What is a Call Option? - Stock Options for Beginners

Summary

TLDRThis video explains the basics of call options, using Nvidia stock as an example. A call option allows you to profit if the stock price exceeds a set 'strike' price by the option's maturity date. The script walks through the process of buying a call, paying the premium, and calculating potential profits. If the stock price surpasses the strike price, you earn the difference. Additionally, the video highlights that call options are typically for 100 shares, and the total profit depends on the stock’s performance relative to the strike price and premium paid.

Takeaways

- 😀 A call option is a financial instrument that gives you the right to buy a stock at a predetermined strike price within a specified time frame.

- 😀 When you buy a call option, you pay a premium, which is the cost of acquiring the option.

- 😀 The strike price is the price at which you can exercise the option to buy the stock.

- 😀 If the stock price on the maturity date is below the strike price, you make no money, and your loss is limited to the premium paid for the option.

- 😀 If the stock price is above the strike price, your profit is the difference between the stock price and the strike price, minus the premium paid.

- 😀 To break even on a call option, the stock price needs to rise above the strike price by the amount you paid for the premium.

- 😀 For example, if you buy a call with a $100 strike price and pay an $8 premium, you need the stock price to reach at least $108 to break even.

- 😀 When buying one call option, you are purchasing the right to buy 100 shares of stock, not just one share.

- 😀 This means that the profit or loss is multiplied by 100. For instance, if your profit is $20 per share, your total profit is $2,000 for 100 shares.

- 😀 A call option can be a profitable tool if the stock price increases, but it is important to account for the premium and other factors to understand the potential returns.

Q & A

What is a call option?

-A call option is a financial contract that gives the buyer the right, but not the obligation, to buy a stock at a specified strike price within a certain time frame.

What does it mean to pick a strike price when buying a call option?

-The strike price is the price at which the buyer of the call option can purchase the underlying stock. The option becomes profitable if the stock price exceeds the strike price.

What is the premium in the context of a call option?

-The premium is the cost the buyer of the call option must pay to purchase the option. It is a non-refundable payment made to the seller of the option.

How do you calculate profit from buying a call option?

-Profit from buying a call option is calculated by subtracting the strike price and the premium from the stock price at maturity. If the stock price is above the strike price, the difference is your profit.

What happens if the stock price is below the strike price at the option's expiration?

-If the stock price is below the strike price at expiration, the call option expires worthless, and the buyer loses the premium paid for the option.

How does the break-even point work for a call option?

-The break-even point for a call option is the strike price plus the premium paid. If the stock price reaches this level, the buyer neither gains nor loses money.

What is the difference between buying a call option on one share vs. 100 shares?

-When buying a call option, it usually represents 100 shares. So, instead of paying the premium for just one share, the cost is multiplied by 100. Profits and losses are also based on 100 shares, making the stakes higher.

How is profit calculated if the stock price rises above the strike price?

-If the stock price rises above the strike price, the profit is calculated by taking the difference between the stock price and the strike price, then subtracting the premium paid. This gives the net profit.

What happens if the stock price reaches $128 with a strike price of $100 and a premium of $8?

-If the stock price reaches $128, the profit would be $28 per share ($128 - $100), but since the buyer paid an $8 premium, the net profit would be $20 per share.

How is profit different when you buy a call option for 100 shares?

-When you buy a call option for 100 shares, the profit is multiplied by 100. For example, if the stock price reaches $128 with a strike price of $100, your profit would be $28 per share, and for 100 shares, your total profit would be $2,800. After subtracting the $800 premium, your net profit would be $2,000.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

Trading de OPCIONES para principiantes

CFA Level I Derivatives - Binomial Model for Pricing Options

How to DOUBLE & TRIPLE Your Potential Profits (with Options)

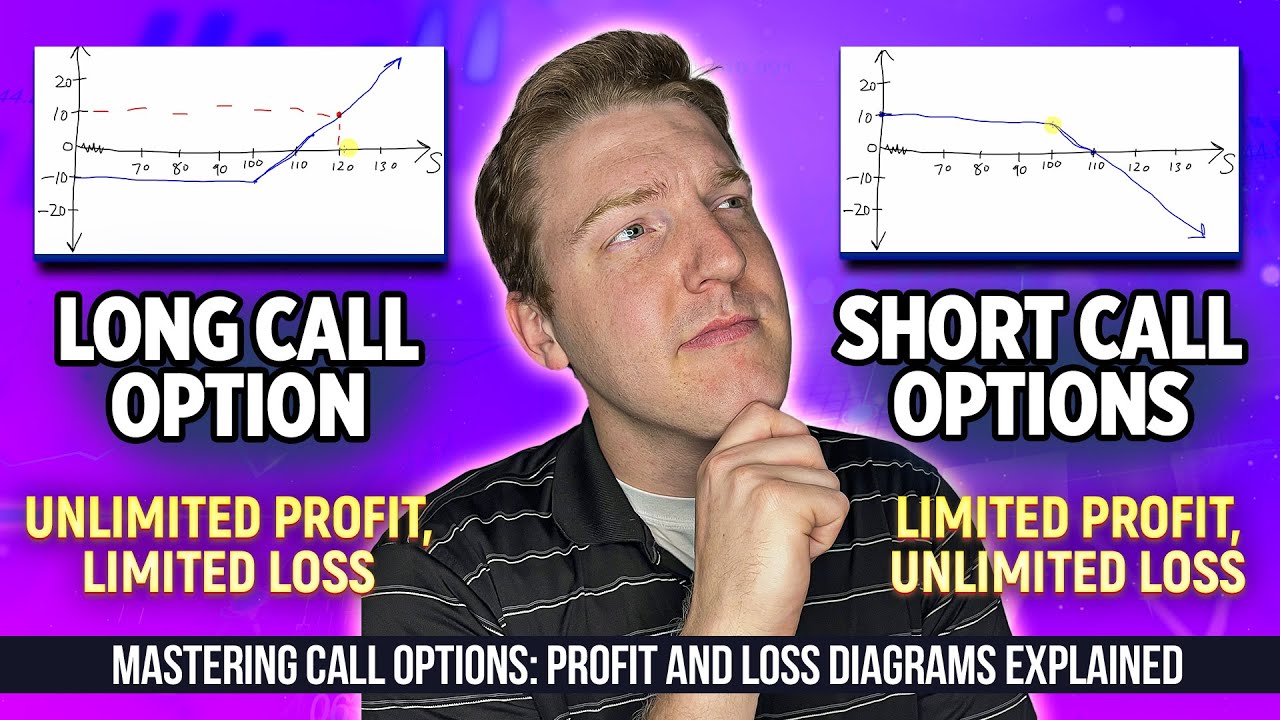

Call Options Explained: Understanding Short and Long Calls

Delta of a Stock Option 🔺 Finance Lessons for Quants

This Nvidia ETF Has a Shocking 48% Dividend Yield – Is it Too Good to Be True?

5.0 / 5 (0 votes)