The 7 Wealth Killers That No One Talks About

Summary

TLDRThis video script delves into seven significant wealth killers often overlooked. It emphasizes that residential real estate and cars, being the largest expenses for most, are liabilities rather than assets. The speaker argues for treating homes as expenses, investing less in them, and channeling more funds into assets like stocks and rental properties. The transcript also cautions against cheap services in business, emotional and impulse investing, high-interest short-term loans, and impulse purchases. Lastly, it advises skepticism towards unsolicited financial advice online, advocating for personalized financial strategies.

Takeaways

- 🏠 The home you live in is often a liability, not an asset, as it requires continuous expenses without generating income until sold.

- 🚗 Cars are a significant expense and depreciate rapidly, making them a liability and a wealth killer for many Americans.

- 💰 Being cheap can be expensive in business, as hiring cheap services often leads to poor quality and additional costs to fix mistakes.

- 📉 Emotional investing, driven by fear or impulse, often results in buying high and selling low, which is detrimental to wealth building.

- 💳 Relying on short-term loans and credit cards for immediate expenses can lead to a cycle of high-interest debt.

- 🛍️ Impulse purchases can quickly accumulate and drain wealth; implementing a 24-hour rule can help curb this behavior.

- 🤔 Never blindly follow financial advice from random sources online, as what works for one person may not work for another.

- 📈 Focus on long-term trends and financials rather than short-term news when making investment decisions.

- 🔑 Prioritize investing in assets like stocks, real estate, or businesses that can generate income and appreciate over time.

- 🛑 Recognize and avoid the seven wealth killers to build and maintain wealth, starting with the largest expenses.

- 💼 Apply learned information to your own life and circumstances, innovating rather than copying, to achieve financial success.

Q & A

What is considered the biggest wealth killer according to the speaker?

-The biggest wealth killer, as mentioned in the script, is the place where you live. The speaker argues that homes are often mistaken as investments when they are actually liabilities that do not generate income.

Why does the speaker believe that a home is not a good investment?

-The speaker believes a home is not a good investment because it requires ongoing expenses such as mortgage payments, maintenance, property taxes, and insurance, and it does not generate income until it is sold or refinanced.

What is the second largest expense for most Americans, as discussed in the script?

-The second largest expense for most Americans, following housing, is their car. Cars are considered liabilities because they depreciate in value over time.

Why does the speaker suggest that buying an expensive car may not be financially wise?

-The speaker suggests that buying an expensive car may not be financially wise because it involves paying interest on a depreciating asset, leading to a cycle of debt and high ongoing costs such as insurance, fuel, and maintenance.

What is one of the key points the speaker makes about the importance of treating your home as an expense rather than an investment?

-The key point is that by treating your home as an expense, you can allocate more funds towards actual investments like stocks, rental properties, or your own business, which can generate income and build wealth over time.

What is the third wealth killer mentioned in the script, and why is it considered a wealth killer?

-The third wealth killer mentioned is being cheap, especially in business. The speaker explains that hiring cheap services or professionals can lead to higher long-term costs due to poor quality work that may require expensive fixes.

How does the speaker describe the impact of impulse investing on wealth building?

-The speaker describes impulse investing as a wealth killer because it is often driven by emotions and market news, leading to buying high and selling low, which is the opposite of the wealth-building strategy of buying low and selling high.

What is the average credit card debt in America, and how does the speaker describe its impact on wealth building?

-The average credit card debt in America is around $6,500. The speaker describes it as a wealth killer because the high interest rates associated with credit card debt can lead to paying thousands of dollars in interest over time.

What advice does the speaker give to avoid falling into the trap of impulse purchases?

-The speaker advises implementing a 24-hour rule for impulse purchases. If you find something you want to buy, wait 24 hours before making the purchase decision. This allows you to sleep on it and reconsider whether the purchase is necessary.

What is the seventh wealth killer discussed in the script, and how can it be avoided?

-The seventh wealth killer is blindly listening to advice from random sources on the internet without discerning opinion from fact. To avoid this, the speaker suggests learning from various sources but applying the information critically and innovatively to one's own life.

What is the speaker's view on the role of online education in wealth building, and how should it be approached?

-The speaker acknowledges that there is good online education that can be valuable for wealth building. However, they caution against blindly following systems or dreams sold by some educators, and instead, recommend learning and then applying the knowledge innovatively to one's own situation.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

Dave McGowan's Programmed to Kill: MK Ultra Serial Killers - Jay Dyer (Free Part)

ADHD and Emotional Dysregulation: What You Need to Know

Deadly Moments in History - Ancient Serial Killers

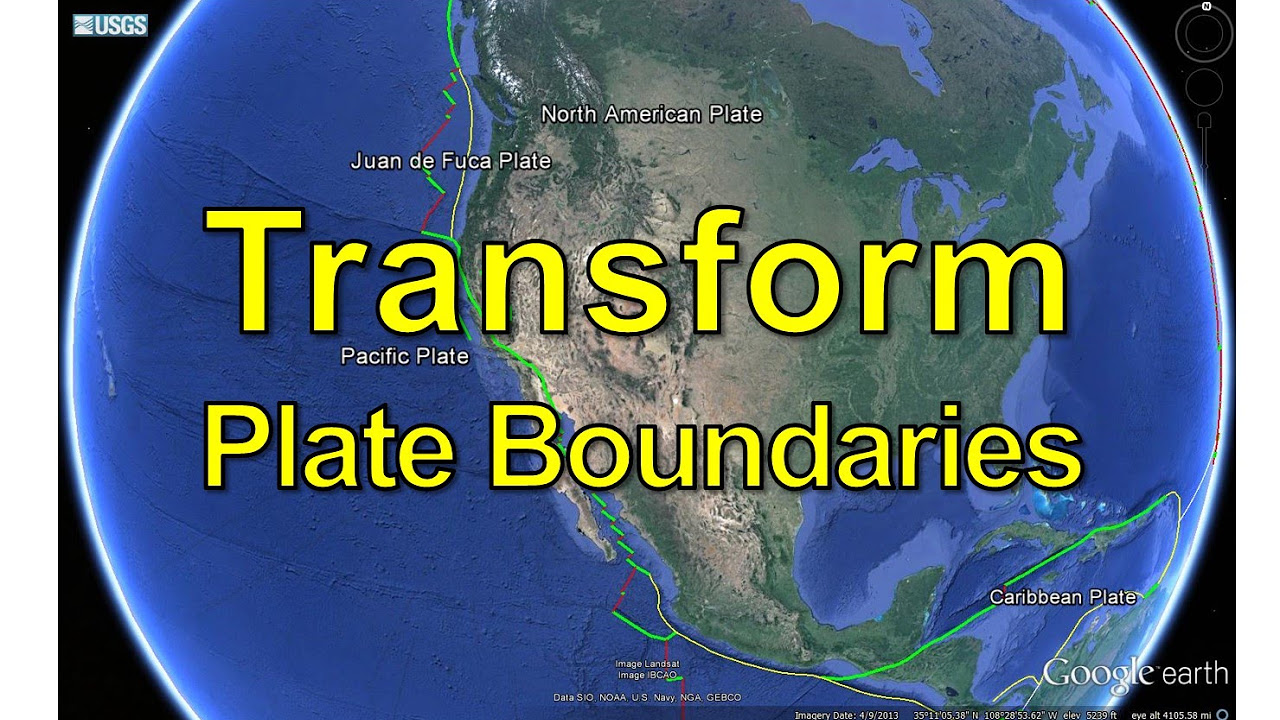

Transform Plate Boundaries

The Good Earth by Pearl S. Buck Summary

The Disturbing Trait That Almost All Serial Killers Share

5.0 / 5 (0 votes)