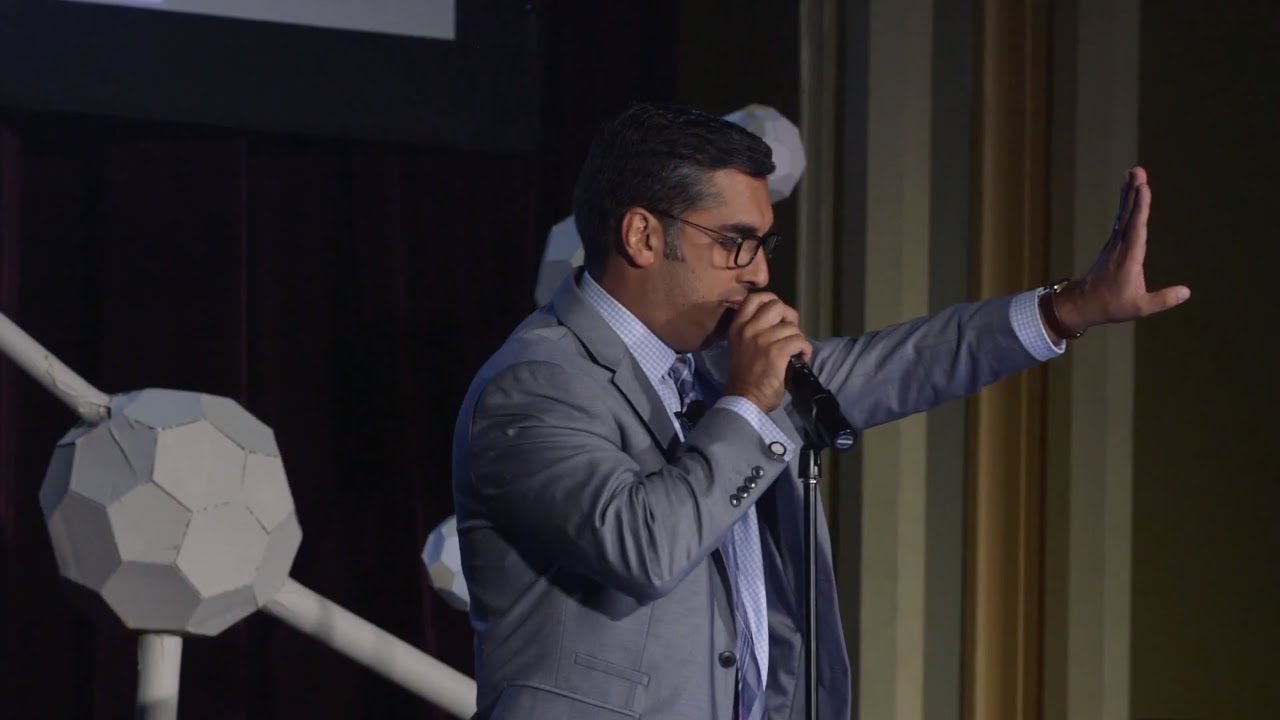

The reason ICT cant explain everything

Summary

TLDRThe speaker passionately discusses their unique trading knowledge, which they've been told not to share. They've created a language to describe market algorithms without revealing secrets. The speaker challenges common trading misconceptions, emphasizing the potential for significant earnings with even a small account, and the various income streams available to skilled traders. They promise to demonstrate their trading prowess, aiming to change skeptics' minds and inspire others with their expertise.

Takeaways

- 😖 The speaker feels burdened by knowledge they were told not to share and had to create a secret language to discuss it.

- 🤔 The speaker hints at understanding complex market algorithms without explicitly revealing their secrets.

- 💡 They mention the existence of two types of algorithms in the market: one that sets prices and another that interacts with these price-setting algorithms.

- 🤑 The speaker is confident in their trading abilities and claims to be able to demonstrate profitable trades in real-time.

- 😡 There is frustration expressed towards people who do not recognize the speaker's trading skills or the validity of their methods.

- 🚫 The speaker is clear that they will not divulge all the knowledge they have, only what they have already shared.

- 💰 They emphasize the potential to make significant money in trading, even with a relatively small account balance.

- 📈 The speaker believes in the possibility of consistent, profitable trading and dismisses the idea of needing a large account to be successful.

- 🤷♂️ Despite proving their trading abilities, the speaker acknowledges that there will always be skeptics who question their methods.

- 🏆 The speaker highlights the various income streams available to skilled traders, such as education, signal services, and social media presence.

- 📊 They suggest that by mastering trading, one can achieve financial success and independence from societal pressures and comparisons.

Q & A

What does the speaker imply by saying they had to create a language to discuss certain market algorithms?

-The speaker implies that they had knowledge of sensitive or proprietary trading algorithms that they were not supposed to share. To discuss these without revealing confidential information, they developed a coded language.

What are the two types of algorithms the speaker refers to in the marketplace?

-The speaker refers to two types of algorithms: one that runs the price, which is the price engine, and another that engages with the price engine, which is related to smart money algorithms.

What does the speaker mean by 'smart money algorithms'?

-Smart money algorithms likely refer to trading algorithms used by professional or institutional traders, which are sophisticated and designed to execute trades in a way that maximizes profit and minimizes the impact on market prices.

Why does the speaker claim that they can find a 'five handle move' every day in the market?

-The speaker suggests that they have identified a pattern or opportunity in the market that allows them to consistently find profitable trades, referred to as a 'five handle move,' which implies a significant price movement that can be capitalized on.

What is the significance of the speaker's statement about being able to trade without revealing their methods?

-The statement highlights the speaker's confidence in their trading abilities and the secrecy surrounding their trading strategies, which they believe are unique and not widely understood or shared.

What does the speaker mean by 'mapping out every one minute and five minute candle real time two times a week'?

-The speaker is offering to provide a detailed analysis of market movements over short time frames, specifically one and five-minute intervals, twice a week, to demonstrate their trading insights and strategies.

What is the speaker's view on the importance of having a large trading account to be successful?

-The speaker challenges the notion that a large trading account is necessary for success, arguing that with the right strategies and mindset, even a smaller account can yield significant profits.

How does the speaker feel about the idea of needing a high strike rate in trading?

-The speaker expresses a desire for a trading environment that does not rely on a high strike rate, meaning they do not want to operate in conditions where success is based on a 50-50 chance but rather on calculated and favorable odds.

What is the speaker's opinion on the role of education in trading success?

-The speaker believes that education is crucial for trading success and has made more money selling educational materials than through live trading, indicating the value they place on knowledge and understanding the market.

What potential income streams does the speaker suggest are available to those who learn how to trade effectively?

-The speaker suggests several income streams for skilled traders, including fund management, working for a proprietary trading firm, providing education, signal services, and creating content for platforms like YouTube.

How does the speaker address the skepticism and criticism they receive from others?

-The speaker acknowledges the skepticism but remains confident in their abilities, stating that they will continue to demonstrate their trading prowess and that the critics often lack successful trading records themselves.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

ORA PARLIAMO NOI

What is Share Market? #StockMarket Explained in Hindi from Beginners | How to Make Money?

Being BRUTALLY HONEST about the skin treatments I’ve done + reacting to hate comments lol

Does African American Studies Matter? | Kush K. Bhardwaj | TEDxBuffalo

How To Become a POLYMATH (Genius)

I Passed The RESEARCH ANALYST Exam In Just 40 Days ! BUT....

5.0 / 5 (0 votes)