AP Gov 2.2.2 Congress: Entitlement Spending | NEW!

Summary

TLDRThis video explores the U.S. federal government's spending, focusing on mandatory and discretionary categories. It highlights Congress's power over the budget, with $6 trillion spent in 2023. Mandatory spending, comprising 70% of the budget, covers entitlement programs like Social Security, Medicare, and Medicaid. Discretionary spending, including defense and education, requires annual approval. The video also delves into the national debt, budget deficits, and the complexities of tax revenue. It concludes by discussing pork barrel legislation and vote trading in Congress to pass budget bills.

Takeaways

- 💰 Congress controls the federal budget, with 2023 spending exceeding $6 trillion, an almost incomprehensible amount.

- 📊 Federal spending is divided into mandatory (70%) and discretionary (30%) categories, with mandatory spending steadily increasing.

- 📜 Mandatory spending includes entitlement programs like Social Security, Medicare, and Medicaid, and cannot be changed without new legislation.

- 💸 In 2023, $1.2 trillion was spent on Social Security, and $1.5 trillion on Medicare and Medicaid, making up 45% of federal spending.

- 📈 Rising interest rates since 2022 have made debt interest payments more expensive, with the government spending significant sums just to cover interest.

- 👴 Social Security provides retirement, disability, and survivor benefits, while Medicare and Medicaid offer health insurance based on age or income level.

- 💊 Entitlement programs can be means-tested (based on income) or non-means-tested (age or other factors), with benefits provided in cash or in-kind services.

- 🛠 Discretionary spending must be approved annually and covers areas like defense (the largest portion), education, and infrastructure.

- 💸 The federal government has run annual deficits for decades, increasing the national debt, which was over $32.5 trillion in 2023.

- 🐷 Pork barrel legislation and vote trading (logrolling) often help secure votes for larger appropriation bills by offering tangible benefits to certain districts.

Q & A

What are the two main categories of federal spending mentioned in the script?

-The two main categories of federal spending are mandatory spending and discretionary spending.

What is mandatory spending, and what percentage of federal spending does it represent?

-Mandatory spending is spending on existing programs required by law, which takes place automatically without the need for annual approval by Congress. It accounts for about 70% of federal spending.

Which programs are included in mandatory spending?

-Mandatory spending includes entitlement programs like Social Security, Medicare, and Medicaid, as well as interest payments on the national debt.

Why have interest payments on the national debt become more expensive since 2022?

-Interest payments have become more expensive due to rising interest rates, making it costlier for the federal government to pay back the interest on the debt.

What amount was spent on Social Security, Medicare, and Medicaid in 2023 according to the CBO?

-In 2023, approximately $1.2 trillion was spent on Social Security, and around $1.5 trillion was spent on Medicare and Medicaid.

What is the distinction between means-tested and non-means-tested entitlement programs?

-Means-tested programs require people to qualify based on their income level, such as Medicaid. Non-means-tested programs, like Social Security and Medicare, provide benefits based on criteria such as old age, regardless of income level.

What is the difference between monetary and in-kind benefits in entitlement programs?

-Monetary benefits, like Social Security, involve sending beneficiaries money that they can spend as they choose. In-kind benefits, like those provided by Medicare and Medicaid, cover specific services, such as medical bills, without sending direct cash to beneficiaries.

What is discretionary spending, and what portion of federal spending does it cover?

-Discretionary spending requires annual approval through the budget process and covers about 30% of federal spending. Defense spending makes up the largest portion of discretionary spending.

What is the difference between a budget deficit and the national debt?

-A budget deficit occurs when the government spends more in a year than it collects in tax revenue. The national debt is the total amount of money the government owes, which increases every year there is a deficit.

What is pork barrel legislation, and how does it affect Congress members?

-Pork barrel legislation provides tangible benefits, such as jobs or money, to a congressional district and helps Representatives win reelection by delivering benefits to their constituencies.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

For Oom Piet - Poem Analysis

How would you go about solving this? Limit of x/sqrt(x^2+1) as x goes to infinity. Reddit inf/inf

Apresiasi Usai Timnas Juara Piala AFF U-19 2024 - iNews Pagi 01/08

Embedded Linux | Introduction To U-Boot | Beginners

How to Diagnose and Replace Universal Joints (ULTIMATE Guide)

Complements of Sets

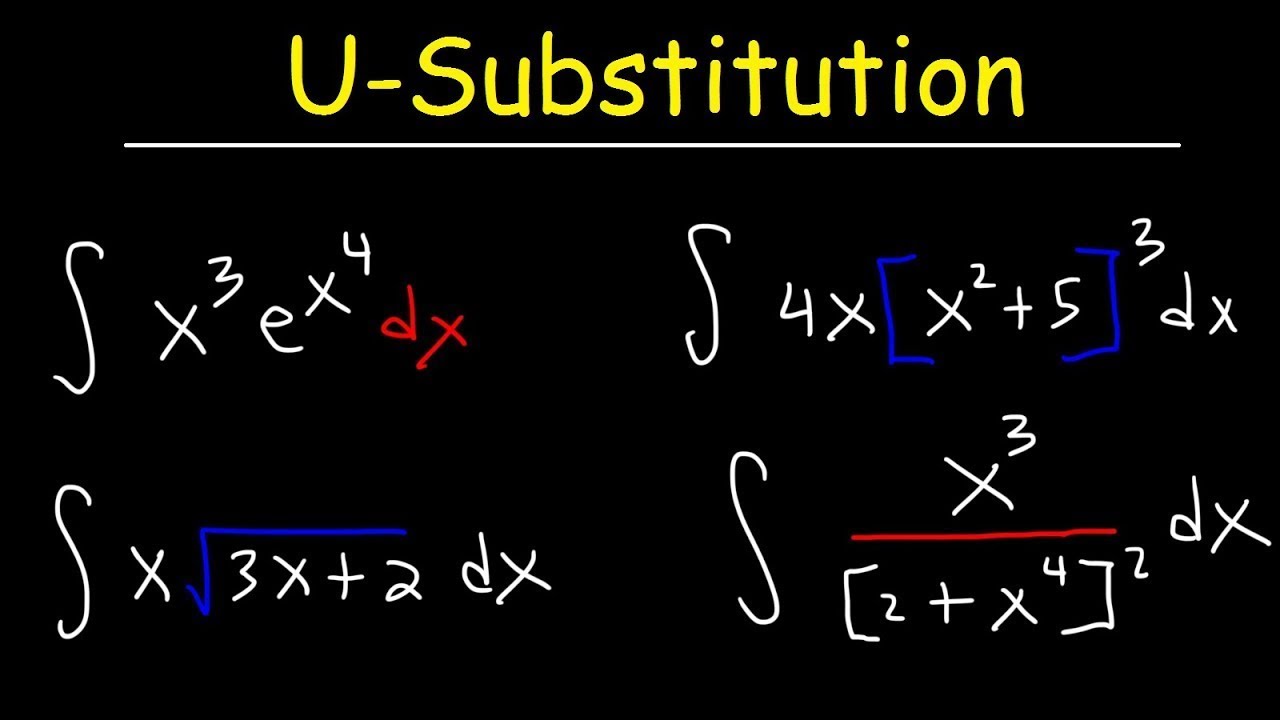

How To Integrate Using U-Substitution

5.0 / 5 (0 votes)