O TESOURO DIRETO PAGANDO 15,25% E IPCA + 7,8% ENTERROU OS DIVIDENDOS? O que fazer agora?

Summary

TLDRIn this video, the speaker delves into the comparison between high-yield fixed-income investments (like IPCA+7.8% or 15% per year) and variable-income assets such as stocks and real estate funds. They explain the benefits of compound interest, the importance of balancing investment strategies for long-term financial growth, and how to take advantage of market volatility to build wealth. The speaker also emphasizes the value of dividend income, financial freedom, and the necessity of diversifying your portfolio to achieve stability and resilience in the face of changing market conditions.

Takeaways

- 😀 The Brazilian investment market offers high returns, such as fixed income rates above 15% per year with almost zero credit risk.

- 😀 Inflation-indexed investments like IPCA+ 7.8% offer historically high returns, even though pre-fixed options seem more attractive at the moment.

- 😀 Fixed-income investments are taxed and have a custody fee, which reduces the effective returns. For example, a 15.25% pre-fixed rate results in a net return of approximately 12.93% per year.

- 😀 The IPCA+ 7.8% offers a return of around 14.3% annually when factoring in a 6.5% inflation rate, but may be lower than pre-fixed rates at the moment.

- 😀 Historically, inflation-indexed investments (IPCA+) have outperformed pre-fixed investments, providing a better long-term return.

- 😀 Investors should consider the impact of volatility on investment decisions, as it can create opportunities to buy assets at lower prices and benefit from future price increases.

- 😀 The tax advantages of dividends are highlighted—dividends from stocks and real estate funds are tax-free, unlike fixed income that incurs taxes after two years.

- 😀 Dividend stocks and real estate funds allow investors to take advantage of volatility by reinvesting received dividends when prices drop, increasing long-term returns.

- 😀 The value of fixed-income investments will eventually stabilize, while stocks and funds will rise as interest rates decrease, offering potential for capital appreciation.

- 😀 The main goal is achieving financial freedom by investing smartly in both fixed income and variable income assets, to benefit from both stability and market volatility.

Q & A

What is the primary focus of the video discussed in the script?

-The video focuses on comparing fixed income investments with variable income investments, specifically discussing the current high returns in fixed income options like pre-fixed and IPCA-linked bonds, and the risks associated with equity investments such as stocks and real estate funds.

Why is the question of choosing between fixed and variable income investments being raised?

-The question arises because of the attractive returns offered by fixed income investments, particularly those paying 15% per year or higher, and the potential risks of variable income investments like stocks and real estate funds, which typically offer lower yields but come with higher volatility.

What are the main types of fixed income options mentioned in the video?

-The main fixed income options mentioned are the pre-fixed bonds (with returns like 15.25% annually) and IPCA-linked bonds, which offer returns like IPCA + 7.8%, which represents a historical record.

What are the costs associated with the pre-fixed and IPCA-linked bonds?

-For pre-fixed bonds, there are two main costs: a custody fee of 0.22% per year, and income tax at 15% if the investment is held until maturity (beyond 2 years). These fees reduce the effective return on the investment.

What is the effective return on a 15.25% pre-fixed bond after fees?

-After deducting the custody fee and the income tax, the effective return on a 15.25% pre-fixed bond is around 12.93% annually, which translates to a compounded monthly return of approximately 1%.

How does the IPCA-linked bond compare to the pre-fixed bond in terms of return?

-The IPCA-linked bond offers a return of around IPCA + 7.8%, which, assuming an inflation rate of 6.5%, results in a total return of about 14.3%. This is slightly lower than the pre-fixed bond's return of 15.25%, but the IPCA-linked bond offers inflation protection.

What historical context is given for the current high interest rates in Brazil?

-The high interest rates in Brazil are linked to the country's historical inflation, which has been above 6% annually, and the depreciation of the Brazilian real against the US dollar. These factors necessitate high interest rates to protect investments from inflation and currency devaluation.

Why does the presenter suggest that fixed income may be more appealing than variable income investments right now?

-The presenter suggests that, given the current high returns from fixed income options, especially in a scenario where inflation is high and the real is weakening, fixed income investments offer a more stable and predictable return compared to the volatility and risks of variable income investments like stocks and real estate funds.

How can volatility benefit investors in stocks and real estate funds, according to the video?

-Volatility can benefit investors in stocks and real estate funds because it creates opportunities to buy at lower prices during market downturns, potentially leading to higher gains when the market recovers. This is contrasted with fixed income investments, which do not provide such opportunities for capital appreciation.

What role does taxation play in the investment decision between fixed and variable income?

-Taxation plays a significant role because income from fixed income investments is subject to income tax (15% for long-term holdings), whereas dividends from stocks and real estate funds are received tax-free, making them potentially more attractive for long-term income generation despite their volatility.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

LFTB11: A MELHOR RENDA FIXA PARA CURTO E MÉDIO PRAZO | CAIO MATHIAS

Os 4 MELHORES INVESTIMENTOS da RENDA FIXA para JUNHO de 2025!

4 INVESTIMENTOS EM RENDA FIXA QUE MAIS PAGAM

🥇 10 MELHORES INVESTIMENTOS DE RENDA FIXA COM LIQUIDEZ DIÁRIA COM SELIC EM 14,25%

What is Fixed Income? | Types of Fixed Income Securities

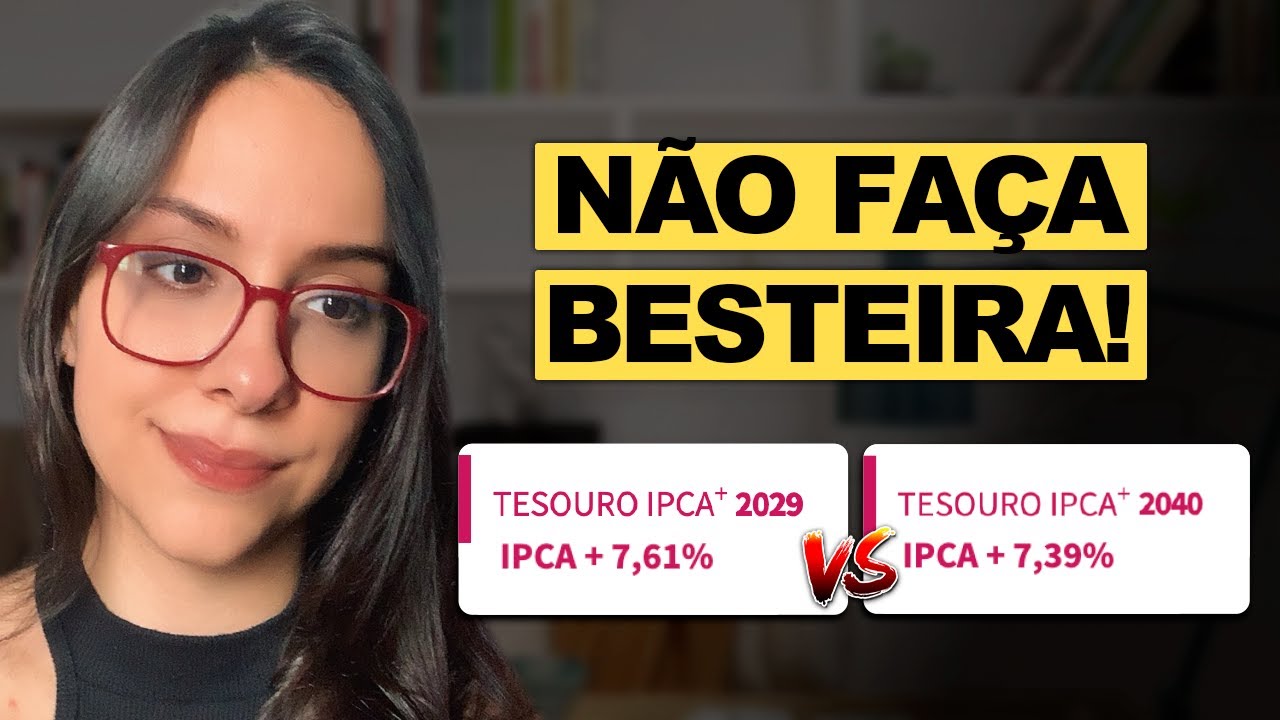

O ERRO que MUITOS COMETEM ao INVESTIR no TESOURO IPCA+! TESOURO IPCA+ 2029, 2040 OU 2050?

5.0 / 5 (0 votes)