Konsep Keuangan 50/30/20 SALAH TOTAL?!😱

Summary

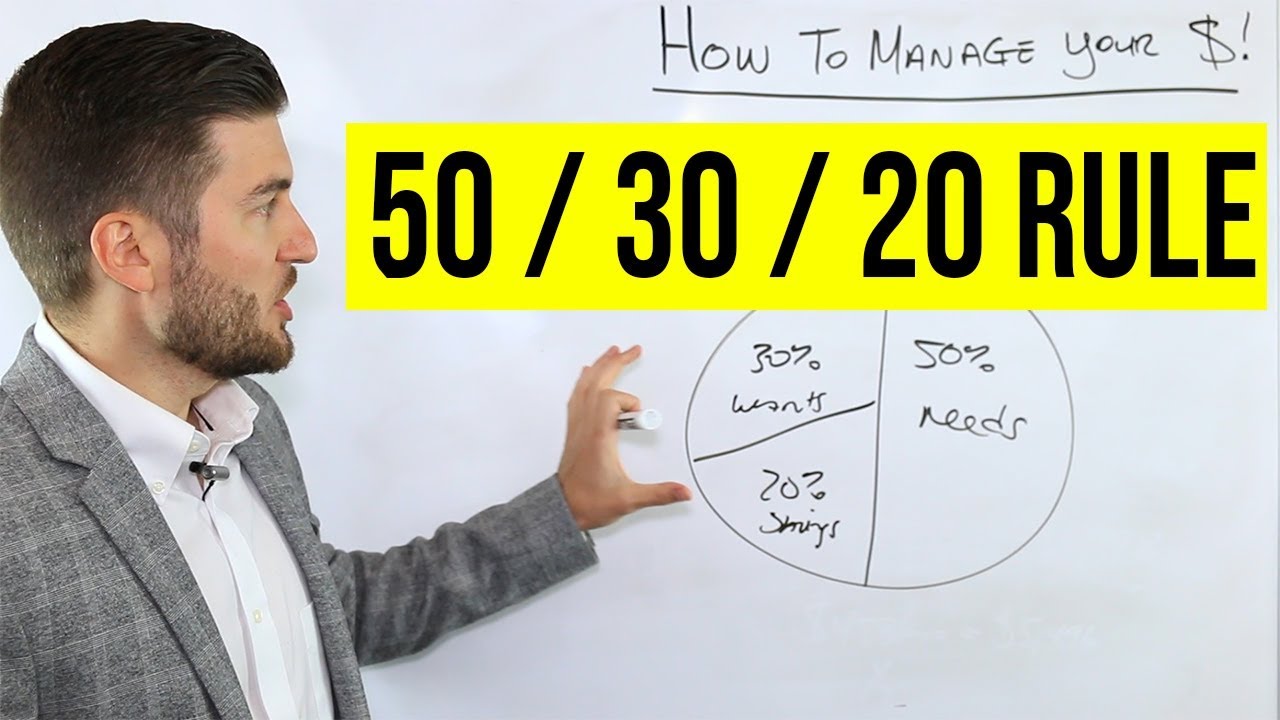

TLDRIn this video, the speaker challenges popular budgeting formulas like the 50/30/20 rule, arguing they often fail to accommodate diverse financial situations. Using relatable scenarios, they emphasize the need for tailored budgeting strategies based on individual income and family dynamics. The speaker advocates for a habit of saving at least 10% of income, stressing that investing consistency is more critical than high returns. By increasing savings rates over time, one can significantly shorten the path to financial freedom. Ultimately, the video encourages viewers to create personalized budgeting and investment plans that suit their unique circumstances.

Takeaways

- 😀 Budgeting formulas like 50/30/20 are often oversimplified and may not be practical for everyone, especially those with low or high incomes.

- 😀 The example of a low-income family demonstrates that following strict budgeting rules can lead to unrealistic financial expectations.

- 😀 It's essential to recognize that one budgeting approach does not fit all, as individual financial situations vary greatly.

- 😀 Building a habit of saving at least 10% of income for investments is recommended, regardless of the income amount.

- 😀 The importance of consistency in saving and investing is emphasized, rather than trying to save a large percentage all at once.

- 😀 Higher saving rates can significantly reduce the number of working years needed to achieve financial freedom.

- 😀 A golden rule suggests that saving just 10% of income could require working for 51 years before retirement.

- 😀 Focus on increasing your saving rate gradually and understanding the returns on investments rather than chasing high-risk opportunities.

- 😀 Personal budgeting strategies should adapt to individual lifestyles and financial goals, making tracking spending more manageable.

- 😀 There are two options for growing wealth: seeking high returns on investments or consistently saving and investing smaller amounts over time.

Q & A

What are the main budgeting formulas discussed in the video?

-The main budgeting formulas discussed are the 50-30-20 and 40-30-20 methods, which suggest allocating percentages of income to needs, wants, and savings or debt repayment.

Why does the speaker criticize these budgeting formulas?

-The speaker criticizes these formulas as being impractical and not universally applicable, especially for individuals with low or high incomes, or for those with complex family situations.

Can you provide an example of a scenario where the 50-30-20 formula might not work?

-Yes, an example provided is a father with a low income supporting a family of six. The formula suggests allocating a portion of income to discretionary spending, which is unrealistic given the family's financial constraints.

What is the suggested minimum percentage to set aside for investments?

-The speaker suggests setting aside a minimum of 10% of income for investments, with the potential to increase this percentage over time.

How does the saving rate impact financial independence?

-The saving rate significantly impacts the time required to achieve financial independence; for example, saving only 10% could require working for 51 years, while a higher saving rate could reduce that time considerably.

What is the importance of building a saving and investment habit?

-Building a saving and investment habit is crucial for long-term financial success, as consistent saving can lead to better investment opportunities and financial security.

What is the potential risk of seeking high returns on investments?

-The risk of seeking high returns includes the possibility of losing the entire investment, as individuals may turn to high-risk investments that can result in significant losses.

What personal strategy does the speaker follow for managing their finances?

-The speaker manages their finances by maintaining a maximum emergency fund in their bank account and investing any excess income according to their investment strategy.

How does the speaker engage with the audience regarding personal finance strategies?

-The speaker encourages viewers to share their own budgeting strategies and experiences in the comments, promoting community dialogue and exchange of ideas.

What is the overarching message of the video regarding personal finance?

-The overarching message is that there is no one-size-fits-all approach to budgeting and personal finance; individuals should adapt their strategies to fit their unique circumstances and focus on developing sustainable financial habits.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

5.0 / 5 (0 votes)