ACCOUNTING BASICS: Debits and Credits Explained

Summary

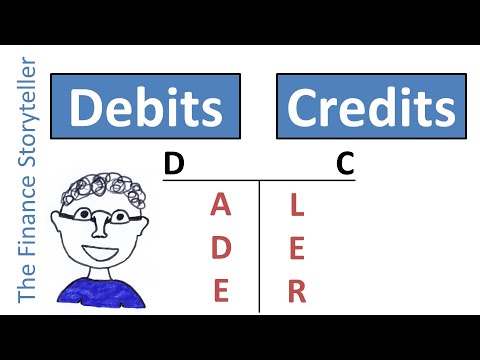

TLDRIn this educational video, James clarifies misconceptions about debits and credits, emphasizing they are not inherently good or bad, nor are they equivalent to addition or subtraction. He explains debits and credits as tools to reflect the dual nature of financial transactions, with debits representing the destination and credits the source of economic benefit. James uses the analogy of heads and tails on a coin to illustrate this concept. He then breaks down the accounting equation, Assets = Liabilities + Equity, and expands it to show how debits and credits affect different accounts. A memorable tip, 'DEALER,' is introduced to help viewers recall which side of the equation various terms belong to. The video concludes with a recap of key points and an invitation to engage with the content.

Takeaways

- 🧐 Debits and Credits are not inherently good or bad; they are accounting terms used to reflect the dual nature of financial transactions.

- 🔄 Debits and Credits are not synonymous with addition or subtraction; they represent the flow of economic benefit in transactions.

- 🪙 The concept of Debits and Credits can be likened to the heads and tails of a coin, indicating every transaction has two sides.

- 💵 In finance, money does not appear or disappear without a corresponding transaction; it flows from a source to a destination.

- 💼 Credits signify the source from which economic benefit flows, such as Owner's Equity, Liabilities, and Revenue.

- 🏢 Debits indicate the destination where economic benefit is received, including Assets, Expenses, and Dividends.

- 📊 The Accounting Equation is Assets = Liabilities + Equity, which can be expanded to show the relationship between Debits and Credits.

- 🔢 Equity can be broken down into Owner's Equity paid in, less Dividends paid out, plus Retained Earnings, which is Profit held for future use.

- 📝 Retained Earnings are calculated as Revenue minus Expenses, and this formula is used to rearrange the Accounting Equation to show Debits and Credits.

- 🃏 The acronym 'DEALER' is offered as a mnemonic to remember which side of the Accounting Equation includes Debits and Credits.

- 📚 The video concludes with a recap of the main points and an encouragement to use the 'DEALER' mnemonic for memorizing Debits and Credits.

Q & A

What is the main purpose of the video?

-The main purpose of the video is to explain what debits and credits are, define them, and demonstrate how understanding these concepts can be beneficial.

How does the video define debits and credits?

-Debits and credits are defined as words used to reflect the duality or double-sided nature of all financial transactions, not as inherently good or bad, nor as the same as adding or subtracting.

What analogy is used in the video to help visualize debits and credits?

-Debits and credits are compared to heads and tails on a coin, emphasizing that every transaction has equal and opposite sides.

What is meant by 'Economic Benefit' in the context of the video?

-Economic Benefit refers to the potential for an asset to contribute either directly or indirectly to the flow of an entity's cash.

How are debits and credits related to the source and destination of Economic Benefit?

-Credits represent the source from which Economic Benefit flows, while debits represent the destination to which it flows.

What are the examples of destinations for Economic Benefit mentioned in the video?

-Destinations for Economic Benefit include Assets, Expenses, and Dividends.

What are the examples of sources for Economic Benefit mentioned in the video?

-Sources for Economic Benefit include Owner's Equity, Liabilities, and Revenue.

How is the Accounting Equation expanded and rearranged in the video to show the relationship between debits and credits?

-The Accounting Equation is expanded and rearranged to show that Dividends plus Expenses plus Assets equal Liabilities plus Owner's Equity paid in plus Revenue, with the left-hand side representing debits and the right-hand side representing credits.

What is the tip provided in the video to remember which side of the Accounting Equation includes debits and credits?

-The tip is the word 'DEALER', which helps to remember that debits (D, E, A, L, E, R) are on the left-hand side and credits are on the right-hand side of the Accounting Equation.

What does the acronym 'DEALER' stand for in the context of the video?

-The acronym 'DEALER' is a mnemonic to remember that debits include Dividends, Expenses, Assets, Liabilities, Expenses, and Revenue.

How does the video encourage viewers to engage with the content?

-The video encourages viewers to engage by asking them to like the video if they found it useful and to subscribe for more content.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

Debits and credits DC ADE LER

¿Es posible controlar las emociones? 🤔 Enric Responde 61

MTH150 1.2 Properties of Negatives and Technical Communication

How to deal with negative energies, toxic people and thoughts | [This will change your life]

Most People Don't Know How Evil They Are | Jean-Jacques Rousseau

Debits and Credits

5.0 / 5 (0 votes)