IPCA +10,25%: A MELHOR OPORTUNIDADE DO ANO NA RENDA FIXA?

Summary

TLDRThe video discusses a fixed income investment opportunity offering IPCA + 10.25% annually, highlighting the potential returns and associated risks. The speaker analyzes the issuer, Prime Agro, detailing its financial health and significant debt compared to equity. Emphasizing the importance of understanding risks in private credits versus government bonds, the discussion also addresses the impact of taxes on net returns. Viewers are encouraged to evaluate their investment strategies and consider a balanced approach between fixed income and equities. The video concludes with an invitation for a free portfolio analysis to help investors make informed decisions.

Takeaways

- 📈 A new investment opportunity offers IPCA + 10.25% per year, already factoring in income tax.

- 💡 The Club of Value analysts recommend evaluating the risks and benefits of such fixed-income investments.

- 🔍 The Prime Agro CRA provides insights into how agricultural companies can raise funds through financial instruments.

- 📅 The Prime Agro CRA matures in 2028, indicating a long-term investment horizon.

- 🏦 Investing in fixed income means lending money to someone; the safest option is usually government bonds.

- ⚠️ Private companies carry higher risks compared to government or bank investments, as they lack deposit insurance.

- 🔒 Prime Agro has structured guarantees for their CRA, including personal guarantees from owners and fiduciary rights.

- 📊 High debt levels in a company can signal potential investment risks; Prime Agro's debt is 3 times its equity.

- 💰 The recent increase in Prime Agro's debt raises concerns about its financial stability.

- 🌟 The difference in tax treatment between government bonds and private credits can significantly affect net returns.

Q & A

What is the investment opportunity discussed in the video?

-The video discusses an investment in a title offering IPCA + 10.25% per year, which is already net of income tax.

What does IPCA represent in the context of this investment?

-IPCA refers to the Brazilian Consumer Price Index, which measures inflation in Brazil. The investment yield is adjusted for this inflation measure.

How does the yield of this investment compare to a traditional CDB?

-To match the yield of the discussed investment, a CDB would need to pay IPCA + 13%, indicating a significantly higher return from the investment in question.

What is a CRA and how does it relate to the investment discussed?

-CRA stands for Certificado de Recebíveis do Agronegócio, a type of security used in agribusiness financing. The discussed investment is a CRA issued by Prime Agro.

What are the risks associated with investing in private credit like CRAs?

-Investing in private credit, such as CRAs, involves risks like potential company bankruptcy, with no protection from the Credit Guarantee Fund (FGC) unlike bank products.

What factors should be considered when assessing the financial health of the company behind the CRA?

-Key factors include the company's debt levels, liquidity, and overall financial statements, particularly examining the debt-to-equity ratio and cash generation metrics.

What was the total debt of Prime Agro as of the end of 2023?

-As of the end of 2023, Prime Agro had a total debt of R$251 million, which includes both current and long-term liabilities.

What does a debt-to-equity ratio above 1 indicate?

-A debt-to-equity ratio above 1 suggests that the company has more debt than equity, raising a warning signal regarding its financial stability.

Why might some investors prefer government bonds over private credit investments?

-Investors might prefer government bonds because they are generally considered safer, with lower risk of default compared to private credit investments.

What should an investor do if uncertain about their current investment strategy?

-The video encourages investors to seek a free portfolio analysis to evaluate whether their investment strategy aligns with their financial goals and risk tolerance.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

LFTB11: A MELHOR RENDA FIXA PARA CURTO E MÉDIO PRAZO | CAIO MATHIAS

Os 4 MELHORES INVESTIMENTOS da RENDA FIXA para JUNHO de 2025!

O TESOURO DIRETO PAGANDO 15,25% E IPCA + 7,8% ENTERROU OS DIVIDENDOS? O que fazer agora?

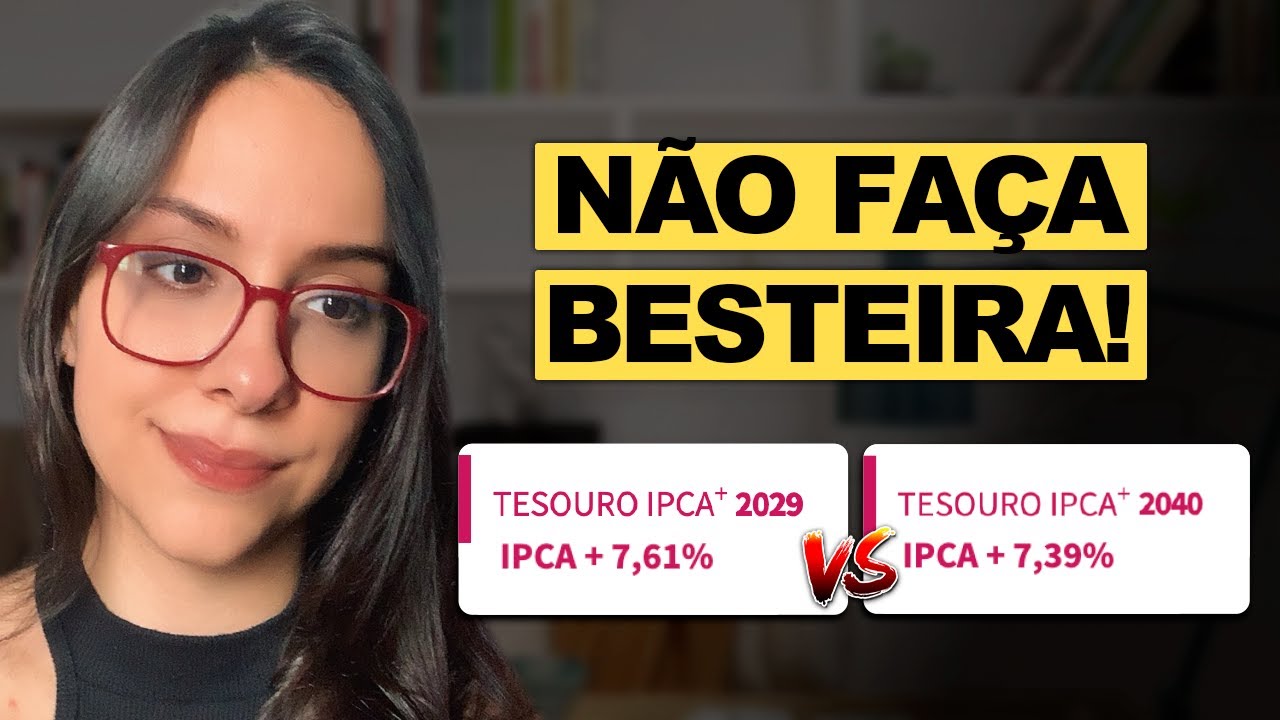

O ERRO que MUITOS COMETEM ao INVESTIR no TESOURO IPCA+! TESOURO IPCA+ 2029, 2040 OU 2050?

IPCA +10,8%: NÃO CAIA NESSA ARMADILHA do IPCA+

TESTEI O PORQUINHO DO APLICATIVO DO BANCO INTER EM DÓLAR. O que achei?

5.0 / 5 (0 votes)