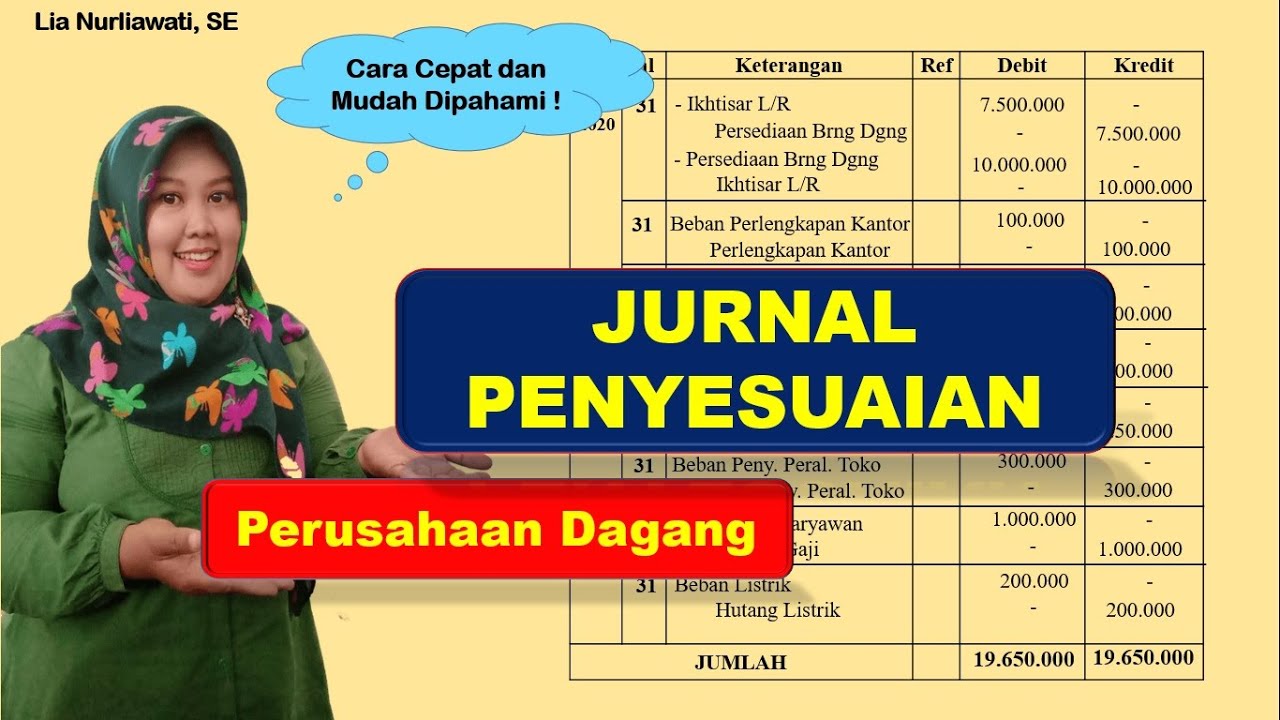

JURNAL PENYESUAIAN - PERSEDIAAN BARANG DAGANG

Summary

TLDRIn this educational video on accounting, the presenter explains the process of adjusting inventory entries for trading companies. Two main methods are covered: the **Ikhtisar Laba Rugi (Income Summary)** method and the **HPP (Cost of Goods Sold)** method. The video offers a step-by-step guide on how to adjust inventory records, move these adjustments to financial statements, and highlights the key components involved in each method. Examples and practical applications are also provided to clarify the process, making it easier for viewers to understand and apply in real-world scenarios.

Takeaways

- 😀 Adjusting inventory is crucial due to discrepancies between the trial balance and actual stock counts.

- 😀 There are two primary methods for adjusting inventory: the Ikhtisar Laba Rugi method and the HPP method.

- 😀 The Ikhtisar Laba Rugi method involves debiting the correct inventory value and crediting the Profit and Loss Summary (Ikhtisar Laba Rugi) to balance the entry.

- 😀 In the HPP method, the final inventory is debited, while other related accounts like purchases and returns are adjusted to reflect the cost of goods sold (HPP).

- 😀 Example of the Ikhtisar Laba Rugi method: If the initial inventory value is 5 million, but the actual stock count is 4 million, the journal entry adjusts the 1 million difference.

- 😀 In both methods, it’s important to adjust inventory values based on physical stock opname rather than relying on initial values.

- 😀 The HPP method involves adjusting accounts like purchases, purchase returns, and purchase discounts to calculate the cost of goods sold correctly.

- 😀 When using the Ikhtisar Laba Rugi method, the Profit and Loss Summary account is used as a balancing account to record the adjustments.

- 😀 After making the necessary journal entries, the next step is to transfer the adjustments to the workpaper (kertas kerja) for review.

- 😀 The script provides clear examples and step-by-step guides for both methods, making it easier for students to understand inventory adjustments in practice.

Q & A

What is the main topic of the video?

-The main topic of the video is about adjusting journal entries for inventory in accounting, specifically for trading companies.

Why is inventory adjustment necessary in accounting?

-Inventory adjustment is necessary because of discrepancies between the inventory balances in the trial balance and the actual inventory count from stocktaking (stock opname).

What are the two methods to adjust inventory in accounting?

-The two methods to adjust inventory are the 'Profit and Loss Summary' method (Ikhtisar Laba Rugi) and the 'Cost of Goods Sold' method (HPP or Harga Pokok Penjualan).

How does the 'Ikhtisar Laba Rugi' method adjust inventory?

-The 'Ikhtisar Laba Rugi' method involves debiting the inventory account with the actual inventory amount from stocktaking and crediting the inventory account with the initial trial balance amount. The balancing entry is made to the 'Profit and Loss Summary' account.

What is the importance of stocktaking (stock opname) in inventory adjustment?

-Stocktaking is important because it provides the real-time inventory count, which serves as the basis for adjusting the inventory account in the books. It helps ensure that the accounting records reflect the actual stock available.

What happens if the inventory balance in the trial balance is higher than the actual stock?

-If the inventory balance in the trial balance is higher than the actual stock, the excess amount is removed by crediting the inventory account and debiting the 'Profit and Loss Summary' account to adjust the balance.

How does the 'HPP' method adjust inventory?

-The 'HPP' method adjusts inventory by considering the beginning inventory, purchases, purchase returns, and purchase discounts. The final adjusted inventory is debited, and the corresponding purchases and other relevant accounts are credited, with the balancing entry made to the 'HPP' account.

In the 'HPP' method, why are accounts like purchases and purchase returns credited?

-In the 'HPP' method, purchases and purchase returns are credited because they are part of the cost structure used to calculate the cost of goods sold. These adjustments reflect the true cost of inventory sold during the period.

How is the 'Profit and Loss Summary' (Ikhtisar Laba Rugi) account used in the adjustment process?

-The 'Profit and Loss Summary' account is used to balance out the adjustments made to the inventory accounts. It serves as the intermediary account to absorb the differences between the trial balance and the adjusted inventory values.

What are the final steps in transferring adjusted journal entries to the worksheet?

-The final steps involve transferring the adjusted journal entries for inventory, purchases, and other relevant accounts to the worksheet. For each account, the adjusted balances are listed, and the necessary calculations are made to ensure the accounts balance properly.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

Siklus Akuntansi Perusahaan Dagang Edisi Sinema-2

"CARA MUDAH MEMAHAMI SIKLUS AKUNTANSI PERUSAHAAN DAGANG "

Transaksi antar Perusahaan Afiliasi 3: Penjualan / Pembelian Persediaan Arus ke Atas

Jurnal Penyesuaian Perusahaan Dagang

Penyesuaian Accurate Perusahaan Jasa

Akuntansi Penjualan Konsinyasi 2 AKUNTANSI BAGI PENGAMANAT

5.0 / 5 (0 votes)