FA 50 - Horizontal Analysis

Summary

TLDRThis video script offers a detailed explanation of horizontal analysis in financial statement evaluation. It demonstrates how to compare two consecutive years to identify significant changes in a company's performance. The script illustrates the process by examining sales, cost of goods sold, gross profit, operating income, and other financial figures, highlighting the importance of year-over-year percentage changes for a more insightful analysis. The presenter emphasizes the need to investigate any discrepancies, such as a higher increase in cost of goods sold compared to sales, to understand underlying business dynamics.

Takeaways

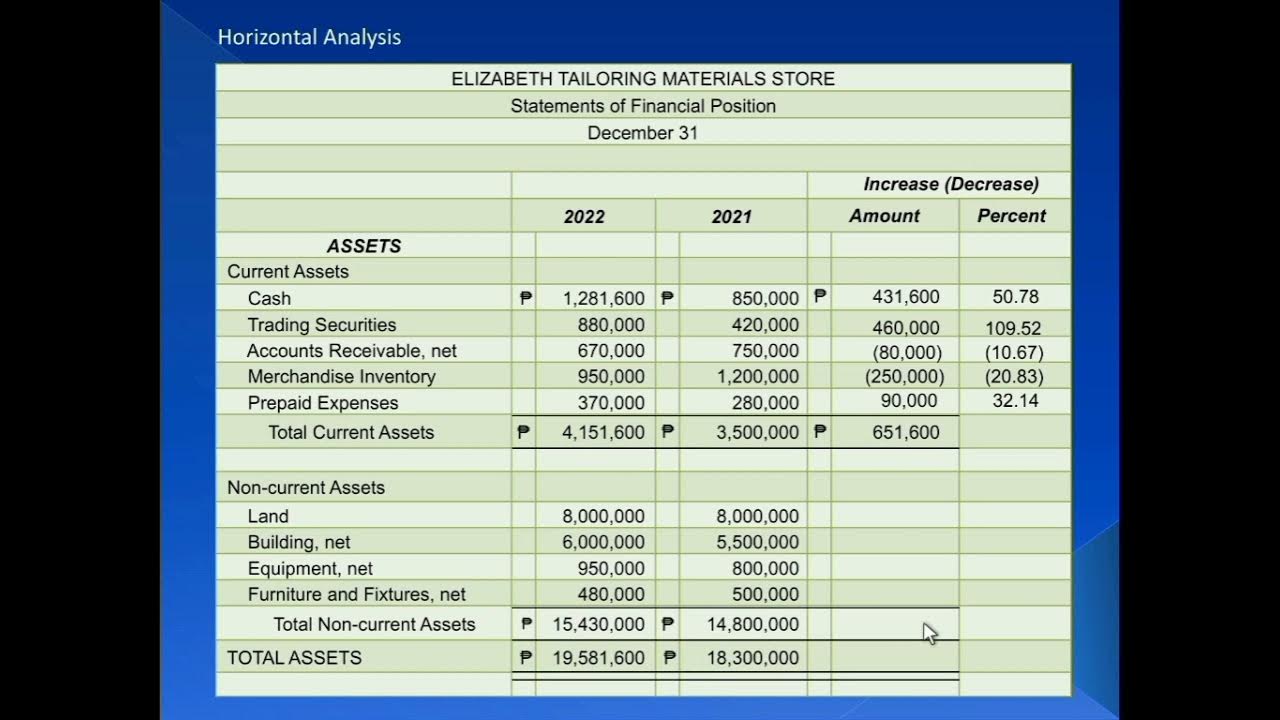

- 📘 The video discusses how to perform a horizontal analysis on financial statements by comparing one year to the next.

- 📊 Horizontal analysis involves looking for significant changes in numbers between two consecutive years to understand the company's performance trends.

- 🔍 The speaker emphasizes the importance of identifying big numbers with large changes as they can quickly reveal insights about a company's financial health.

- 📈 The example given in the script shows a comparison of sales, cost of goods sold, gross profit, operating expenses, operating income, interest expense, income before tax, income taxes, and net income between 2023 and 2024.

- 📉 The speaker points out that while most items increased, the interest expense decreased, which might be related to changes in long-term debt rather than operational performance.

- 📊 Percentage change is highlighted as a more useful measure than absolute change, as it provides a relative comparison to the previous year's figures.

- 🧮 To calculate the percentage change, the change in value is divided by the value of the earlier year, which gives a more meaningful insight into the company's growth or decline.

- 🤔 The speaker suggests that comparing percentage changes can be more informative than absolute changes, especially when comparing companies of different sizes or in different industries.

- 🚨 A key concern raised in the script is the cost of goods sold (COGS) increasing at a higher rate than sales, which could indicate a potential issue with pricing strategy or cost management.

- 🔎 The speaker recommends investigating why COGS increased at a higher rate than sales, as this discrepancy could impact the company's profitability and margins.

- 🔑 The takeaway emphasizes the importance of horizontal analysis as a fundamental tool for quickly understanding and evaluating a company's financial performance over time.

Q & A

What is the main focus of the video script?

-The main focus of the video script is to explain the concept of horizontal analysis in the context of financial statements, using the example of a company's sales and other financial figures from two consecutive years.

Where can the workbook containing the problems discussed in the video be found?

-The workbook can be found on a website mentioned in the script, where one can click the PDF link to download a copy of the problems.

What does the term 'horizontal analysis' refer to in the context of the video?

-In the context of the video, 'horizontal analysis' refers to the process of comparing financial statements from one year to the next, to identify changes and trends in the company's financial performance.

How does the video script suggest identifying significant changes in financial statements?

-The script suggests identifying significant changes by eyeballing the statements for big numbers with big changes, which can quickly tell a story about the company's financial performance.

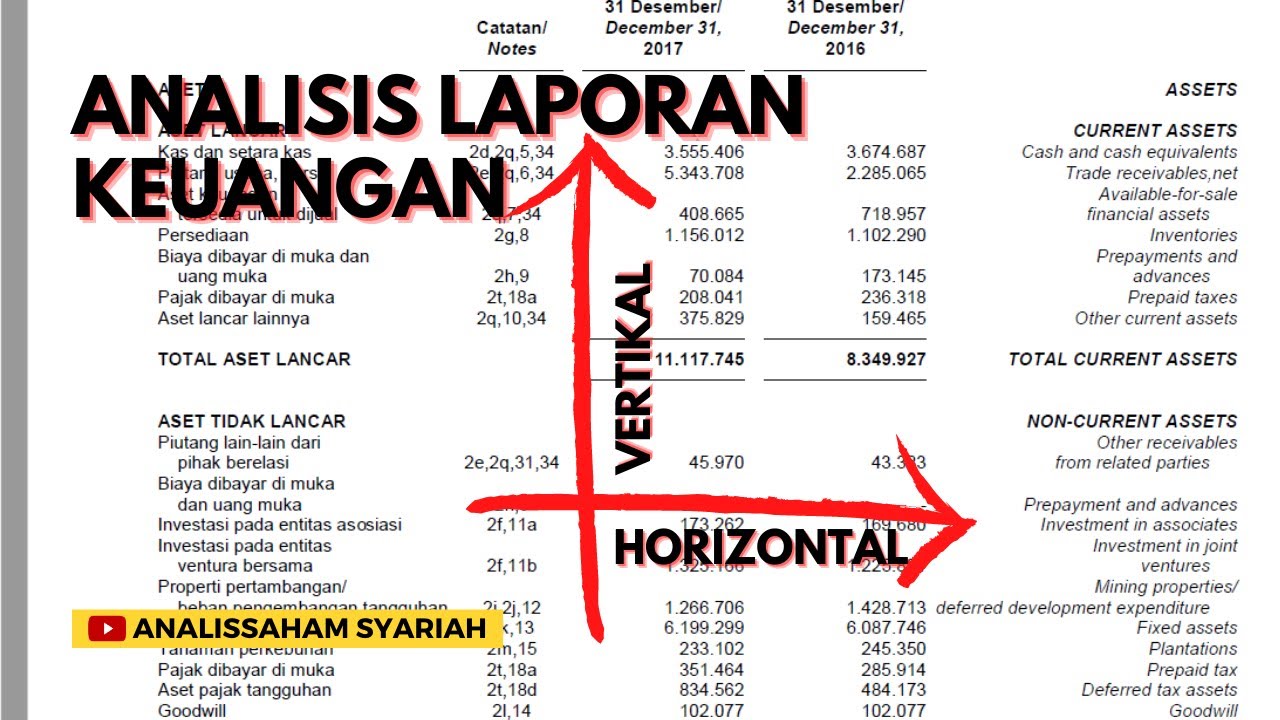

What is the difference between horizontal and vertical analysis in the context of financial statements?

-Horizontal analysis involves comparing financial figures across different years to identify year-over-year changes, while vertical analysis compares figures within the same year to understand the proportionate relationship between different line items.

What is the significance of calculating percentage change in financial analysis?

-Calculating percentage change is significant as it provides a relative measure of change, allowing for better comparison of performance across different time periods and between companies of varying sizes.

How does the video script define the year-over-year change in sales?

-The year-over-year change in sales is defined as the difference in sales figures between two consecutive years, in this case, from 2023 to 2024.

What is the importance of comparing similar competitors when analyzing financial performance?

-Comparing similar competitors is important to benchmark the company's performance against industry standards and to understand how effectively the company is performing relative to its peers.

Why might a company's cost of goods sold (COGS) increase at a higher rate than its sales?

-A company's COGS might increase at a higher rate than its sales due to various factors such as increased production costs, higher input prices, or a change in the product mix that results in lower profit margins.

What does the video script suggest as the most concerning figure in the financial analysis presented?

-The script suggests that the most concerning figure is the cost of goods sold (COGS) increasing at a higher rate than sales, which indicates a potential issue with profit margins and cost management.

How does the video script recommend further investigation of the financial figures?

-The script recommends investigating the reasons behind significant changes, such as why COGS increased at a higher rate than sales, by examining factors like pricing strategies, cost management, and market conditions.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

Contoh Cara Menghitung Analisis Vertikal / Horizontal Laporan Keuangan

Statement of Financial Position (SOFP) | Laporan Posisi Keuangan | Akuntansi Keuangan Menengah

Vid # 5 BUSINESS MANAGEMENT ACCOUNTING Module 3 Part 1

ANALISIS LAPORAN KEUANGAN UNTUK SMK KELAS XII SEMESTER GENAP

Part 1: Financial Statements Analysis (Intro, Horizontal Analysis and Vertical Analysis)

Profit & Loss Account, Preparation of Final Accounts, Format of Profit and Loss Account, Accounting

5.0 / 5 (0 votes)