Auditing the Investment Cycle [CPA Prep]

Summary

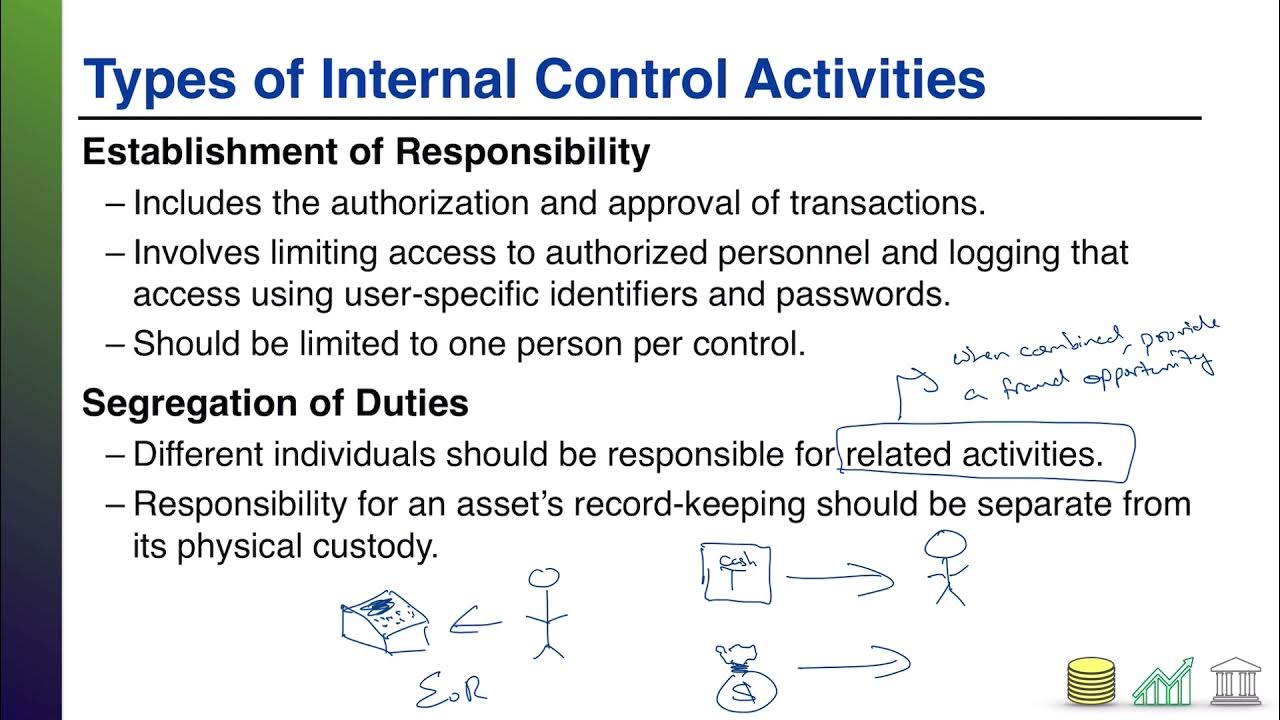

TLDRThis video script dives into the importance of segregation of duties and internal controls in the investment cycle. It covers various testing methods for investment transactions, including verifying authorization, accuracy, collateralization, and ensuring proper personnel control. The script discusses key audit assertions such as existence, completeness, and valuation of investments, as well as methods for testing and verifying these assertions. It also touches on more complex topics like derivatives, explaining their role and risks. The script concludes with a focus on the accuracy of investment presentation and classification in financial statements.

Takeaways

- 😀 Effective segregation of duties and internal controls are crucial in managing investments, ensuring proper authorization, and preventing unauthorized transactions.

- 😀 Regular reviews and approval processes for investments help ensure compliance with company policies, risk tolerance, and avoid risky decisions.

- 😀 It's essential to verify the existence of investments through third-party confirmations, examining investment contracts, and reviewing related documents.

- 😀 Completeness can be verified by confirming that investment purchases and sales match records in investment accounts and bank statements.

- 😀 Valuation and accuracy assertions require recalculating investment values, ensuring proper valuation methods, and verifying data used for fair market valuation.

- 😀 Internal audit processes are critical for evaluating the effectiveness of investment cycles and ensuring investments are properly documented.

- 😀 Derivatives are complex investments that require auditors to assess inherent risks, economic substance, and possible loss recognition, especially in operational contexts like hedging.

- 😀 The rights and obligations assertion for investments requires confirming with external agents that investments are properly recorded in the client's name without contingencies.

- 😀 The cut-off assertion ensures transactions are recorded in the correct period, verifying accurate timing of investment records and dividend recognition.

- 😀 Presentation and classification of investments involve verifying the accuracy of their categorization (e.g., short-term or long-term) and ensuring proper disclosure of significant investments in financial statements.

Q & A

What is the main focus of the video in terms of investments?

-The video primarily focuses on understanding the rights and obligations related to investments, confirming the accuracy of investment transactions, and ensuring proper presentation, classification, and disclosure of investment-related information in financial statements.

How can the rights and obligations of investments be tested?

-The rights and obligations of investments can be tested by confirming with the third-party custodian or agent who holds the securities to ensure they are in the client's name and that no contingencies or issues exist regarding the rights or obligations attached to those securities.

What is the purpose of the 'cut-off assertion' in the context of investments?

-The 'cut-off assertion' ensures that transactions related to investments are recorded in the correct accounting period, avoiding errors where transactions are recorded too early or too late, thus affecting the accuracy of financial statements.

How is the cut-off assertion related to other assertions like completeness and occurrence?

-The cut-off assertion is closely related to completeness and occurrence assertions. Completeness ensures all transactions are recorded, while occurrence ensures that all recorded transactions actually occurred. The cut-off assertion specifically ensures that these transactions are recorded in the proper period.

What methods can be used to test the cut-off for investments?

-To test the cut-off for investments, one can examine the timing of investment transactions, confirm proper recording in the correct period, verify accuracy of journal entries, and cross-check dividend records online to ensure the proper recognition of dividends in the correct period.

What does revenue recognition involve in terms of investment dividends?

-Revenue recognition for investment dividends involves ensuring that dividends are only recognized when they are declared and paid, based on accrual accounting principles. This ensures that the financial statements reflect the appropriate revenue in the correct period.

What are the key aspects of investment presentation and classification in financial statements?

-The key aspects of investment presentation and classification include ensuring that investments are accurately classified into categories like short-term and long-term, and verifying that significant investments are disclosed in the financial statement notes. Additionally, proper reclassification of securities at the year-end is crucial for accurate financial reporting.

How should investments be classified in financial statements?

-Investments should be classified into proper categories such as trading securities, available-for-sale securities, and held-to-maturity securities. This classification helps in providing clarity on the investment's purpose and how it is reported in the financial statements.

What is the significance of disclosing significant investments in the financial statement notes?

-Significant investments, especially those exceeding certain thresholds (e.g., $10 million), must be disclosed in the financial statement notes. This disclosure ensures transparency and provides shareholders and stakeholders with essential information regarding the entity's investments.

What is the role of verifying security transfers near year-end in investment reporting?

-Verifying security transfers just before and after year-end is important to ensure that securities are properly recorded and classified in the correct period. This helps avoid misstatements in the financial statements, especially if securities are reclassified between categories like held-to-maturity and trading.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenant5.0 / 5 (0 votes)