कितना GST देती है मिडिल क्लास?

Summary

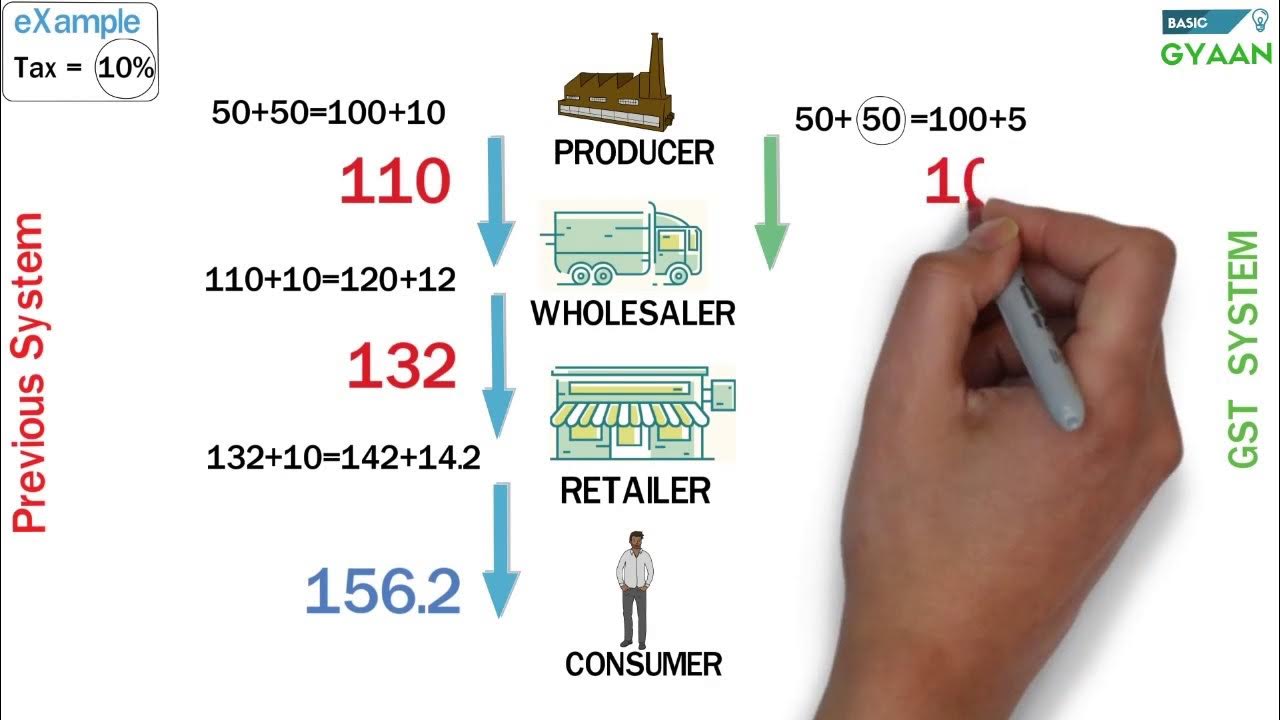

TLDRRavish Kumar critiques India's Goods and Services Tax (GST) in a satirical yet poignant manner, highlighting its complex, often burdensome nature. He draws comparisons with the government's promises of economic unity, painting a picture of widespread confusion and dissatisfaction among the public. Kumar humorously comments on the GST’s impact on everyday goods and services, and how it has become a source of political mockery. He also touches on the role of the media and politicians in shaping the public narrative around GST, questioning its actual benefits for the common man while pointing out the socio-economic pressures it creates.

Takeaways

- 😀 GST is not just a tax; it has become a central political issue in India, with public sentiment largely against it, especially under the leadership of Modi.

- 😀 The implementation of GST has caused widespread confusion and frustration, especially among small businesses and the common man.

- 😀 GST is compared to a pervasive and difficult-to-escape burden, akin to an unavoidable and tragic love affair, with citizens feeling trapped in its complexities.

- 😀 The opposition to GST in India is so deep that it has even sparked memes and jokes, with people humorously blaming it for various woes like inflation and economic hardship.

- 😀 Critics argue that GST was implemented hastily, and its complexities have hurt the middle class, leading to increased prices for everyday items like food and fuel.

- 😀 The GST system has significantly altered the way businesses operate, leading to more paperwork, higher costs, and confusion, especially in sectors like real estate, insurance, and vehicles.

- 😀 The public perception of GST is that it is a 'complicated tax' that has worsened inflation and made life harder for ordinary people, including small vendors and consumers.

- 😀 The GST is viewed as a tool of political control, with opposition leaders accusing the government of using it to suppress the economy and manipulate public opinion.

- 😀 Comparisons are drawn between India’s GST implementation and similar reforms in countries like Malaysia, where a similar tax was removed due to public backlash and economic pain.

- 😀 The script emphasizes that the GST issue has transcended economics and become a political and cultural symbol of Modi's leadership, with the public divided on its efficacy.

Q & A

What is the main argument in Ravish Kumar's speech about GST?

-Ravish Kumar's speech primarily argues that GST (Goods and Services Tax) is a complex and burdensome tax system that has caused widespread confusion and hardship among the common people of India. He critiques its implementation, its impact on daily life, and its failure to deliver on promises made by the government, including economic unification and simplified taxation.

How does Ravish Kumar describe GST's impact on common people?

-Ravish Kumar portrays GST as a major source of frustration for the average Indian. He highlights how people from all walks of life, from the poor to the middle class, have been burdened by the tax system, causing confusion, increasing costs, and diminishing purchasing power. He also points out that even small things like popcorn are subjected to multiple taxes, which reflects the complexity and perceived unfairness of the system.

What is Ravish Kumar’s critique regarding the government's promises about GST?

-Ravish Kumar critiques the government's promises made during the introduction of GST, particularly the claims that it would simplify the tax system and reduce tax terrorism. He argues that instead of simplifying taxes, GST has created more confusion and burden for the people. The promise of making India a 'One Nation, One Tax' system has not been fully realized, and the common man is bearing the brunt of this failure.

What comparison does Ravish Kumar make between GST and the Hindi film industry?

-Ravish Kumar compares GST to a recurring theme in Hindi cinema, particularly to the concept of 'love' in films. He argues that just as love is a universal theme in Indian cinema, GST has become a ubiquitous issue in the lives of Indians. People, regardless of their political affiliations, are united in their suffering from the complexities of GST, much like how characters in a movie are bound by the theme of love.

How does Ravish Kumar relate GST to popular culture and public opinion?

-Ravish Kumar suggests that GST has become so ingrained in public discourse that it has transformed into a subject of jokes, memes, and even political commentary. He notes that people are not only frustrated with GST but have also begun to express their anger through comedy, poetry, and even astrology, showing the widespread impact and the deep emotional response it evokes.

What metaphor does Ravish Kumar use to describe the relationship between Indians and GST?

-Ravish Kumar uses the metaphor of a lover and a beloved to describe the relationship between Indians and GST. He compares GST to a 'beloved' whom people, despite their frustrations, cannot escape, and thus remain trapped in this difficult and painful relationship. He highlights that, much like in a doomed love story, people wish for freedom from GST but see no escape.

What is Ravish Kumar's opinion on the financial impact of GST?

-Ravish Kumar argues that GST has worsened financial conditions for the average Indian. He states that despite promises of reducing the cost of living, GST has only increased prices, leading to greater financial strain. He mentions how people are now more aware of the increasing tax burden and how it impacts their everyday purchases, leaving them financially stretched.

How does Ravish Kumar describe the attitude of politicians toward GST?

-Ravish Kumar criticizes the political elite, particularly the ruling party, for their indifference toward the suffering caused by GST. He mocks the disconnect between the government's claims of economic unification and the reality faced by the people. He suggests that politicians, especially from the ruling party, are either unaware or dismissive of the public's frustration with GST.

What does Ravish Kumar say about the media's role in covering GST protests?

-Ravish Kumar accuses mainstream media of downplaying or ignoring the protests and frustrations surrounding GST. He claims that media outlets have shifted their focus from the real issues faced by the common people, such as the rising cost of living and the difficulties caused by GST, to trivial matters like humor and satire. He criticizes the media for failing to report on the genuine grievances of the people.

How does Ravish Kumar compare GST in India to the tax system in Malaysia?

-Ravish Kumar draws a parallel between the implementation of GST in India and its initial impact in Malaysia. He cites the case of Malaysia, where the rushed implementation of GST in 2015 led to widespread dissatisfaction, economic hardship, and eventual political consequences. Ravish uses this example to highlight the negative impact of GST and to suggest that India could face similar repercussions if the system remains unchanged.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

Massive GST Fraud unveiled in Delhi | Know all about it | UPSC

GST Easy Explanation (Hindi)

Goods and Services Tax (GST) (Part-1) - Simplified | Drishti IAS English

Nirmala Seetharaman Point By Potluri నిర్మలమ్మ నిజంగా వేధిస్తోందా

L2 | Charge of GST Composition Levy | GST Revision | CA Inter Tax September '24/January '25 Revision

Real Estate में GST कितना लगता है | Real Estate में GST कैसे लगता है | GST on Real Estate Business |

5.0 / 5 (0 votes)