Estágio Prática Contábil: MPM

Summary

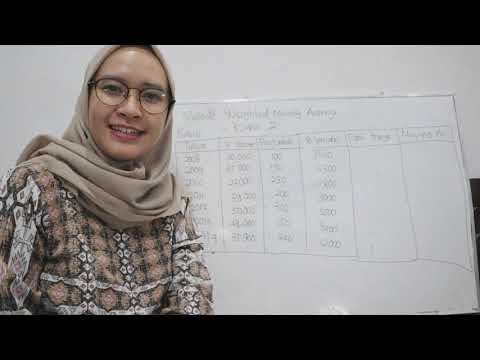

TLDRIn this educational video, Professor Mike guides viewers through the process of inventory control using the weighted average method (MPM). She explains how to calculate the cost of goods sold (COGS) based on stock movements, such as purchases and sales, while considering tax recoveries like ICMS. Throughout the lesson, practical examples are provided to illustrate the method, including entries for purchases, stock adjustments, and sales transactions. The script also covers the significance of maintaining accurate stock records for proper financial reporting in accounting, demonstrating how this impacts both inventory and accounting entries.

Takeaways

- 😀 The lecture covers inventory control using the weighted moving average (MPM) method, which is applied in practical accounting tasks.

- 😀 The focus is on calculating the unit cost of products based on purchases and sales of inventory items through the MPM method.

- 😀 The initial inventory data includes 150 units at a unit price of R$9.70, with a total value of R$1,455.

- 😀 Purchases are recorded in the stock control sheet by entering the purchase date, quantity, unit price, and total cost, with adjustments for tax credits such as ICMS.

- 😀 When a purchase is made, the ICMS tax credit is subtracted from the total cost of goods to determine the real cost of the purchased inventory.

- 😀 The unit cost of goods purchased is calculated by dividing the total cost by the quantity of items purchased, with updated prices reflected in the inventory sheet.

- 😀 As inventory purchases occur, the unit cost may fluctuate, and the weighted average unit price is recalculated to reflect new acquisitions.

- 😀 The price of purchases directly impacts the average unit cost in inventory, especially when the purchase price differs from the existing stock price.

- 😀 Sales are recorded in the inventory sheet based on the unit cost from the stock balance (not the selling price). The cost of goods sold is then deducted from inventory using the latest unit price.

- 😀 Entries and exits of inventory are accounted for through the MPM method in the inventory sheet, with both the ICMS tax and the unit costs reflecting in the company’s accounting records.

- 😀 The final stock balance and total cost are updated regularly, and these values should match the company's balance sheet and inventory accounts for proper financial reporting.

Q & A

What is the primary focus of the accounting practice in this script?

-The primary focus is on controlling inventory using the weighted average method (Média Ponderada Móvel or MPM), particularly for stock movements like purchases and sales.

How is the weighted average cost per unit calculated in this method?

-The weighted average cost per unit is calculated by dividing the total cost of the inventory (after accounting for purchases and adjustments) by the total number of units in stock.

What is the significance of ICMS in inventory cost calculation?

-ICMS (a sales tax) is subtracted from the total purchase price to calculate the true cost of goods purchased, as it is recoverable and should not be part of the inventory cost.

What is the role of the 'final balance' column in the inventory ledger?

-The 'final balance' column records the updated quantity, unit price, and total value of inventory after each transaction (purchase, sale, etc.), reflecting the latest stock status.

Why does the unit cost change after a purchase is made?

-The unit cost changes because the weighted average method recalculates the average cost of the inventory whenever a new purchase is made, based on the cost of the newly acquired goods and their quantity.

How is the inventory updated after a sale?

-When a sale occurs, the inventory is updated by deducting the sold units, and the corresponding cost of those units is transferred to the cost of goods sold (CMV), using the latest weighted average unit cost.

What does the inventory 'entry' refer to in the ledger?

-An 'entry' refers to the addition of purchased inventory to the stock, recorded in the ledger with details like date, quantity, unit cost, and total cost.

How are sales recorded in the inventory ledger?

-Sales are recorded by listing the quantity sold, the date, and the cost of the sold goods, which is determined by the most recent weighted average cost of inventory.

Why is the sale price not included in the inventory ledger?

-The sale price is not included in the inventory ledger because it focuses solely on inventory management. The sale price impacts the revenue and profit calculations, which are recorded separately in the accounting system.

What happens when multiple purchases are made at different prices?

-When multiple purchases are made at different prices, the weighted average unit cost is recalculated after each purchase, factoring in the new units and their cost, which then adjusts the overall inventory value and cost per unit.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

5.0 / 5 (0 votes)