Perkembangan Transaksi Ekonomi di Era Digital

Summary

TLDRThis video script explores the evolution of global trade and modern payment systems in the digital age. It highlights the impact of technological advancements in transportation and telecommunications, which have streamlined and expanded trade. The rise of e-commerce has transformed how goods and services are bought and sold, offering convenience, variety, and competitive pricing. Additionally, the script delves into the growing use of electronic payments, including mobile banking, fintech solutions, and e-money, alongside traditional methods like cheques and debit cards, emphasizing their role in simplifying transactions and enhancing efficiency while cautioning against fraud.

Takeaways

- 😀 Technological advancements in transportation and communication have significantly boosted global trade efficiency and connectivity.

- 😀 In 2019, global trade reached $19 trillion for goods and $5 trillion for services, highlighting the growing scale of international transactions.

- 😀 E-commerce has revolutionized shopping, allowing businesses to operate online with features like virtual storefronts, stock information, and customer service.

- 😀 The key benefits of e-commerce include product variety, shortened distribution channels, easy payment methods, convenience, and competitive pricing.

- 😀 E-commerce also presents risks such as fraud and the inability to physically inspect goods before purchasing, making caution necessary for buyers.

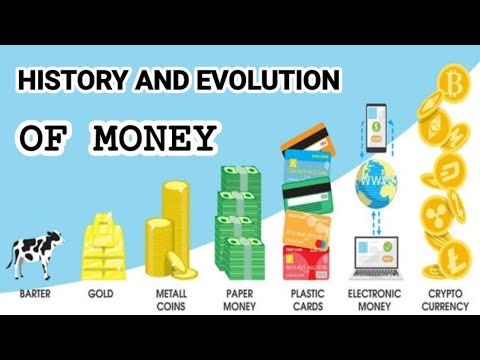

- 😀 A payment system refers to the methods used to transfer money between parties, ranging from physical cash to digital transactions.

- 😀 The shift from cash to non-cash payments has been driven by the efficiency, security, and convenience of digital payment systems like mobile banking and electronic wallets.

- 😀 Fintech (financial technology) integrates financial services with modern tech, providing solutions for payments, loans, investments, and more through digital platforms.

- 😀 Tools for modern payments include checks, giro transfers, credit/debit cards, and electronic money (e-money) stored on digital platforms.

- 😀 Electronic money (e-money) offers a convenient way for people to make transactions without carrying physical cash, often used for things like tolls, shopping, and public transport.

- 😀 In Indonesia, popular e-money platforms include Ovo, GoPay, Dana, and Mandiri E-money, enabling seamless digital transactions across various services.

Q & A

How has technology advanced the global trading system?

-Technological advancements in transportation and communication have significantly enhanced the efficiency of global trade. Improved transport systems optimize the movement of goods, while communication technologies facilitate broader and faster interaction between buyers and sellers, leading to more effective trade processes.

What is e-commerce, and how does it function?

-E-commerce refers to the buying and selling of goods and services through electronic media, typically the internet. It includes online stores with digital displays, stock updates, and customer service, integrated with payment systems to process transactions quickly and efficiently.

What are some key benefits of e-commerce?

-E-commerce offers several advantages, including a wide range of products and services, shortened distribution channels, easy payment options, convenience of shopping anytime and anywhere, and competitive pricing due to lower operational costs.

What are the risks associated with e-commerce?

-The main risk in e-commerce is the potential for fraud, as buyers cannot physically inspect products before purchase. It’s essential for consumers to apply caution, follow protective measures, and ensure they respect, educate, and protect themselves during transactions.

What is the role of fintech in modern payment systems?

-Fintech, or financial technology, combines finance and technology to offer digital solutions for transactions, including payment apps, financial planning tools, lending, and investment services. This technology is changing how financial services are accessed and managed.

What types of payment systems are most commonly used today?

-The most common modern payment systems include electronic banking methods such as mobile banking, internet banking, debit and credit cards, and digital wallets, which provide faster and more convenient ways to transfer money compared to traditional cash payments.

What distinguishes cash payments from electronic payments?

-Cash payments involve physical money (coins and banknotes), while electronic payments utilize digital methods like bank transfers, debit or credit cards, and mobile payments, offering more security, convenience, and efficiency for transactions.

What is the impact of digital wallets on transactions?

-Digital wallets, or e-wallets, allow users to store and transfer money electronically, making transactions quicker and more convenient. They are increasingly popular for everyday purchases, like paying for public transportation, shopping, and online services.

How do non-cash payments improve transaction efficiency?

-Non-cash payments, such as card payments and mobile transfers, reduce the need to carry physical money, minimize risks like theft, and streamline processes, enabling faster transactions and reducing human error in financial exchanges.

What are some examples of electronic money (e-money) in Indonesia?

-In Indonesia, electronic money platforms like Ovo, GoPay, Dana, and Mandiri e-money are commonly used for various transactions, including paying for public transport, online shopping, and even ordering food, providing users with a convenient, digital alternative to physical cash.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

Kurikulum Merdeka Rangkuman IPS Kelas 9 Tema 2

History and Evolution of Money - The History

Transportes, globalização e o comércio! Expansão marítima!

Sejarah dan Perkembangan Kewirausahaan

Perkembangan Transaksi Ekonomi di Era Digital + LKPD : Dampak Teknologi pada Perdagangan Modern

Como funciona o comércio internacional

5.0 / 5 (0 votes)