2. Rekam Referensi Nomor Seri Faktur Pajak

Summary

TLDRThis tutorial guides users on how to record tax invoice reference numbers in the e-Faktur application. The process involves accessing the 'Reference' menu, selecting 'Invoice Number Reference', and recording the starting and ending serial numbers of the tax invoices from the provided notification. Once the invoice numbers are recorded, users are instructed to finalize the process by clicking the 'Record Invoice Numbers' button. The tutorial is designed to help users effectively navigate and complete the e-Faktur tax invoice entry process.

Takeaways

- 😀 Welcome to the e-Faktur tutorial for recording invoice reference numbers.

- 😀 The tutorial guides you through the steps in the e-Faktur application.

- 😀 Step 1: Access the 'Referensi' menu within the application.

- 😀 Step 2: Click on the 'Referensi Nomor Faktur' menu option.

- 😀 Step 3: Enter the starting and ending serial numbers of the invoice.

- 😀 The invoice serial numbers can be found on the 'Surat Pemberitahuan' (Notification Letter).

- 😀 After entering the serial numbers, click the 'Rekam Nomor Faktur' button.

- 😀 This action saves the invoice serial numbers into the system.

- 😀 The process ensures the accurate recording of invoice reference numbers.

- 😀 The tutorial emphasizes a simple and straightforward process for users to follow.

- 😀 After completing the steps, your invoice serial numbers are successfully recorded and saved.

Q & A

What is the purpose of this tutorial?

-The tutorial aims to guide users through the process of recording the reference number for tax invoices in the e-faktur application.

Which menu do you need to click on first to start recording invoice numbers?

-The first menu you need to click on is the 'Referensi' menu.

What do you need to select after clicking on the 'Referensi' menu?

-After clicking on the 'Referensi' menu, you need to select 'Referensi Nomor Faktur'.

How do you begin recording the invoice serial numbers?

-To begin recording, click on the 'Rekam' button to input the invoice number range.

What information must be entered when recording invoice numbers?

-You need to enter the 'Start Serial Number' and 'End Serial Number' of the invoices.

Where do you find the serial numbers to input into the application?

-The serial numbers are provided in the notification letter (Surat Pemberitahuan) from the tax authority.

What should you do after entering the start and end serial numbers?

-After entering the start and end serial numbers, click the 'Rekam' button to record the numbers.

Why is it important to input the correct serial numbers?

-It is important to input the correct serial numbers to ensure that the tax invoice reference is accurate and compliant with tax regulations.

Is there any confirmation after recording the serial numbers?

-Yes, once you have recorded the serial numbers by clicking 'Rekam', the data will be saved, confirming the process.

What is the final step in the process after recording the invoice numbers?

-The final step is that your tax invoice reference numbers will have been successfully recorded and stored in the system.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

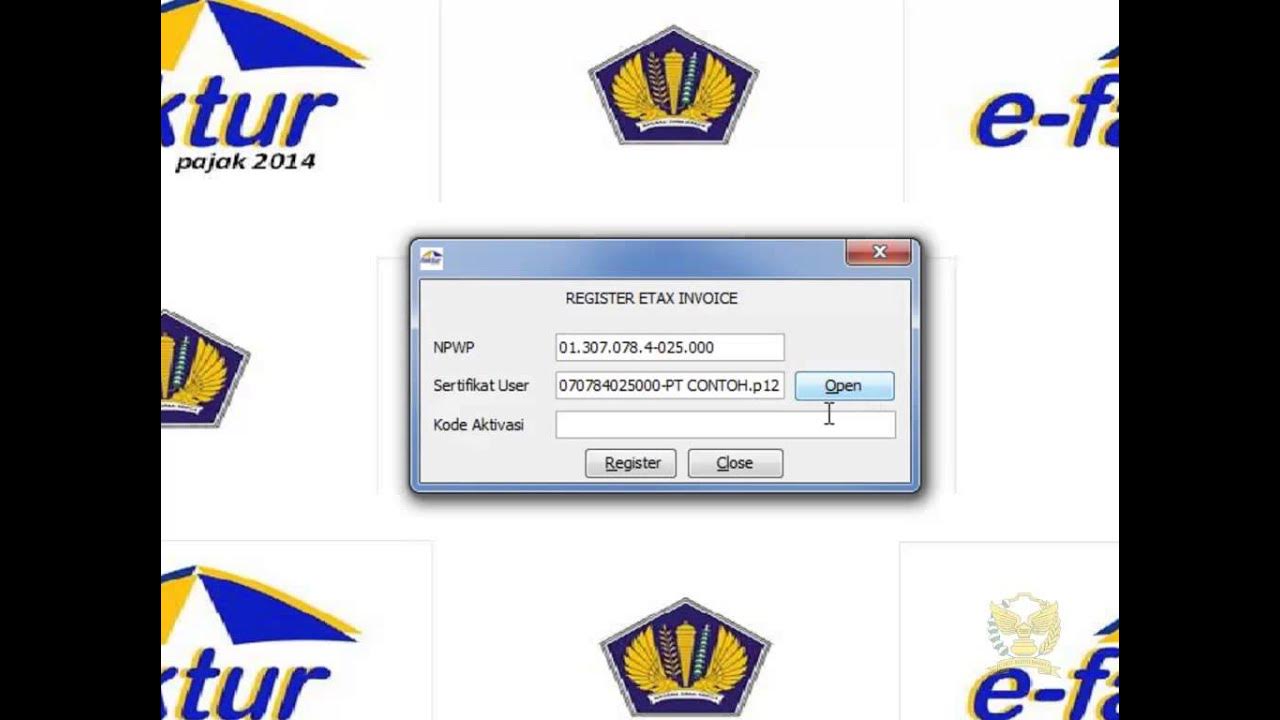

1. Registrasi dan Konfigurasi Aplikasi e-Faktur Pajak

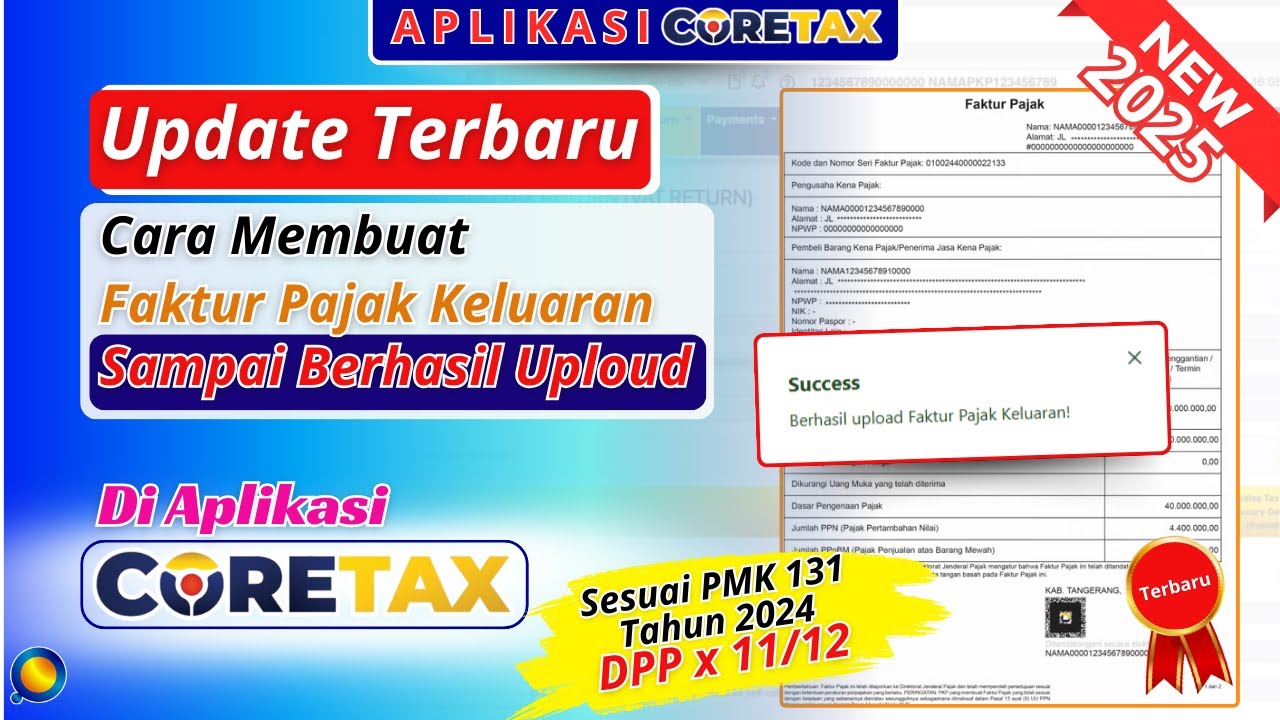

Cara Buat Faktur Pajak Keluaran Di Aplikasi Coretax | Cara Menerbitkan Faktur Pajak di Coretax

Cara Buat Faktur Pajak Di Coretax Sampai Berhasil Uploud | Cara Uploud Faktur Pajak di Coretax

||CLASS-42||INVOICE VERIFICATION IN SAP MM || MIRO/MIR4/MRBR T code In SAP||IR BEFORE GR PROCESS||

Cara Mudah Akses Menu dan Fitur Coretax | Tutorial Lengkap

Apa Itu Faktur Pajak Digunggung? Bagaimana Cara Membuatnya?

5.0 / 5 (0 votes)