The ONLY Way to Trade Reversals and Retracements (That Actually Works)

Summary

TLDRIn this video, the creator delves into the strategies behind trading reversals and retracements, focusing on premium and discount, swing areas, and understanding market ranges. The concept of identifying equilibrium in market movements is explained, with an emphasis on using GAN boxes and key levels to spot high-probability setups. Key distinctions between retracements and reversals are explored, showing how different traders (scalpers, day traders, and swing traders) can apply these techniques to their own strategies. The creator also shares insights on using time-based windows and a blueprint model to enhance trading accuracy.

Takeaways

- 😀 Liquidity is crucial in trading. The market will often reverse when it hunts liquidity, which is why understanding liquidity levels is key to predicting price movements.

- 😀 Time is a critical factor in successful trading. Key time windows like 9:30 and 3:00 a.m. are important for identifying potential reversals and market manipulation.

- 😀 Trading strategies are fractal in nature. The same principles can be applied whether you're a swing trader, day trader, or scalper, but with different time frames and approaches.

- 😀 Swing traders can use higher time frames (such as the daily chart) to identify key liquidity zones where reversals may occur, just like day traders or scalpers.

- 😀 A 25-50% retracement is a typical target for minimum trades, whether you're trading on a higher time frame (like daily) or in lower time frames (like scalping or day trading).

- 😀 The market often operates within ranges, which form on higher time frames. Understanding these ranges helps traders identify key points for potential reversals.

- 😀 A good trade setup is based on a combination of liquidity levels and specific times when the market is most likely to reverse.

- 😀 Time-based models help increase the probability of trade success by timing entries and exits with high probability setups.

- 😀 Traders can use a free flowchart available from the creator's Twitter (X) page to simplify and visualize the approach described in the video.

- 😀 The content is designed for traders of all experience levels, and the creator offers a more in-depth learning opportunity via a paid academy for those who want one-on-one mentorship.

Q & A

What is the core concept of trading retracements and reversals?

-Trading retracements and reversals involves identifying when price is likely to reverse or retrace after an initial movement. The idea is to buy or sell at a more favorable price within a market range, using key levels like premium, discount, and swing points to guide decisions.

How do premium and discount levels help in trading retracements and reversals?

-Premium and discount levels help traders identify potential entry and exit points based on price movement. Premium refers to higher price levels in a trend, while discount refers to lower levels. By understanding these levels, traders can better predict when price is likely to retrace or reverse.

What is the importance of swing points in the context of retracement and reversal trading?

-Swing points, such as swing highs and lows, act as key reference points for identifying potential turning points in the market. They help define the range within which the market is moving and provide insight into when price might return to equilibrium or reverse direction.

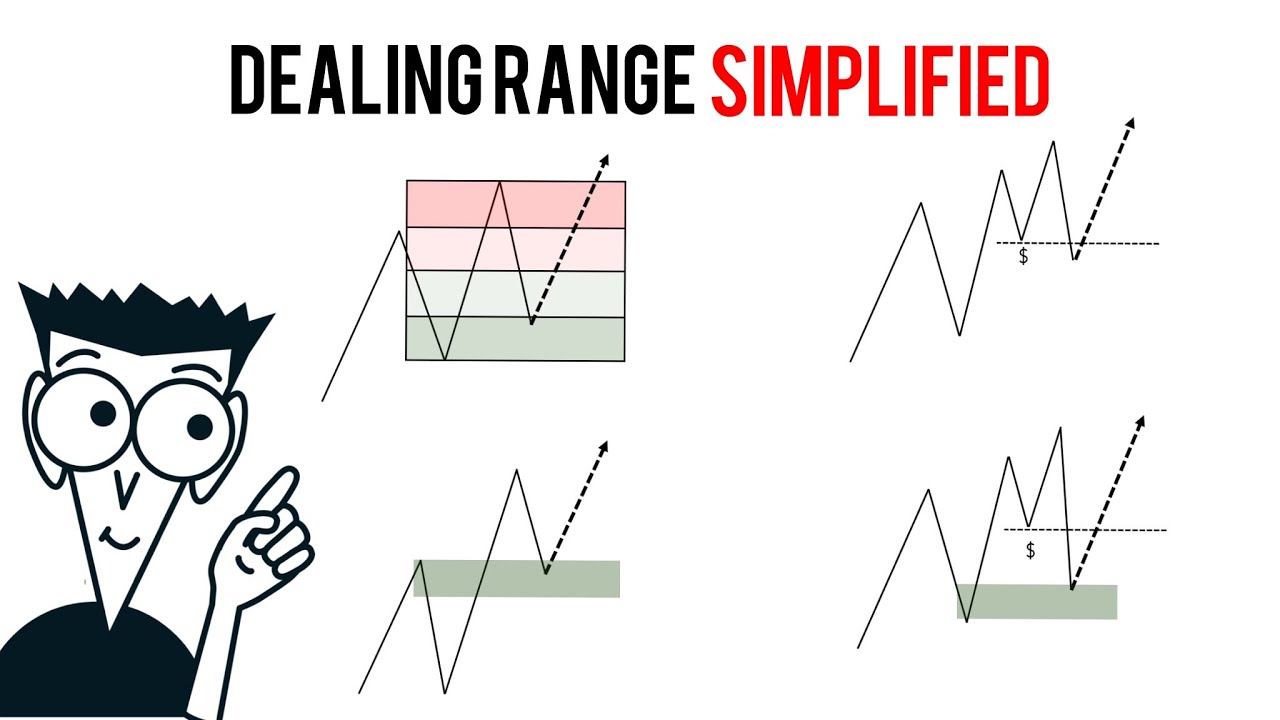

What is a dealing range and how is it used in this strategy?

-A dealing range is the area between a swing high and swing low within the market. By identifying this range, traders can look for retracements to the equilibrium point (50%) or reversals at higher levels, depending on the market's behavior.

How do you know when a market is likely to reverse rather than just retrace?

-A reversal is confirmed when the market closes above key levels such as 0.5 or 0.75 within a price swing. If the market fails to close above these levels and instead reverses back, it indicates that a full reversal may be taking place.

What role does time play in this trading strategy?

-Time is crucial in identifying manipulation and reversal points. Specific time windows, such as 3:00 a.m. or 9:30 a.m., can mark significant liquidity shifts and manipulation, giving traders a higher probability of success when trading within these periods.

What is the difference between retracement and reversal trading?

-Retracement trading involves taking positions within a trend at key levels (like 50%) and targeting a return to the equilibrium point. Reversal trading, on the other hand, seeks to identify when a trend has fully changed direction, often requiring price to close above 50% or higher levels like 0.75.

How do traders use grading price swings in their analysis?

-Grading price swings involves analyzing the price movement in stages, such as 0.25, 0.50, and 0.75. By observing how price interacts with these levels, traders can assess whether a retracement or full reversal is likely to occur.

What is the significance of buy-side and sell-side liquidity in market analysis?

-Buy-side liquidity refers to orders placed above the market's recent highs, while sell-side liquidity refers to orders placed below recent lows. Traders use these liquidity levels to understand where price may be driven towards and where reversals might occur.

How does a trader define their personality to determine the best trading approach?

-A trader's personality influences their approach to trading, whether they prefer swing trading (long-term holds), day trading (shorter holds), or scalping (quick trades). Identifying your personality traits helps define the right strategy for your risk tolerance and time commitment.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

5.0 / 5 (0 votes)