Ringkasan Materi Pertemuan-12. Penentuan Harga dalam Praktek

Summary

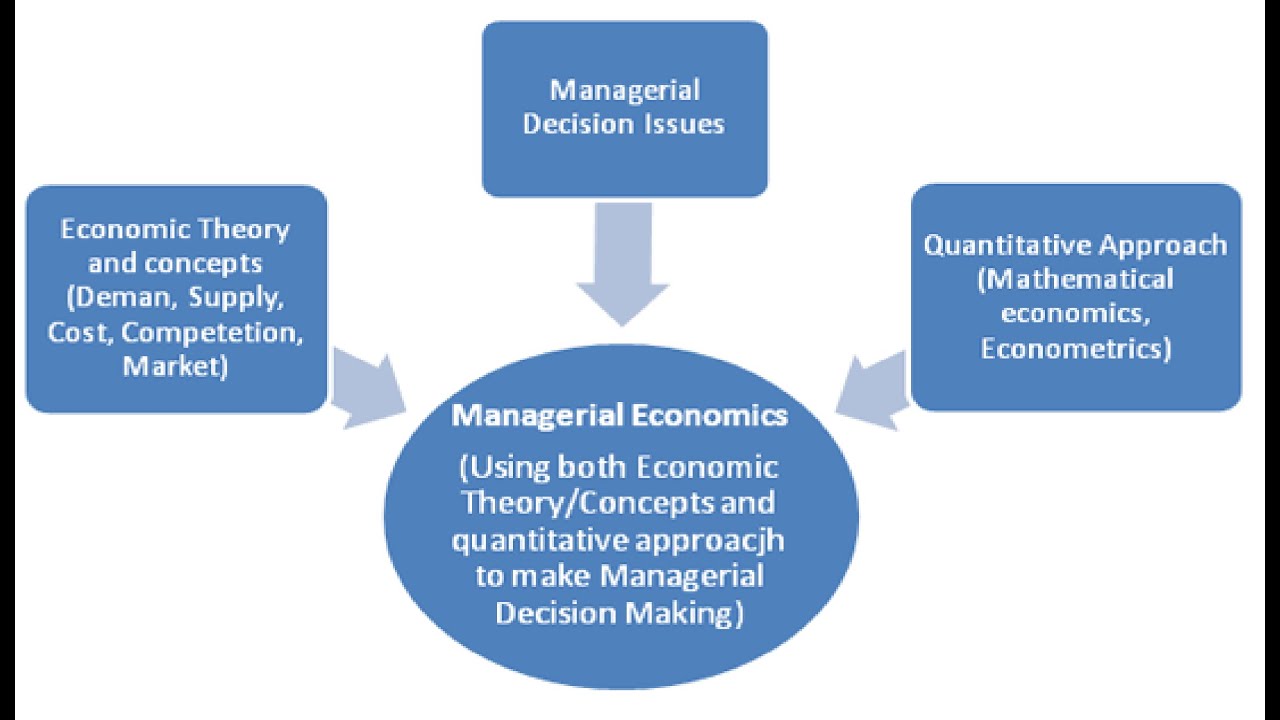

TLDRThe transcript explores key concepts in pricing strategy and economics, focusing on optimizing prices for multiple products produced by a company. Topics include marginal revenue, price discrimination, transfer pricing, and determining optimal output levels. It also touches on the role of monopolies, different pricing techniques, and the importance of understanding market demand elasticity. The discussion covers first, second, and third-degree price discrimination, as well as strategies for pricing intermediate products within a company. The content concludes with the importance of determining the right transfer price and the use of cost-plus pricing methods to ensure profitability.

Takeaways

- 😀 Companies producing multiple products must consider the relationships between substitutes and complements when determining product pricing.

- 😀 To achieve optimum pricing and output, the marginal revenue of each product should equal its marginal cost.

- 😀 The company’s production mix should be based on the profit potential of each product to fully utilize available production facilities.

- 😀 Pricing and output decisions are made based on the point where marginal revenue equals marginal cost, ensuring maximum profit.

- 😀 Price discrimination refers to charging different prices for the same product under different conditions, such as for different customer groups or at different times.

- 😀 The three conditions for price discrimination are: monopoly power, differing price elasticity of demand, and the ability to separate markets.

- 😀 First-degree price discrimination involves charging the highest price for each unit sold individually.

- 😀 Second-degree price discrimination charges different prices based on the quantity of the product purchased.

- 😀 Third-degree price discrimination occurs when different prices are charged in different markets for the same product.

- 😀 Transfer pricing is important for determining the cost of intermediate products within a company and for evaluating division performance.

- 😀 Cost-plus pricing, though common for transfer pricing, can lead to negative profits if the pricing method does not reflect the actual market conditions.

Q & A

What is the primary concern when a company produces multiple products?

-The company must consider the relationships between complementary and substitute products, as these relationships influence the marginal revenue function of each product to make optimal pricing and output decisions.

How does a company decide on the best combination of products to produce?

-The company produces products in the order of their profitability, ensuring that the marginal revenue of each product matches its marginal cost to maximize profit.

What does the marginal revenue function help determine?

-The marginal revenue function helps determine the optimum pricing and output level for each product produced in combination with others.

What is the significance of the isorevenue and product transformation curves?

-The tangent point between the isorevenue line and the product transformation curves indicates the optimal output level of products produced in combination, in varying proportions.

What is price discrimination?

-Price discrimination involves charging different prices for the same product to different customers or customer groups, without changes in production costs. It can occur at different times, based on product quality, or for different outcomes.

What conditions must be met for a company to engage in price discrimination?

-The company must have monopoly power, the price elasticity of demand for the product must differ in each market, and the markets for the product must be separable or segmented.

What are the three types of price discrimination?

-First-degree price discrimination involves charging the highest possible price for each unit sold. Second-degree price discrimination involves varying prices for different quantities of a product. Third-degree price discrimination involves different prices for the same product in different markets.

What is international price discrimination?

-International price discrimination, also known as side-by-side pricing, occurs when a monopolist sells products at different prices in different countries, often due to variations in market conditions.

What is the role of transfer pricing in a company?

-Transfer pricing determines the price of intermediate products or goods between divisions within a company. It is crucial for evaluating performance, optimizing techniques, and ensuring the profitability of each division.

What is the ideal transfer price when there is an external market?

-The ideal transfer price for intermediate products when there is an external market is equal to the marginal cost of production, assuming the market is perfectly competitive.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

5.0 / 5 (0 votes)