009 HIGH TICKET TRANSACTIONS

Summary

TLDRThis video demonstrates how to analyze high-ticket transactions in a business using DAX in Power Pivot. It walks through filtering sales over $500, calculating their contribution to overall revenue, and displaying this as a percentage. The tutorial covers creating measures to find both total sales and the number of transactions over $500, explaining how small percentages of large transactions can drive significant revenue. The presenter also highlights the use of DAX Formatter to simplify complex queries, making it easier to debug and present data insights effectively to management.

Takeaways

- 💡 High-ticket transactions are defined as individual transactions over $500.

- 📊 64% of total sales volume comes from transactions greater than $500, highlighting the significant contribution of these high-ticket purchases.

- 🔍 Filtering transactions above $500 using Power Pivot helps to analyze the sales distribution across different price brackets.

- 🛠️ You can create a new measure in Power Pivot to calculate the total sales from transactions greater than $500 by using the CALCULATE function.

- 📈 Out of 167,000 total transactions, 73,000 came from high-ticket transactions (those over $500).

- 📉 In certain categories like envelopes, high-ticket transactions contribute only a small percentage of total sales, while in others like machines, they contribute a large percentage (e.g., 93%).

- 📊 The proportion of transactions over $500 can be calculated as a percentage of total sales volume using simple formulas in Power Pivot.

- 💼 The analysis can be refined by also calculating the percentage of transactions over $500 in terms of the number of transactions, not just sales volume.

- 🖥️ DAX Formatter is a useful tool for cleaning and organizing complex DAX queries, making it easier to maintain and debug.

- 🤔 High-ticket transactions often contribute disproportionately to total sales, meaning fewer transactions can generate a significant portion of revenue in many business categories.

Q & A

What is the main objective of the analysis presented in the script?

-The main objective of the analysis is to identify high-ticket transactions, specifically those over $500, and to understand their contribution to total sales and transaction volume.

How does the script define high-ticket transactions?

-High-ticket transactions are defined as individual sales transactions where the value is greater than $500.

What percentage of the total sales volume comes from transactions over $500?

-64% of the total sales volume is contributed by transactions over $500.

What tool or method is used to calculate the total sales from high-ticket transactions?

-The analysis uses a pivot table and a DAX formula in Power Pivot to calculate total sales from high-ticket transactions.

What is the importance of creating measures in this analysis?

-Creating measures allows for precise calculations such as filtering and calculating the total sales for transactions over $500, and for comparing these against overall sales and transaction data.

How is DAX Formatter used in this process?

-DAX Formatter is used to clean up and format long and complex DAX queries, making the code easier to read and maintain.

What conclusion can be drawn about copier transactions in the analysis?

-For copiers, 82% of transactions are greater than $500, and these transactions contribute 96% of total sales, suggesting that copiers are typically high-ticket items.

How does the percentage of high-ticket transactions vary across different product categories?

-The percentage of high-ticket transactions varies, with machines having 93% of sales from transactions over $500, copiers having 96%, accessories having only 44%, and phones at 64%.

What insight does the script provide about small versus large transactions in terms of sales contribution?

-The script highlights that a small percentage of high-ticket transactions (e.g., 5% of transactions) can contribute disproportionately to total sales (e.g., 70%), while smaller transactions may represent a large volume but a lower contribution to sales.

What is the significance of filtering transactions greater than $500 in a business context?

-Filtering transactions over $500 helps businesses understand where most of their revenue is coming from, allowing them to focus on high-ticket customers and potentially optimize marketing and sales strategies for larger transactions.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

pivot tabel, informatika Kl 8 bab 6 Analisis Data kurikulum Merdeka bag 37 hal 149 153

Calculate Running Total (Rolling Total) in Power BI

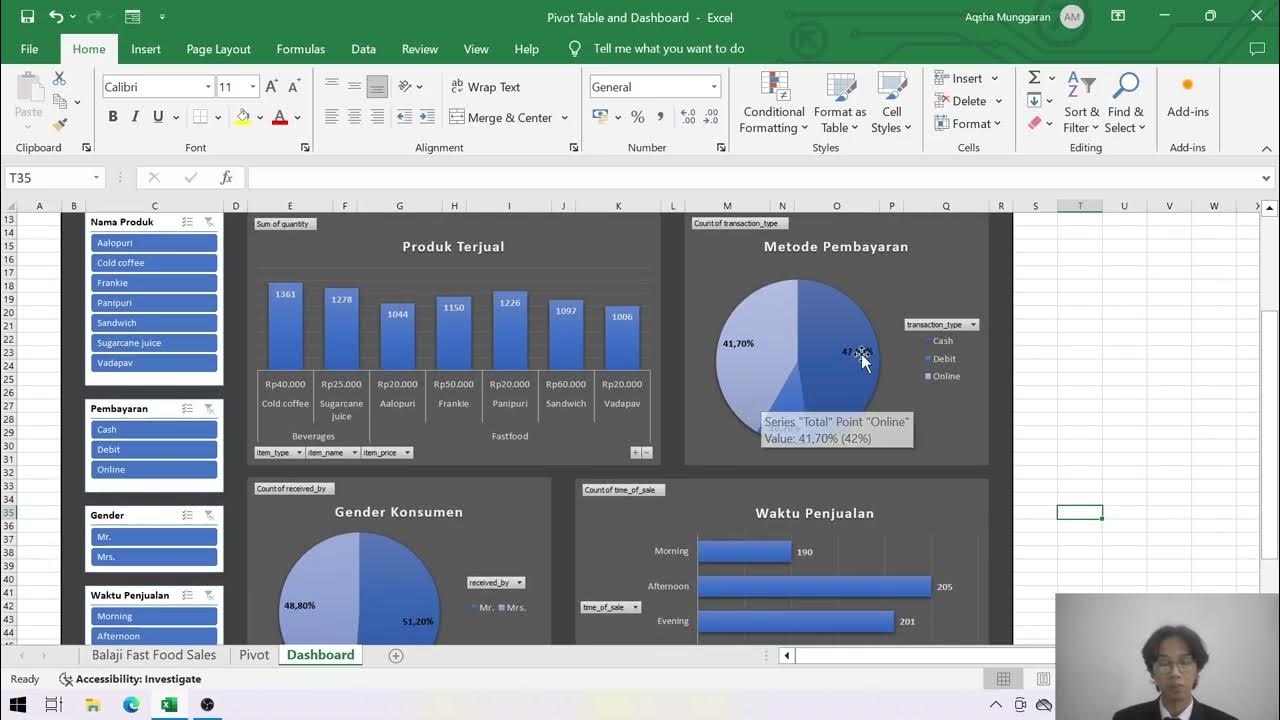

Presentasi Tugas TAD: Dashboard dan PivotTable - Muhammad Aqsha Munggaran

Cross Filter and Highlight Excel Charts like Power BI

Performing Customer Churn Rate Analysis in Excel

This is how I ACTUALLY analyze data using Excel

5.0 / 5 (0 votes)