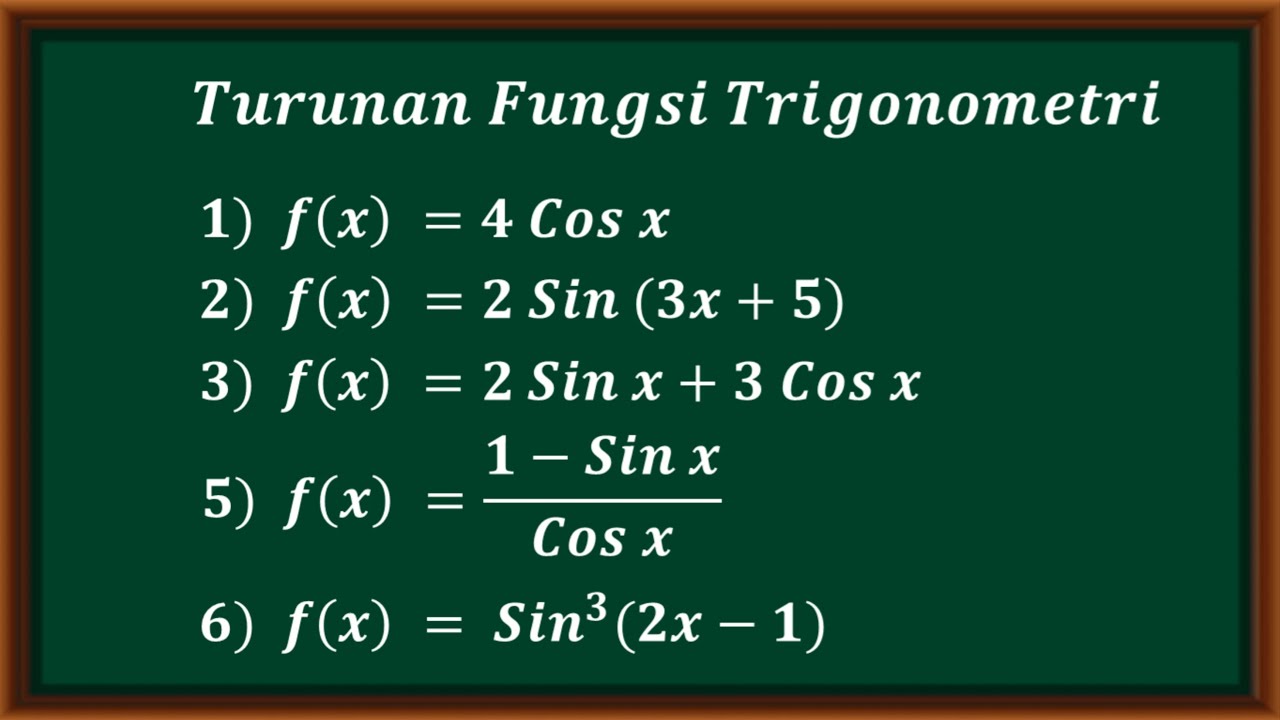

Turunan fungsi trigonometri

Massive Bitcoin Miner Predicts Big Bull Market!

What are financial instruments? | History of History of Financial Markets

Bitcoin Derivatives: Open Interest

5.0 / 5 (0 votes)