Process Costing (Weighted Average Method) Example

Summary

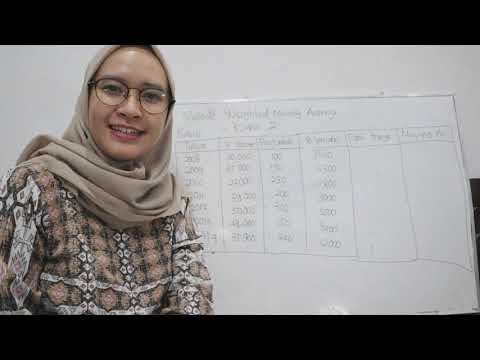

TLDRThe video tutorial illustrates process costing, specifically the weighted average method, using Fitz's Rootbeer as an example. It explains how to assign costs to 2,000 completed units and 500 in-process units in the bottling department. The direct materials are 100% complete for the in-process units, while conversion costs are only 80% complete. The video demonstrates calculating cost per equivalent unit for direct materials (49 cents) and conversion costs (60 cents), then assigning these costs to completed and in-process units, resulting in $1,180 for completed units and $485 for those still in the department.

Takeaways

- 🍻 The video discusses process costing, specifically the weighted average method, for a company named Fitz's Rootbeer.

- 🔄 Fitz's Rootbeer uses process costing for its bottling department, focusing on how to assign costs to units.

- 📊 The company bottled 2,000 units of root beer during the period, with 500 units still in process at the end of the period.

- 📈 All 500 in-process units are 100% complete in direct materials but only 80% complete in conversion costs.

- 💼 Conversion costs include direct labor and manufacturing overhead, which are not fully completed for the in-process units.

- 📝 The video explains how to calculate the cost per equivalent unit for direct materials and conversion costs.

- 💡 The cost per equivalent unit is used to assign costs to completed units and those still in process.

- 📉 For the 2,000 completed units, $980 is assigned for direct materials and $1,200 for conversion costs.

- 📋 For the 500 in-process units, $245 is assigned for direct materials and $240 for conversion costs, considering their completion percentage.

- 🔢 The total cost assigned to the completed and transferred units is $2,180, while the in-process units have $485 assigned to them.

Q & A

What is process costing?

-Process costing is a method of assigning costs to products when the production process is continuous, and it's particularly useful for companies that produce items in a flow, such as in a manufacturing setting.

What is the weighted average method in process costing?

-The weighted average method in process costing is a technique used to calculate the cost per equivalent unit by taking into account both the beginning work in process inventory and the costs added during the period.

Which company is used as an example in the video?

-The company used as an example in the video is Fitz's Rootbeer, a manufacturer that uses process costing for their bottling department.

How many units of root beer did Fitz's Rootbeer bottle during the period mentioned in the video?

-Fitz's Rootbeer bottled 2,000 units of root beer during the period.

What is the status of the 500 units still being processed at the end of the period?

-At the end of the period, the 500 units still being processed are 100% complete with respect to direct materials but only 80% complete with respect to conversion costs.

What are conversion costs in the context of the video?

-Conversion costs in the video refer to the combination of direct labor and manufacturing overhead costs that are used to convert direct materials into finished goods.

How is the cost per equivalent unit calculated for direct materials and conversion costs?

-The cost per equivalent unit is calculated by dividing the total costs of direct materials and conversion costs by the number of equivalent units produced, which in the video is 49 cents per unit for direct materials and 60 cents per unit for conversion costs.

How are costs assigned to the completed units in the bottling department?

-Costs are assigned to the completed units by multiplying the number of units completed (2,000) by the cost per equivalent unit for direct materials (49 cents) and conversion costs (60 cents), then summing these amounts.

What is the total cost assigned to the bottles that were completely finished during the period?

-The total cost assigned to the bottles that were completely finished during the period is $2,180, which is the sum of the direct materials cost ($980) and the conversion cost ($1,200).

How are costs assigned to the units still in process in the bottling department?

-For the units still in process, the direct materials cost is assigned at 100% (500 units * $0.49), while the conversion cost is assigned at 80% completion (400 equivalent units * $0.60).

What is the total cost assigned to the units still in the bottling department at the end of the period?

-The total cost assigned to the units still in the bottling department at the end of the period is $485, which includes $245 for direct materials and $240 for conversion costs.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

VIDEO TERBAIK - PENYUSUNAN LAPORAN BIAYA PRODUKSI - Metode Rata Rata dan FIFO - AKUNTANSI BIAYA

Calculating Average Atomic Mass

FA 34 - Inventory - Weighted Average (Average Cost) Method

8 - Basic Concepts of Inventory Costing Methods

Job Order Costing

Peramalan Permintaan Part 1 (Moving Average and Weighted Moving Average)

5.0 / 5 (0 votes)