Modelo DuPont

Summary

TLDRThe speaker introduces a conceptual framework for business management, focusing on profitability indicators. They discuss the relationship between the balance sheet and the income statement, starting with net sales and moving through cost of goods sold, operating expenses, financial expenses, and taxes to arrive at net profit. Key metrics include net profit margin, asset turnover, and return on assets. The discussion also covers the financial structure, including short and long-term liabilities, and how it relates to equity to calculate financial leverage and return on equity, providing a comprehensive view of business performance.

Takeaways

- 📊 The script discusses a conceptual and instrumental management structure that highlights profitability indicators of a company.

- 💼 It starts with net sales, not considering gross sales, and then considers items in the income statement (DRE) to be covered by net sales.

- 🏭 For industrial companies, it includes production costs; for commercial companies, it includes CMV; for service companies, it includes CPV.

- 💼 It covers operational expenses and financial expenses, including short-term and long-term loans.

- 💵 It calculates net profit by subtracting all these costs from net sales, which can be either a net profit or a loss.

- 📈 The script introduces the 'net margin' indicator, which compares net profit to net sales to show the contribution of sales to net profit.

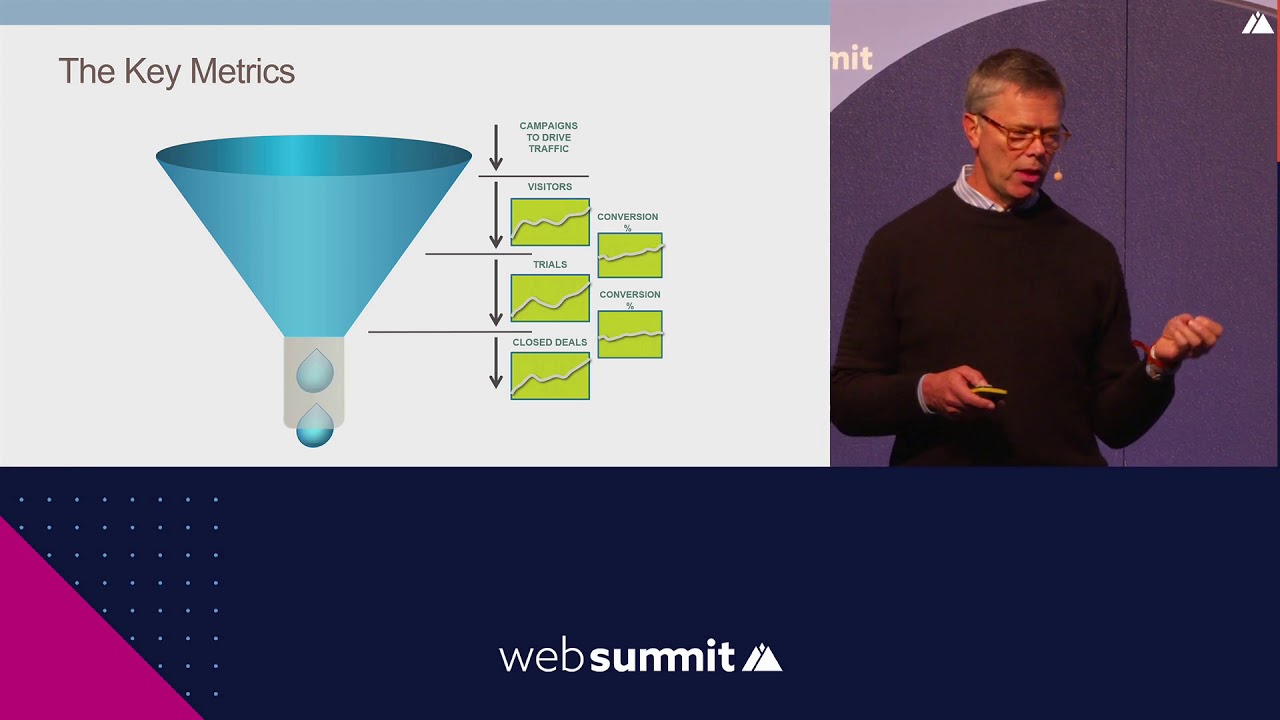

- 🔄 It links the income statement with the balance sheet by using the 'asset turnover' indicator, which shows how many times the total assets are being used to generate net sales.

- 💹 The 'return on assets' (ROA) is derived by comparing the net margin with the asset turnover, indicating how much the company earns from all its operations.

- 💸 The script also discusses the financial structure, including short-term and long-term third-party resources, and how they relate to the company's financial leverage.

- 🌐 The 'capital turnover' or 'gearing' is introduced, which shows how many times the financial structure is renewed in generating the net profit.

- 🏛 The 'return on equity' (ROE) is the final indicator discussed, which relates the net profit to the company's equity, showing the gain for the owners or shareholders.

Q & A

What is the main focus of the presented conceptual structure?

-The main focus is to highlight indicators that show the profitability of a company, relating them to the balance sheet and income statement.

Why does the speaker start with net sales instead of gross sales?

-The speaker starts with net sales to consider all items that compose the income statement (DRE), which should be covered by net sales, excluding gross sales which include discounts and returns.

What does the speaker mean by 'costs derived from the production process'?

-The speaker refers to the costs associated with manufacturing or producing goods, which are part of the cost of goods sold (COGS) for industrial companies.

How does the speaker connect net sales with operational expenses?

-The speaker connects net sales with operational expenses by covering operational costs such as cost of materials, labor, and other production costs, which are necessary to generate those sales.

What is the significance of covering expenses from loans in the context of the script?

-Covering expenses from loans is significant as it represents the financial costs associated with short-term and long-term borrowings, which are part of the operational expenses.

Why is the net profit important in the presented structure?

-The net profit is important because it represents what remains after all expenses are deducted from net sales, indicating whether the company made a profit or a loss.

What is the 'liquid margin' and how is it calculated?

-The 'liquid margin' is an indicator calculated by comparing net profit to net sales, showing the contribution of net sales to net profit.

How does the speaker link the balance sheet to the income statement?

-The speaker links the balance sheet to the income statement by starting with current and non-current assets, resulting in total assets, and then relating net sales to total assets to generate indicators like asset turnover.

What is 'asset turnover' and why is it significant?

-Asset turnover is an indicator that shows how many times the total assets are being used to generate net sales, indicating the efficiency of the company's investments in generating sales.

What is the 'return on assets' (ROA) and how is it derived?

-The 'return on assets' (ROA) is derived by relating net profit to total assets, showing how efficiently a company is using its assets to generate profit.

What is the 'financial leverage multiplier' and how does it relate to the company's profitability?

-The 'financial leverage multiplier' is an indicator that shows how many times the company's financial structure is being renewed through the generation of net profit, relating the ROA to the 'capital turnover' to derive the 'return on equity' (ROE).

How does the return on equity (ROE) differ from return on assets (ROA)?

-ROE differs from ROA in that ROE shows the gain for the company's owners or shareholders, considering the company's operations and financial structure, while ROA focuses on the operational efficiency of the assets.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

What is a North Star Metric? - The North Star Framework

Introduction to Business Process Management (BPM) from an experienced transformation executive

Cara Mudah Membuat Kerangka Konseptual Skripsi (Lengkap & Jelas)

Why This Stock Is On Everyone's 'Buy' List | U Gro Capital Analysis

Ratio Analysis (Introduction) | A-Level, IB & BTEC Business

The SaaS business model & metrics: Understand the key drivers for success

5.0 / 5 (0 votes)