TM 4 determinant money supply ch 16 part 3 contoh soal 2

Summary

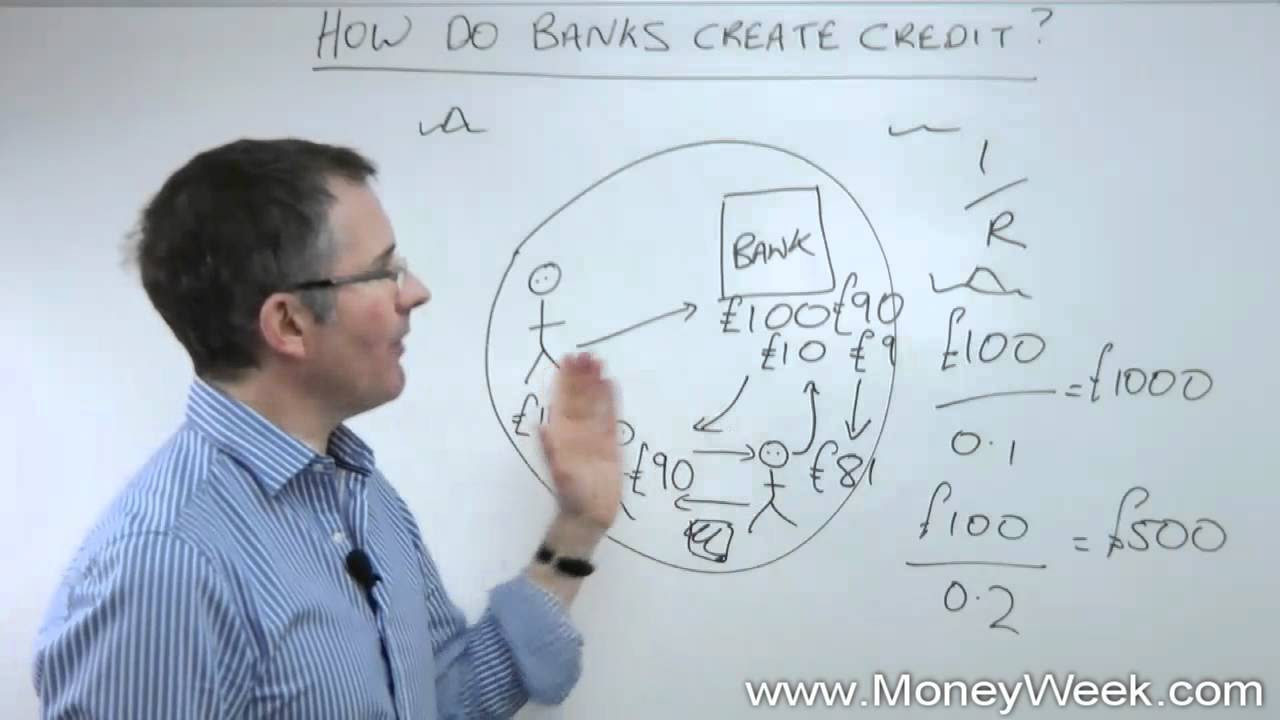

TLDRThe transcript revolves around a detailed financial discussion, where individuals explore banking concepts such as deposit ratios, liquidity, interest rates, and the impact of money circulation. The focus is on the effects of changes in excess reserves on bank lending capacity and how external factors like market interest rates influence depositors' behavior. The conversation also touches on complex financial calculations, with participants elaborating on key concepts and formulas. The aim is to understand the logical framework behind these banking operations, ensuring accurate reasoning before confirming numerical results.

Takeaways

- 😀 The script discusses the importance of logic in banking, particularly how deposit levels and circulation affect the bank's ability to lend money.

- 😀 It emphasizes that a bank’s ability to generate money is impacted by how much deposit is placed in it. More deposit means more liquidity, allowing the bank to lend more.

- 😀 The concept of 'm' (money multiplier) is discussed, where the m-value increases with higher deposits and decreases when liquidity is tight.

- 😀 A key point is that if a bank's exposure is increased (e.g., excess from 0.01 to 0.005), it will reduce its lending potential as it needs to hold more reserves.

- 😀 The script mentions that interest rates and the opportunity cost of holding cash are factors influencing bank behaviors, particularly when banks face liquidity concerns.

- 😀 It also talks about how the banking system adjusts during high transaction periods, like paying tuition fees, and how this impacts the bank's loaning capacity.

- 😀 The discussion includes how depositors' actions influence the circulation of money and, in turn, the economy’s liquidity.

- 😀 The script highlights that a reduction in available liquidity can lead to a decrease in the bank's ability to distribute loans and thus limits economic expansion.

- 😀 It touches on the relationship between expected deposits and how high or low interest rates affect the willingness of individuals to save money in banks.

- 😀 Finally, the role of central banks and their policies in managing money circulation and interest rates is mentioned, especially in relation to controlling inflation and stimulating growth.

Q & A

What is the main topic discussed in the transcript?

-The main topic discussed is the logic behind banking operations related to deposits, excess reserves, and the ability of banks to provide loans, with a focus on liquidity management and market interest rates.

Why does the bank's ability to lend decrease when more reserves are held?

-When the bank holds more reserves, it has less money available to lend out. This is because excess reserves mean that the bank is holding cash rather than using it for lending or investing in the market.

What is the effect of increasing the bank's reserve requirement from 0.01 to 0.05?

-Increasing the reserve requirement reduces the amount of money the bank can lend. As the reserves increase, the money available for lending decreases, resulting in a smaller multiplier effect (denoted as 'm').

What happens to the bank's liquidity when depositors withdraw large amounts?

-When depositors withdraw large amounts, the bank's liquidity decreases. This forces the bank to increase its excess reserves to ensure it can meet withdrawal demands, which further reduces its capacity to make loans.

How does market interest affect the bank's decisions on lending?

-When market interest rates rise, the bank may prefer to hold reserves rather than making loans, as the opportunity cost of holding reserves (i.e., not earning interest from loans) increases. This affects the bank's ability to lend.

What is the logic behind the formula adjustment from 0.5 to 0.75 in the discussion?

-The adjustment from 0.5 to 0.75 reflects a change in the reserve ratio or excess reserve policy. This change directly affects the bank's ability to lend money by altering the amount of reserves it must hold compared to the deposits.

What is the key determinant in the bank's loan capability in the scenario described?

-The key determinant of the bank's loan capability is the amount of excess reserves. The higher the reserves, the less the bank can lend, as most of its funds are tied up in reserves rather than being used for loans.

Why is understanding the logic behind deposit and reserve relationships important in banking?

-Understanding the relationship between deposits and reserves is crucial because it helps predict the bank's lending behavior, impacts the broader economy's liquidity, and provides insight into how market fluctuations affect financial institutions.

How does the bank adjust its operations in response to expected economic changes, such as during school fee payments?

-In response to expected economic changes like school fee payments, the bank might increase its excess reserves to prepare for a surge in withdrawals. This ensures the bank has enough liquidity to handle large-scale cash withdrawals without affecting its lending capacity.

What role does the central bank play in managing the banking system's liquidity?

-The central bank regulates the liquidity of the banking system by adjusting reserve requirements and influencing interest rates, which in turn affects how much money banks can lend and the overall money supply in the economy.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

TM 4 determinant money supply ch 16 part 2 (contoh soal 1)

What is the purpose of the central banks? (May 2013)

How banks create credit - MoneyWeek Investment Tutorials

I tassi SCENDONO: Cosa fare con la liquidità nel 2025

TEORI PERMINTAAN UANG | Ekonomi Kelas XI

TM 3 Deposit Creation part 1 Liability of Federal Reserve

5.0 / 5 (0 votes)