Método PPR - Indo além do óbvio e aproveitando as melhores oportunidades

Summary

TLDRThe video script is a comprehensive tutorial by Flávio Cherenudini, a seasoned tax consultant with over 12 years of experience. He introduces his method, the PPR (Preparation, Profundity, and Production), designed to elevate professionals in the tax field by enhancing their understanding and application of tax laws. Cherenudini emphasizes the importance of not relying on ready-made spreadsheets but instead on a deep comprehension of tax concepts and legislation. The script outlines a step-by-step approach to tax consulting, from initial client engagement, through detailed analysis of financial documents, to the final review of findings. It underscores the need for professionals to be autonomous, secure in their knowledge, and capable of providing high-quality, customized tax advice. The speaker also discusses the potential for career growth in the tax field, especially with the high demand for skilled professionals post-tax reform. The tutorial is part of a series aimed at both newcomers and established practitioners looking to refine their skills and become industry leaders.

Takeaways

- 📚 Start with a solid foundation: The importance of understanding basic tax concepts and accounting principles is emphasized for effective tax consulting.

- 🚀 Specialization is key: To stand out in the field, it's crucial to specialize and become a reference in tax consulting, regardless of your current experience level.

- 🔍 Demand and opportunity: The tax market has high demand, especially post-tax reform, and there's a shortage of qualified professionals to meet this demand.

- 💼 Practical application: The focus is on applying knowledge to real-world scenarios, not just relying on pre-made spreadsheets or models.

- 📈 High demand areas: The script discusses various types of tax work such as rendering opinions, compliance, tax planning, and credit recovery, highlighting their importance and potential earnings.

- 🧐 In-depth analysis: The necessity of a detailed analysis before starting any tax consulting work is underlined, including mapping out the client's financial scenario.

- 📋 Documentation and records: Using technology to organize and extract information from financial records for a comprehensive review is crucial for tax consulting.

- 🤔 Critical thinking: Questioning and challenging the status quo in a client's current tax situation can lead to significant savings and optimizations.

- 📉 Identifying discrepancies: The script stresses the need to identify and understand discrepancies in tax payments and credits to provide the best advice to clients.

- 💡 Legal backing: Every conclusion or recommendation made should be backed by legal foundations, ensuring that advice is sound and actionable.

- ✅ Review and refine: The final step of reviewing work is highlighted as essential to ensure accuracy and build confidence in the consulting process.

Q & A

What is the main focus of Flávio Cherguini's course for professionals in the tax field?

-The main focus of Flávio Cherguini's course is to help professionals such as lawyers, accountants, and analysts become true references in the tax field by understanding high-demand areas, improving their career, and becoming better in what they do.

What are the three pillars of the PPR method mentioned by Flávio Cherguini?

-The three pillars of the PPR method are Preparation, which involves understanding basic tax concepts; Profundity and Production, which is about analyzing and mapping out the client's financial situation in detail; and Review and Result, which is about revisiting conclusions and ensuring the final outcome makes sense.

Why is it important for professionals to not rely on ready-made spreadsheets or models?

-Relying on ready-made spreadsheets or models can limit a professional's ability to analyze a situation from start to finish. It is important to have autonomy and security in one's work, which comes from understanding the underlying concepts and being able to adapt to different scenarios without depending on pre-made tools.

What is the significance of understanding the basic tax and accounting concepts before starting any tax analysis?

-Understanding basic tax and accounting concepts is crucial because it provides a solid foundation for identifying where to find relevant information, understanding the general context, and knowing how to approach problem-solving in a tax-related situation.

How does Flávio Cherguini suggest professionals stay updated with the latest in the tax field?

-Flávio Cherguini suggests that professionals should follow updates and news by reading daily newspapers, blogs, and other relevant sources to be able to discuss the main topics that clients are interested in.

What is the purpose of mapping out a client's financial situation before starting detailed analysis?

-Mapping out a client's financial situation helps to get a comprehensive view of the entire business, identify discrepancies, and focus on the most relevant aspects. It allows the professional to strategically decide where to start the analysis and what areas might require closer attention.

Why is it necessary to review the conclusions and final results of a tax analysis?

-Reviewing the conclusions and final results is essential to ensure that the analysis is accurate and makes sense. It helps to identify any potential errors or inconsistencies and to confirm that the final outcome aligns with the client's financial situation and the applicable tax legislation.

What is the role of technology in optimizing the work of tax professionals?

-Technology plays a crucial role in managing the large volume of information and calculations involved in tax work. It helps to generate reports, map out financial data, and streamline the process of tax analysis, allowing professionals to work more efficiently.

How does Flávio Cherguini define the term 'mapeamento' or mapping in the context of tax consulting?

-In the context of tax consulting, 'mapeamento' refers to the process of examining a client's financial documents and organizing the information in a way that provides a clear overview of the entire business. This helps to identify key areas for analysis and strategic planning.

What is the importance of having a clear understanding of one's professional goals in the tax field?

-Having a clear understanding of one's professional goals is important because it helps to determine the type of professional one wants to become, whether it's someone who resolves issues independently or someone who follows ready-made models. It also guides the learning process and helps to focus on acquiring the necessary skills and knowledge.

How does Flávio Cherguini suggest professionals should approach the analysis of a client's tax situation?

-Flávio Cherguini suggests a systematic approach that starts with a preliminary 'brainstorm' or preparation phase, followed by in-depth analysis and mapping of the client's financial situation. Professionals should then proceed to detailed analysis, always referring back to basic concepts and legislation, and finally, review the conclusions to ensure accuracy and consistency.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

O que você precisa fazer para se destacar no mercado tributário

Certificação Winthor - Mód Adicionais| 3401 - Cadastro de Bens

Introduksi Channel Frans Budi Santika

Certificação Winthor - Mód Adicionais| 3405 - Cadastro de Saldo Inicial

Japan Has Changed | 20 Ways Tourists Waste Money in Japan 2025

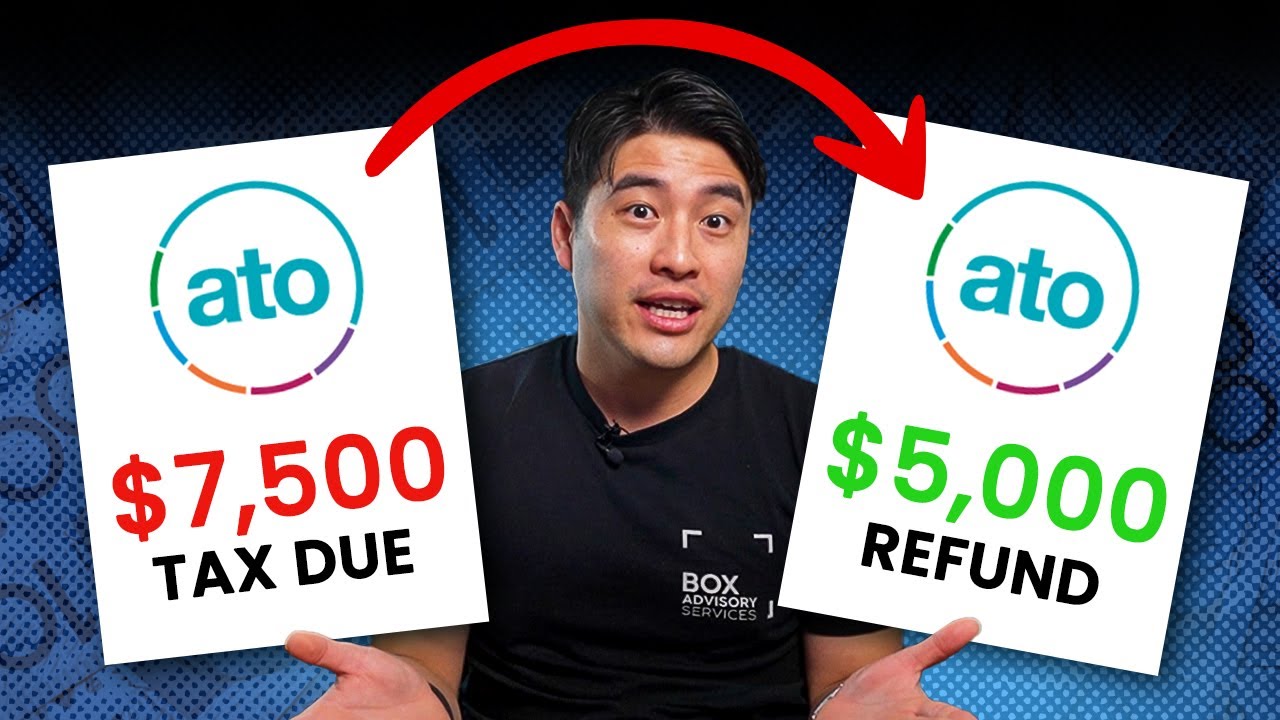

Do this To Legally Pay LESS TAXES in Australia

5.0 / 5 (0 votes)