Editors Discuss The Week Gone By & Road Ahead For The Markets | Editor's Roundtable | CNBC TV18

Summary

TLDRThe discussion revolves around current market dynamics, with insights into the oil and gas sector's recent overreactions, particularly after a six-month rally. The automotive industry shows strong growth in two-wheelers but faces concerns over low retail growth expectations during the festive season. Additionally, the financialization theme in capital markets presents a promising long-term growth outlook, despite short-term volatility. The conversation highlights the strategic importance of asset management firms and wealth management in navigating market changes, emphasizing the need for a cautious yet optimistic approach as the market evolves.

Takeaways

- 😀 The oil and gas sector shows potential for tactical plays, even amid concerns about short-term losses.

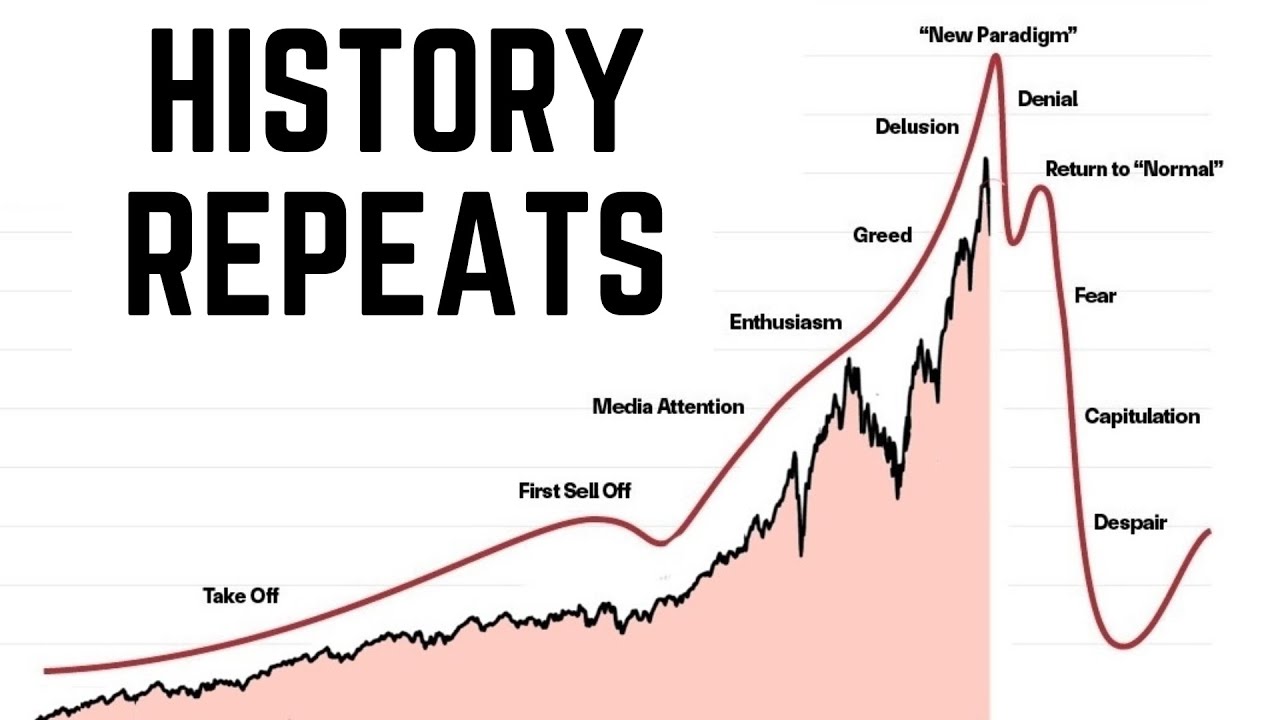

- 📉 Recent stock performance suggests that market reactions can sometimes be excessive, particularly following sharp price increases.

- 🚗 The auto sector, particularly two-wheelers, has seen stronger growth than commercial vehicles, but inventory concerns may impact future sales.

- 🎉 Festive season expectations indicate low single-digit growth for retail sales, raising worries about demand in the auto sector.

- 🔋 The transition to electric vehicles (EV) is crucial for the auto sector, with companies well-positioned for this shift likely to lead the market.

- 💰 Financialization themes are emerging in the market, indicating a longer runway for growth despite recent volatility.

- 📈 There is a strong potential for capital market growth in the next decade, driven by low penetration levels and increasing market participation.

- 🤑 Asset management firms are highlighted as beneficial investments due to their strong free cash flow and lower capital requirements.

- 📊 Wealth managers and distributors are also well-positioned in the asset management space, benefiting from customer loyalty.

- 🔄 Exchanges are characterized by monopolistic advantages, allowing them to mitigate regulatory impacts effectively.

Q & A

What is the main concern regarding the stock performance in the oil and gas sector?

-The main concern is that the recent falls in stock prices are viewed as excessive reactions to short-term negative news, particularly related to inventory reports. The market's overall sentiment reflects an overreaction to these developments.

How did the automotive sector perform compared to expectations?

-The automotive sector, specifically two-wheelers, showed stronger growth than commercial vehicles. However, retail sales during the festive period are disappointing, leading to concerns about inventory management and future demand.

What are the implications of the EV transition in the automotive market?

-The transition to electric vehicles (EVs) is a significant factor in the automotive sector, with companies well-prepared for this shift likely to lead in the market. This transition introduces a new dimension to competition and performance in the sector.

How does the presentation describe the relationship between short-term market volatility and long-term investment strategies?

-The presentation emphasizes that while short-term volatility and regulatory impacts may cause fluctuations, the long-term growth potential for capital markets remains positive. Investors are encouraged to maintain a long-term perspective despite immediate market challenges.

What investment opportunities are highlighted in the discussion?

-Asset management firms and wealth management sectors are highlighted as strong investment opportunities due to their ability to generate stable cash flows and their resilience to market volatility.

What does the term 'mean reversion' refer to in the context of the market discussion?

-Mean reversion refers to the phenomenon where stock prices that have deviated significantly from their historical averages tend to return to those averages over time. The discussion suggests that sectors experiencing excessive price fluctuations are likely to correct themselves.

What factors are contributing to the volatility in the market according to the participants?

-Participants attribute market volatility to speculative elements, regulatory changes, and reactions to earnings reports. The interplay between these factors leads to sharp market movements.

Why is the current market viewed as having a longer runway for growth?

-The market is seen as having a longer runway for growth due to low penetration levels in capital markets and potential for increased participation by investors over the next decade, suggesting room for expansion despite short-term fluctuations.

What are the expectations for the auto sector's sales during the festive period?

-Expectations for the auto sector's sales during the festive period are low, with retail sales anticipated to grow by only 5%. This is a concern given the historical performance and consumer expectations during this time.

How does the presentation suggest investors approach the current market conditions?

-The presentation suggests that investors should remain informed, patient, and focus on long-term strategies rather than reacting hastily to short-term market changes. It encourages viewers to prepare for ongoing market developments.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

Two Stocks at Multi Year Breakout? | CA Rachana Ranade

US Port & Export Update | Port Survey | Port LA & Savannah | Container Lines Realignment | Exports?

Sacgasco poised to pounce in the Australian energy sector.

Đầu tư chứng khoán | Chứng khoán hôm nay | Nhận định thị trường: Mỹ tấn công cơ sở hạt nhân Iran

Mending Beli Bitcoin Atau Ethereum? | Margin Call Recap

We are at the Precipice of a Major Turning Point for US Stocks…

5.0 / 5 (0 votes)