Ep 1 : What Are Futures? CME Contracts Explained Simply

Summary

TLDRIn this video, the concept of futures contracts is explained simply and clearly. It highlights how traders can buy assets like oil, gold, or the S&P 500 without physically owning them, by locking in prices for future transactions. The two main uses of futures are hedging (e.g., for farmers and businesses) and speculation for profit. Key elements such as underlying assets, contract sizes, tick sizes, and leverage are also discussed. The video emphasizes that while futures offer high liquidity and can be beginner-friendly with microcontracts, they carry risks due to the leverage involved.

Takeaways

- 😀 Futures contracts allow traders to buy or sell assets like oil, gold, or the S&P 500 without physically owning them.

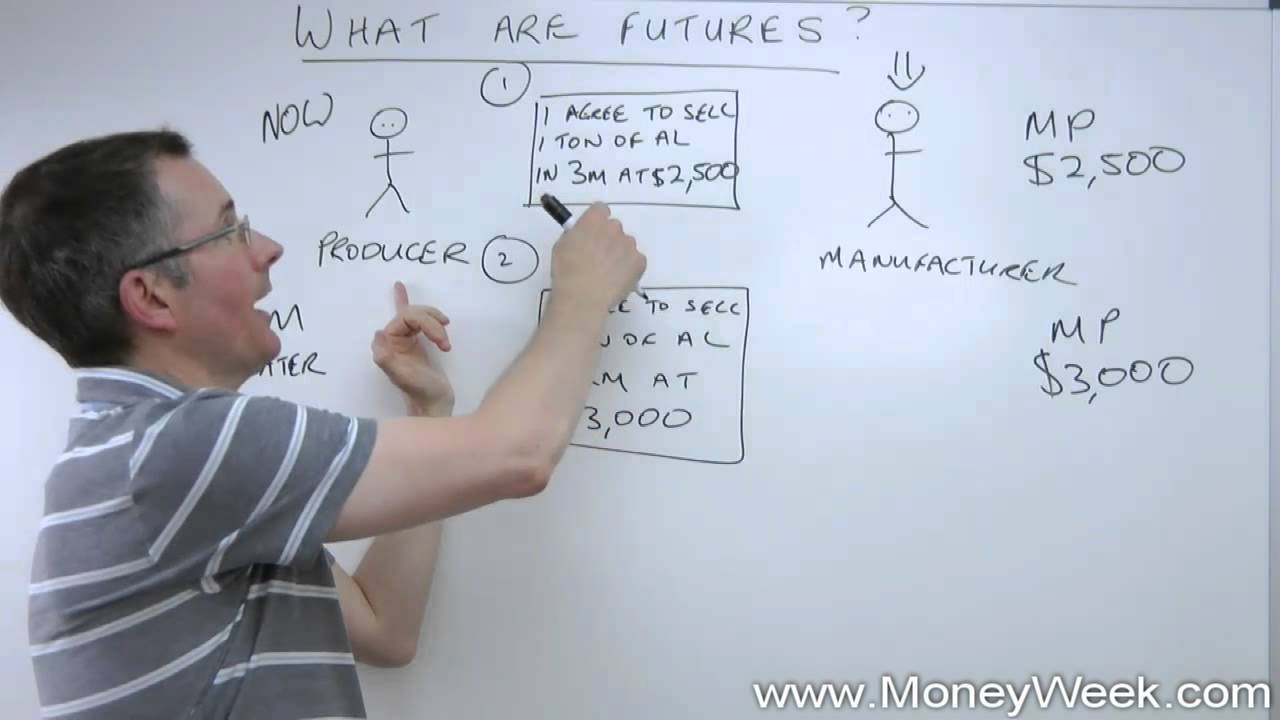

- 😀 A simple example of a futures contract is agreeing to buy a car in 3 months for a set price, regardless of market value at that time.

- 😀 Futures contracts are traded on regulated exchanges like the Chicago Mercantile Exchange (CME).

- 😀 There are two main uses for futures: hedging and speculation.

- 😀 Hedging involves using futures to protect against price changes (e.g., airlines buying oil futures to lock in fuel prices).

- 😀 Speculation involves trying to profit from price fluctuations in assets, whether prices go up or down.

- 😀 Every futures contract has key details: underlying asset, contract size, tick size, and value.

- 😀 Futures contracts use leverage, meaning you only need a fraction of the contract's value to control the full position, making them powerful but risky.

- 😀 Microcontracts are available for beginners and are 1/10th the size of regular contracts, allowing smaller exposure to the market.

- 😀 The CME ensures transparency and security in pricing, as it is a regulated exchange, adding confidence for traders.

- 😀 While futures are a useful trading tool, leverage can magnify both profits and losses, so managing risk is essential.

Q & A

What is a futures contract?

-A futures contract is an agreement to buy or sell an asset at a predetermined price at a specific time in the future, without needing to own the asset immediately.

Where are futures contracts typically traded?

-Futures contracts are traded on regulated exchanges like the Chicago Mercantile Exchange (CME), which ensures transparency and security.

What is an example of using a futures contract in everyday life?

-It’s like agreeing to buy a friend’s car in three months for a fixed price of $20,000, regardless of the car’s market value at that time.

What are the two main reasons traders use futures contracts?

-Futures contracts are used for hedging, to protect against price changes, and for speculation, to profit from price movements without owning the asset.

How do airlines use futures contracts?

-Airlines buy oil futures to lock in fuel prices in advance, which protects them from price fluctuations in the market.

What is contract size in futures trading?

-Contract size specifies how much of the underlying asset one futures contract represents, for example, one crude oil contract equals 1,000 barrels of oil.

What is leverage in futures trading, and why is it important?

-Leverage allows traders to control the full value of a contract with only a fraction of its cost, which can amplify both profits and losses.

What is a tick size and tick value?

-Tick size is the smallest price movement of a futures contract, and tick value is the amount of money that movement represents.

Why are futures contracts considered suitable for beginners?

-Beginners can start with microcontracts, which are smaller and more manageable, allowing them to learn without taking on large risks.

What does liquidity mean in the context of futures contracts?

-Liquidity refers to the ease of entering and exiting a trade quickly without significantly affecting the price of the contract.

What is the main risk of trading futures contracts?

-The main risk is that leverage can magnify losses as well as gains, so effective risk management is essential.

What types of assets can futures contracts be based on?

-Futures can be based on commodities like crude oil or gold, stock indices like the S&P 500, and other financial instruments.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

5.0 / 5 (0 votes)