ANGGARAN - METOPEN

Summary

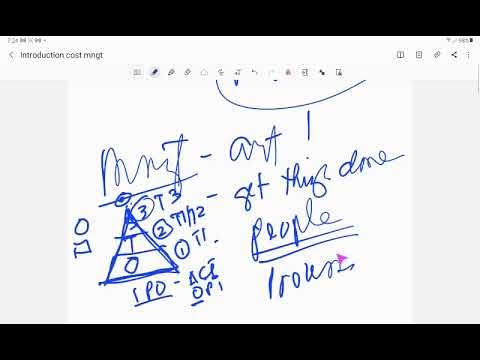

TLDRThe script discusses key concepts in strategic management and budgeting, focusing on long-term planning (5-10 years) and aligning targets with the overarching vision. It covers the budgeting process, including the creation, execution, and monitoring of budgets based on historical data and manager estimates. The importance of assessing performance discrepancies, considering market conditions, opportunistic behavior, and unforeseen circumstances like economic crises or natural disasters, is emphasized. The script also explores the evaluation of managerial accuracy and the role of Strategic Performance Management (SPM) in ensuring reliable budgeting outcomes.

Takeaways

- 😀 Long-term strategic planning (5-10 years) should align with the broader vision of the organization.

- 😀 Budgeting is essential for both D3 (Diploma) and S1 (Bachelor's) programs, but differs in focus and requirements.

- 😀 The budgeting process involves creating a budget that includes activities and money, such as income and expenditure.

- 😀 Historical data from previous years is often used to estimate future budgets, assuming minimal changes.

- 😀 Managers may also provide personal estimations based on their experience and background when preparing budgets.

- 😀 The budgeting cycle includes creation, implementation, and evaluation of actual performance against budgeted amounts.

- 😀 The key measure of success in budgeting is minimizing the variance between budgeted and actual figures.

- 😀 Smaller discrepancies between budget and actual performance indicate more accurate forecasting and better management.

- 😀 External factors like market conditions and unforeseen events (e.g., crises or disasters) can influence budget performance.

- 😀 It's important to assess whether budget variances are due to opportunistic managerial actions, market conditions, or unforeseen circumstances.

- 😀 Monitoring and analyzing budget discrepancies are crucial for understanding the effectiveness and accuracy of financial planning.

Q & A

What is the main focus of the long-term strategy discussed in the transcript?

-The main focus of the long-term strategy is on creating plans for the next 5 to 10 years, aligning with the larger organizational vision. The strategy must be forward-thinking and address long-term goals.

What is the process of budgeting as explained in the transcript?

-The budgeting process involves three main stages: creation, execution, and evaluation. Creation includes estimating the budget based on historical data and managerial experience. Execution involves implementing the planned activities, and evaluation compares the budgeted figures to the actual performance to assess discrepancies.

What is meant by 'selisih' and why is it important?

-'Selisih' refers to the difference between the budgeted amount and the actual performance. A small 'selisih' is considered ideal because it indicates that the budget was accurate and well-executed. Larger discrepancies may suggest poor estimation or mismanagement.

How is historical data used in the budgeting process?

-Historical data is used to estimate future budgets. For example, if a budget for 2025 is being created, the actual performance data from 2024 is typically used as a reference. This provides a baseline for assumptions about future performance.

What role does managerial experience play in budget estimation?

-Managerial experience plays a significant role in budget estimation. Managers are allowed to make personal estimates based on their past experience, knowledge, and understanding of their department or business environment. These estimates complement the use of historical data.

What are the main causes of discrepancies ('selisih') in budget execution?

-Discrepancies in budget execution can be caused by several factors: normal market conditions, opportunistic actions by managers, or unforeseen events (force majeure) such as natural disasters or economic crises.

What are 'force majeure' events and how do they affect budgeting?

-'Force majeure' events refer to unforeseen and uncontrollable events, such as natural disasters or economic crises, that can disrupt normal business operations. These events can lead to significant discrepancies in the budget as they are not predictable and are beyond the control of the business.

What is the ideal relationship between the budgeted amount and the actual performance?

-The ideal relationship is when the budgeted amount closely matches the actual performance. A small discrepancy indicates that the budget was accurate and the financial management was effective. Larger discrepancies should be analyzed to understand the causes.

How should managers handle opportunistic actions that could affect the budget?

-Managers should be aware of the potential for opportunistic actions that may artificially alter the budget's accuracy. These actions should be monitored and controlled to ensure that the budget reflects realistic expectations and market conditions.

What steps should be taken when there is a large discrepancy between the budget and actual performance?

-When there is a large discrepancy, the first step is to analyze the causes of the difference. This includes reviewing market conditions, evaluating whether managerial actions were opportunistic, and assessing whether any force majeure events affected the business. Understanding the root cause will help in adjusting future budget estimates and plans.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

INTRO STRATEGIC COST MANAGEMENT

COBIT 2019 - Domain 2 | Align, Plan, and Organize (APO)

Talent Management Series : 9 Langkah Proses Manajemen Talenta bagi Perusahaan Anda

Budgeting Systems in Malaysia: Modified Budgeting System (LO3)

STRAT Module 1 Lesson 2.1

The Difference Between Mission And Vision Statement [PLUS EXAMPLES]

5.0 / 5 (0 votes)