Session 18: Optimal Financing Mix II- The cost of capital approach

Summary

TLDRIn this session, the speaker explores critical concepts in economics, focusing on topics such as capital, its various forms, and their impact on economic systems. The speaker highlights the importance of understanding capital in shaping market dynamics and the role it plays in both individual and societal contexts. The presentation provides insightful perspectives on how capital influences production, investment, and the overall economy, aiming to clarify complex ideas for a broader audience.

Takeaways

- 😀 The cost of capital is a weighted average of the cost of debt and the cost of equity, crucial for investment decisions.

- 😀 Minimizing the cost of capital maximizes the value of a firm, and the goal is to find the optimal debt-equity mix.

- 😀 The optimal debt ratio for a company is where the cost of capital reaches its lowest point.

- 😀 A company’s capital structure impacts its weighted average cost of capital (WACC), which should be minimized for maximum firm value.

- 😀 The company’s cost of debt can be estimated by analyzing synthetic ratings based on the debt ratio and interest coverage.

- 😀 Adding debt reduces the cost of capital up to a certain point, but too much debt increases the cost due to risks like default.

- 😀 A higher debt ratio means the company can access cheaper financing, but the risk of financial distress also increases.

- 😀 The cost of equity is inversely related to leverage, meaning as debt increases, the cost of equity decreases but its risks grow.

- 😀 For Disney, the cost of capital decreased with increasing debt up to a 40% debt ratio, after which it began to rise.

- 😀 The trade-off theory highlights the balancing act between the tax benefits of debt and the increasing costs of financial distress.

Q & A

What is the primary objective when determining the optimal capital structure of a company?

-The primary objective is to determine the mix of debt and equity that minimizes the company's cost of capital, thereby maximizing firm value.

How does debt impact the cost of capital for a company?

-Introducing debt lowers the overall cost of capital due to the tax-deductibility of interest. However, as more debt is added, the cost of debt increases, and after a certain point, it starts to raise the overall cost of capital.

Why is Disney used as an example in this analysis?

-Disney is used as an example because it is a well-known company with publicly available data, allowing for a clear demonstration of the effects of different debt ratios on the cost of capital.

What does the cost of debt depend on, according to the script?

-The cost of debt depends on the interest rate a company must pay on its borrowed funds, which is influenced by the company’s credit rating and the perceived risk of its debt.

What is the significance of the 'synthetic rating' in this analysis?

-The synthetic rating is used to approximate a company’s credit rating based on its interest coverage ratio. This helps in estimating the cost of debt when the company does not have an official rating.

How does the debt-to-equity ratio affect the company’s risk and cost of capital?

-As the debt-to-equity ratio increases, the company's financial risk increases, which can raise both the cost of debt and the cost of equity. At high levels of debt, the company may face higher interest rates due to the increased perceived risk.

What is the role of tax in determining the optimal capital structure?

-Taxes play a key role because interest on debt is tax-deductible, which lowers the effective cost of debt and thus can reduce the overall cost of capital. This tax shield is an important consideration in the capital structure decision.

What is the 'chicken and egg' problem mentioned in the script?

-The 'chicken and egg' problem refers to the challenge of estimating the cost of debt accurately, as initial debt ratios influence ratings, which in turn affect the cost of debt. This requires iterative adjustments to find an optimal solution.

How is the optimal debt ratio determined in this analysis?

-The optimal debt ratio is determined by calculating the cost of capital at various levels of debt, then identifying the debt ratio that minimizes the overall cost of capital. In the example, this occurs at a debt ratio of around 40% for Disney.

What happens to the cost of capital beyond the optimal debt ratio?

-Beyond the optimal debt ratio, the cost of capital begins to increase rapidly as the company takes on more debt, leading to higher risk, higher interest rates, and reduced firm value.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

Masa Lalu Adalah Pelajaran Yang Berharga - Eps. 6 #GuruTalks

Rangkuman Materi EKONOMI Kelas 10 SMA Semester 1 Kurikulum 2013

Ekonomi Matrikulasi/ STPM (Mikro): Bab 1 - 1.1 Kajian Ekonomi (Takrif, Unit eko &Faktor pengeluaran)

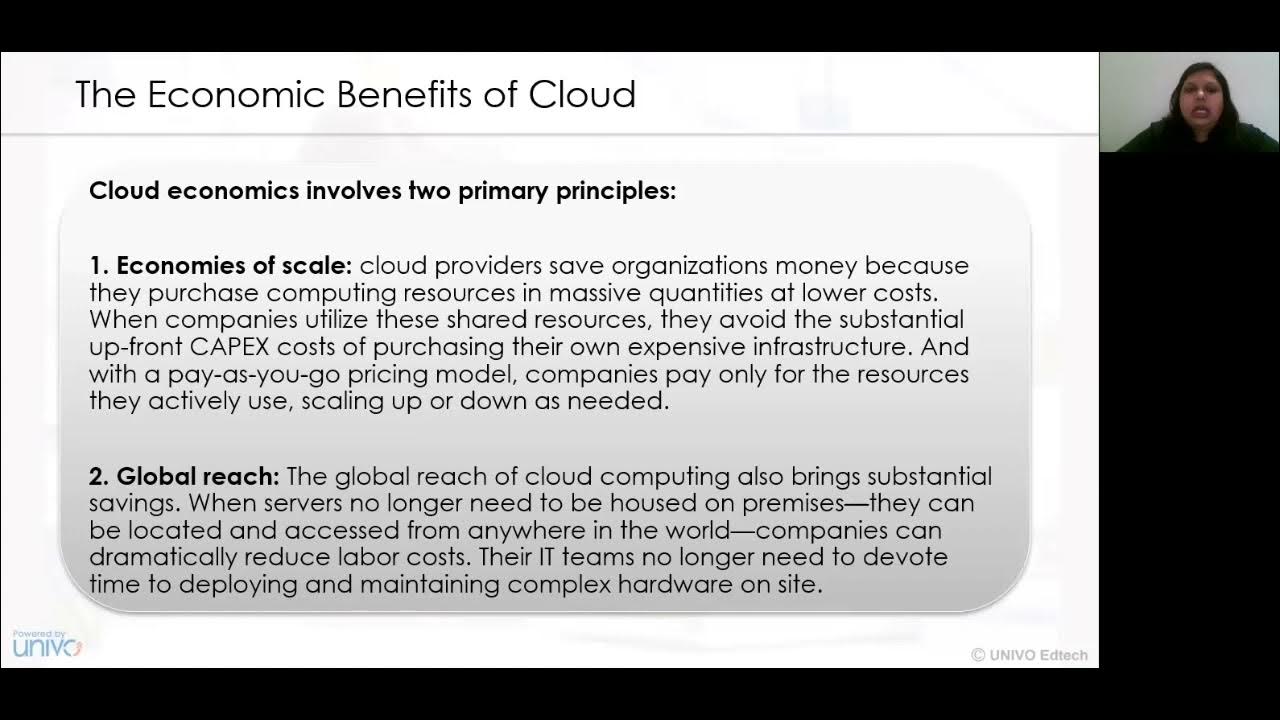

Cloud Economics Cloud Computing infrastructures available for implementing cloud based services

Dasar Dasar Hukum & Perjanjian (Video Meet 04)

Pengantar Ekonomi Islam Sesi 1Muqoddimah

5.0 / 5 (0 votes)