Real Estate में GST कितना लगता है | Real Estate में GST कैसे लगता है | GST on Real Estate Business |

Summary

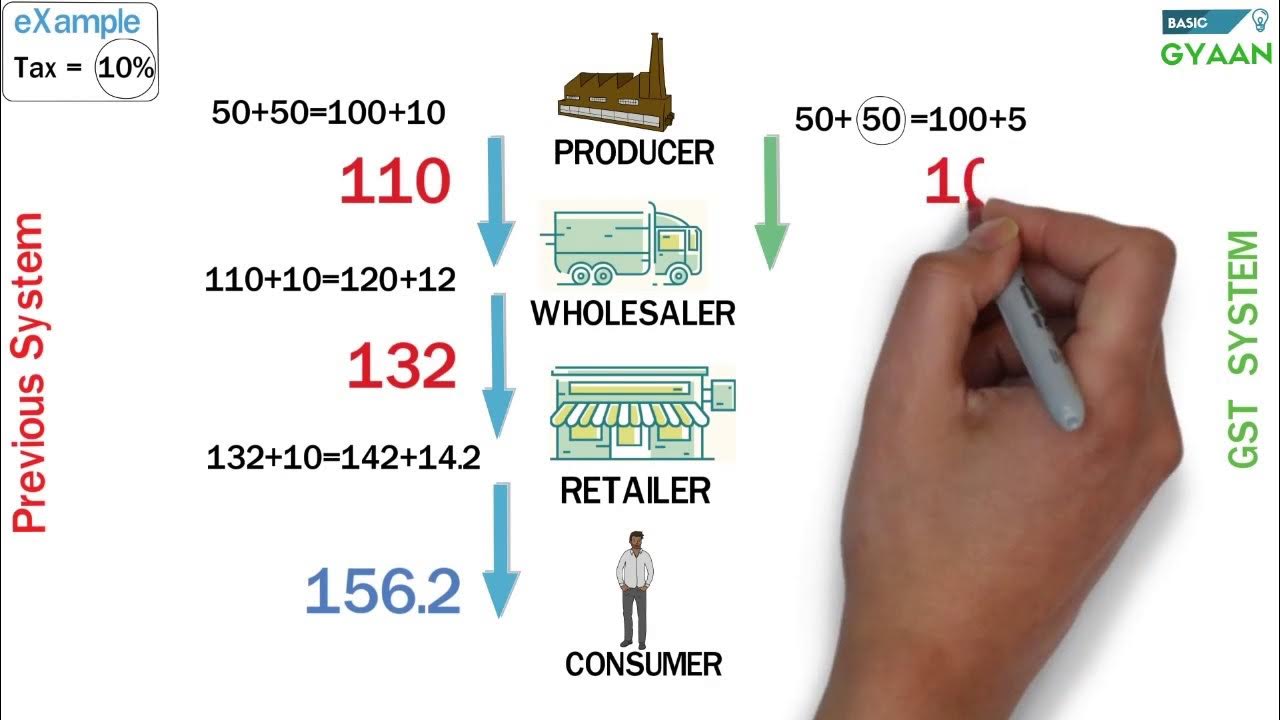

TLDRThis video provides an in-depth explanation of the Goods and Services Tax (GST) framework for real estate developers, builders, and promoters. It covers various categories such as affordable housing, commercial projects, and residential development under different GST schemes. The script highlights key concepts like GST rates, reverse charge mechanisms, and input tax credits. It also discusses the process of land development rights and floor space index, shedding light on how these affect tax liabilities. The video aims to simplify complex GST rules for real estate professionals, helping them understand tax obligations and compliance requirements.

Takeaways

- 😀 Affordable housing projects (EWS) are subject to a 1% GST, with specific carpet area requirements for both metro and non-metro cities.

- 😀 Commercial projects under the Residential Real Estate (RREP) policy are taxed at 5% GST, while other commercial projects are taxed at 12%.

- 😀 Developers cannot claim Input Tax Credit (ITC) for purchases made under affordable housing projects or RREP projects where the GST rate is 1% or 5%.

- 😀 For residential or commercial real estate projects, if GST is 12%, developers can claim ITC on building material purchases.

- 😀 Builders and developers must purchase most goods from GST-registered suppliers, with at least 80% of total supplies needing to come from registered sources.

- 😀 If the 80% registered supplier rule is not met, developers face a reverse charge mechanism (RCM) and must pay GST at a rate of 28% on the shortfall.

- 😀 Builders must also source professional, technical, and engineering services from registered GST suppliers, with 18% GST applicable under reverse charge for unregistered service suppliers.

- 😀 Prime Minister's Housing Scheme (EWS) and RREP projects allow a GST rate of 12% for civil engineering and construction services provided by subcontractors.

- 😀 Development rights (TDR) and Floor Space Index (FSI) are integral to real estate projects, with development rights being transferred from the landowner to the builder under a joint development agreement.

- 😀 If all units in a project are sold before receiving an Occupancy Certificate, the project is exempt from GST. However, if units remain unsold, they attract GST at the applicable rate.

Q & A

What is the GST rate for affordable housing projects under the Economic Welfare Scheme (EWS)?

-The GST rate for affordable housing projects under the Economic Welfare Scheme (EWS) is 1%.

What is the required carpet area for a flat to qualify as an EWS affordable housing project in metro cities?

-In metro cities, the carpet area required for a flat to qualify as an EWS affordable housing project is 60 square meters (645 square feet).

How is the GST rate different for commercial projects compared to residential projects in real estate development?

-For residential projects, the GST rate can be 1% (EWS affordable housing) or 5% (other residential projects), while for commercial projects, the GST rate is generally 12%.

What is the GST treatment for developers involved in RERA (Real Estate Regulation Act) projects?

-In RERA projects, developers are subject to a GST rate of 5% without the option of Input Tax Credit (ITC) on purchases. However, for other commercial projects, the GST rate can go up to 12%, and developers can avail of ITC on building materials.

How does the GST system treat reverse charge mechanisms for land developers and builders?

-Land developers and builders must procure a minimum of 80% of their goods from registered suppliers to avoid reverse charge mechanisms. If this threshold is not met, the GST liability will be added under the reverse charge mechanism (RCM).

What is the GST treatment for subcontracted services in construction projects, such as civil engineering?

-For civil engineering and building-related subcontracted services, the applicable GST rate is 12% for affordable housing projects, and 18% for other commercial or residential projects.

What is the GST rate for Development Rights and Floor Space Index (FSI) in real estate?

-The GST rate for Development Rights and Floor Space Index (FSI) transfers is 18%, which is applicable when a landowner transfers development rights to a developer under a joint development agreement (JDA).

How does the first occupancy certificate affect the GST liability for sold flats in a project?

-If the first occupancy certificate is issued before the sale of all flats, the unsold flats will attract GST at the applicable rate. However, if all units are sold before the certificate is issued, they are exempt from GST.

What is the GST rate for building materials like cement purchased for real estate projects?

-Cement used in real estate projects must be purchased from registered dealers. If the purchase does not meet the 80% threshold from registered suppliers, the GST applicable will be at 28% under the reverse charge mechanism.

How does the GST rate for unsold units in a project get determined?

-The GST rate for unsold units in a real estate project is based on the category of the project. If the units are unsold by the time of the first booking or completion certificate, they will be subject to GST at the applicable rate for that category, such as 5% for RERA projects or 12% for commercial projects.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

GST Easy Explanation (Hindi)

Pengenalan PPh Pasal 22, tarif PPh Pasal 22, dan Contoh Soal PPh Pasal 22

PPN DAN PPNBM - PERPAJAKAN || @dafsofficial

GST on Society maintenance charges | GST on Housing society maintenance | % of GST Applicable

Guide to Singapore GST (Part 1)

Nirmala Seetharaman Point By Potluri నిర్మలమ్మ నిజంగా వేధిస్తోందా

5.0 / 5 (0 votes)