Autoregressive Models | Auto Regression | Machine Learning for Beginners | Edureka

Summary

TLDRThis Edureka video introduces autoregressive models for time series forecasting, explaining the concept, types, and stationarity requirement. It covers how to select the model based on PACF plots and uses cases, including market analysis and seasonal pattern prediction, emphasizing the importance of simplicity in model selection.

Takeaways

- 📈 Auto regressive models are flexible for handling various time series patterns.

- 📚 The script introduces the concept of time series forecasting and the importance of stationarity in data for effective modeling.

- 🔢 Time series data is a sequence of data points collected at regular time intervals, such as years, months, or minutes.

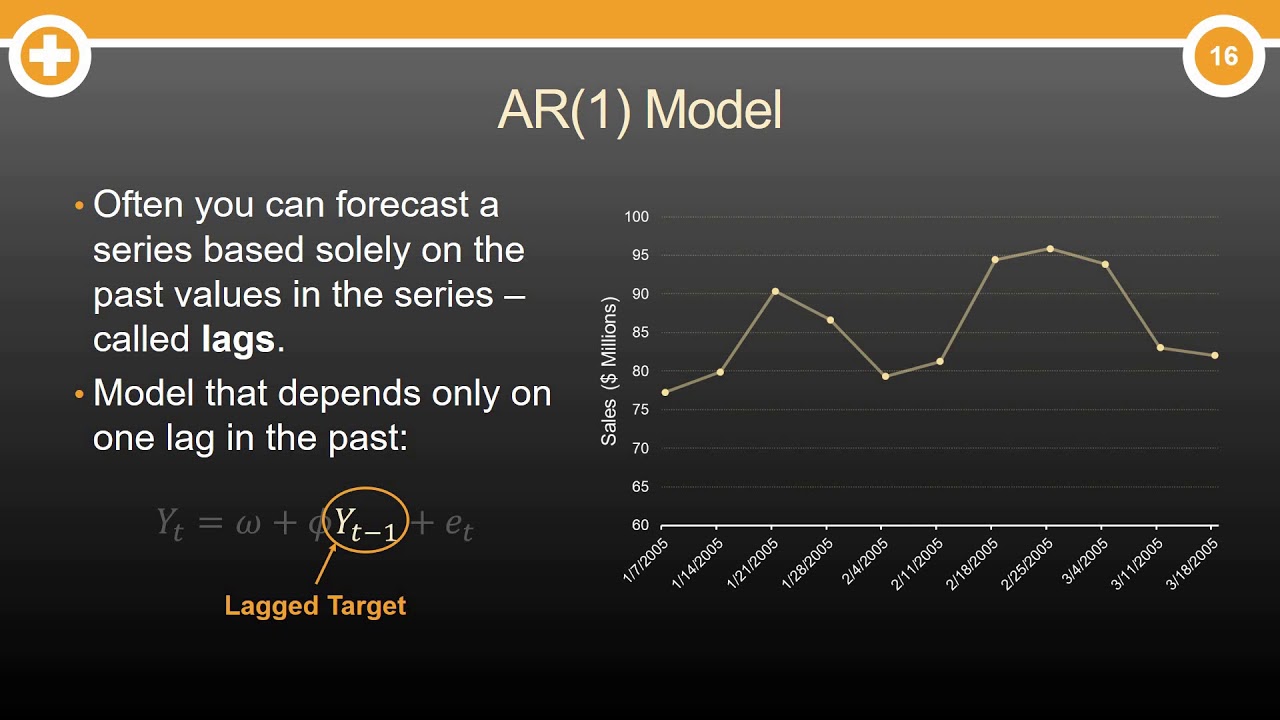

- 📉 Forecasting uses historical data to predict future trends, with notations like \( y_t \), \( \phi \), \( c \), and \( \eta \) representing different elements in the time series.

- 🔄 Auto regression is a self-referential prediction method that uses only historical data of the same variable to make predictions.

- 🚫 A key constraint for using auto regression is that the time series data must be stationary, meaning its statistical properties remain constant over time.

- 📊 Different types of autoregressive models (AR1, AR2, etc.) are determined by the number of previous time steps considered in the prediction.

- 📝 To select the appropriate autoregressive model, the script suggests using a PACF (Partial Autocorrelation Function) plot to identify significant lag values.

- 📉 The PACF plot helps in determining the partial correlation between a given time point and its lags, aiding in the selection of model parameters.

- 💡 Auto regression has various use cases, including detecting lack of randomness in data, predicting future changes, and analyzing market trends like the stock market.

- 📚 The video concludes by encouraging viewers to engage with the content, ask questions, and explore more educational material on the Edureka channel.

Q & A

What is the main focus of the video on auto regressive models?

-The video focuses on explaining auto regressive models, starting with basic concepts like time series and forecasting, moving on to defining auto regression and stationarity, discussing different types of autoregressive models, how to select the appropriate model, and concluding with various use cases of AR models.

What is a time series in the context of mathematics?

-A time series is a sequence of data points recorded at successive, equally spaced points in time. It represents discrete time data and can be measured in various intervals such as years, months, hours, or minutes.

How does forecasting relate to time series data?

-Forecasting is a technique that utilizes historical time series data as inputs to make informed predictions about future trends. It helps in determining the direction of future movements based on past patterns.

What are the common notations used in time series data?

-Common notations include 't' for the time index, 'y_t' for the value of the series at time 't', 'φ' (phi) for the coefficient of each value of 'y_t', 'c' for the constant term or bias of the model, and 'η' (eta) for the error in the forecast at time 't'.

What is meant by auto regression in the context of time series models?

-Auto regression refers to a time series model that uses previous time steps' observations as inputs to predict the same characteristic at the next time step. It is based on the concept of predicting a numeric value based on its own historical data.

Why is stationarity important for using auto regressive models?

-Stationarity is important because it ensures that the statistical properties of the time series data, such as mean and variance, remain constant over time. This allows for more accurate and reliable predictions using auto regressive models.

What does the term 'AR' stand for in the context of time series models?

-In the context of time series models, 'AR' stands for AutoRegressive, which is a model that uses past values of a time series to predict future values.

How do you determine the number of lag values to consider in an autoregressive model?

-The number of lag values to consider can be determined using a PACF (Partial AutoCorrelation Function) plot. It helps identify the significant lags by looking at the points where the PACF values fall below a certain threshold, typically a magnitude of 0.05.

What is the purpose of the constant term 'c' in an autoregressive model?

-The constant term 'c' in an autoregressive model serves as the bias or the baseline value around which the predictions are made, adjusting the forecast according to the historical data's average level.

Can you provide an example of a use case for autoregressive models?

-Autoregressive models are used in various fields such as predicting stock market trends, analyzing recurring or seasonal patterns in data, and detecting lack of randomness in data sequences.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

What are Autoregressive (AR) Models

Time Series Talk : Autoregressive Model

Time Series Analysis - 2 | Time Series in R | ARIMA Model Forecasting | Data Science | Simplilearn

Introduction to Time Series Forecasting | SCMT 3623

Praktikum Ekonometrika II - Analisis ARIMA di EViews

Tutorial Estimasi ARDL Model Dengan Eviews

5.0 / 5 (0 votes)