STATISTIKA BISNIS I MATERI ANGKA INDEKS

Summary

TLDRThis video provides an in-depth explanation of index numbers, which are used to measure the change in various economic activities over time, such as prices, production, and money circulation. It covers different types of index numbers, including unweighted and weighted indices (Laspeyres, Paasche, and Fisher), and demonstrates how to calculate them through practical examples. The video highlights the importance of these indices in tracking economic trends like inflation and price changes, offering valuable insights for businesses, policymakers, and consumers to understand market dynamics.

Takeaways

- 😀 Index numbers are statistical tools used to measure changes in activities like production, sales, and inflation over time.

- 😀 They are expressed as percentages and compare data from different time periods to show how things have changed.

- 😀 Index numbers are widely used in economic indicators like the Consumer Price Index (CPI), Producer Price Index (PPI), and stock market indices.

- 😀 The main purpose of index numbers is to provide a quantitative measure of changes over time in economic activities.

- 😀 There are two types of index numbers: unweighted and weighted.

- 😀 Unweighted index numbers do not account for factors affecting price changes and include relative indices, aggregate indices, and average relative indices.

- 😀 Weighted index numbers take into account factors that influence price changes, such as quantities from the base or current year.

- 😀 The Laspeyres index uses quantities from the base year to calculate price changes, while the Paasche index uses quantities from the current year.

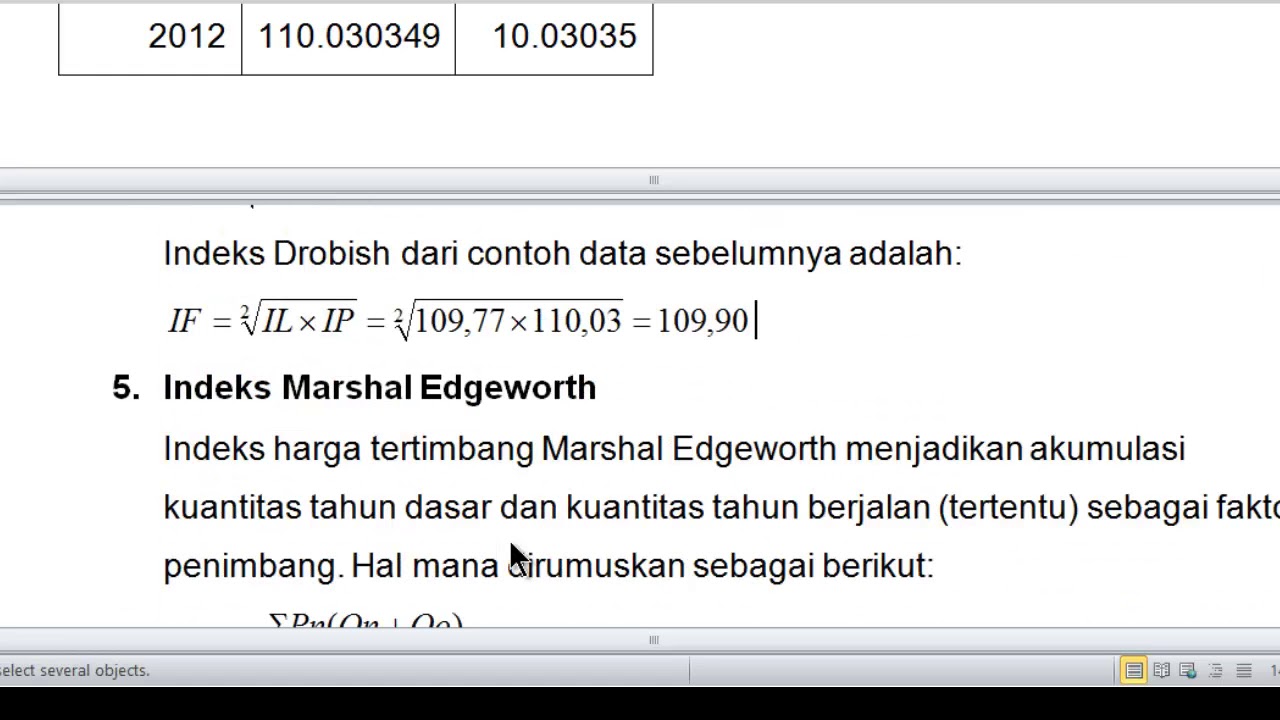

- 😀 The Fisher index is a compromise between the Laspeyres and Paasche indices and is calculated as the geometric mean of the two.

- 😀 A real-world example is the price increase of rice from 1998 to 2002, which is used to calculate a relative index of price changes.

- 😀 Calculations of index numbers help us understand how prices have risen (inflation) or production has changed over time, aiding economic analysis.

Q & A

What is an index number?

-An index number is a statistical measure used to express the relative change in a variable over time. It compares the value of a phenomenon at different points in time, such as prices, production, or other economic indicators.

What is the purpose of using index numbers in economics?

-Index numbers are used to measure changes over time, such as price fluctuations, production levels, or money supply, helping to quantify economic changes between two different time periods.

What are the two main types of index numbers?

-The two main types of index numbers are 'unweighted index numbers' and 'weighted index numbers'. Unweighted index numbers do not consider the varying importance of items, while weighted index numbers factor in the relative importance or quantity of items.

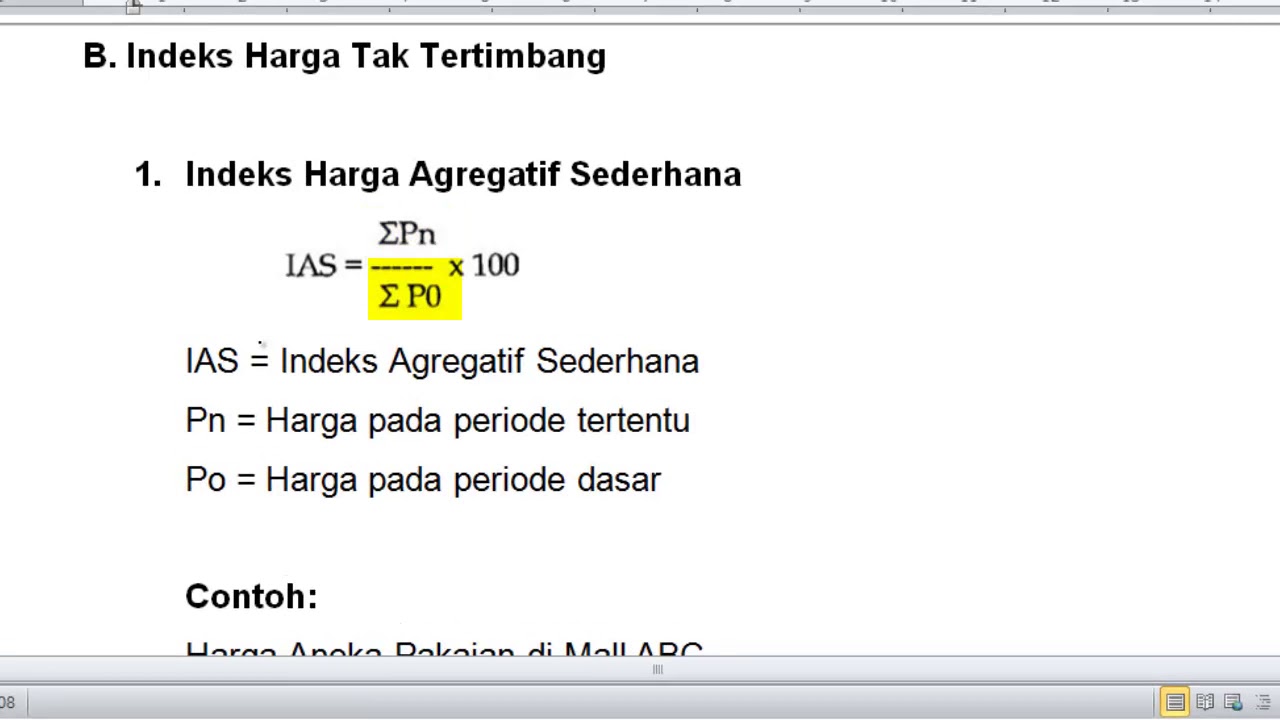

What is an unweighted relative index?

-An unweighted relative index measures the change in a single item (e.g., the price or quantity of rice) over time, without considering the quantity or importance of the item in the overall index calculation.

How is an unweighted aggregate index calculated?

-An unweighted aggregate index is calculated by summing the prices or quantities of goods in different time periods and then comparing the totals for the two periods. The formula is: Aggregate Index = (Total price in current period / Total price in base period) * 100.

What is the difference between a relative index and an average relative index?

-A relative index measures the change in individual items between two periods, while an average relative index takes the average of the relative indices of several items to provide a broader measure of change.

How does a weighted index differ from an unweighted index?

-A weighted index takes into account the relative importance or quantity of items by assigning weights, whereas an unweighted index treats all items equally regardless of their significance or quantity.

What is the Laspeyres index and how is it calculated?

-The Laspeyres index is a weighted index that uses the quantities from the base period as weights. It is calculated using the formula: Laspeyres Index = (Σ P_t Q_0) / (Σ P_0 Q_0) * 100, where P_t is the price in the current period, Q_0 is the quantity in the base period, and P_0 is the price in the base period.

What is the Paasche index and how is it different from the Laspeyres index?

-The Paasche index is another type of weighted index, but it uses quantities from the current period as weights. The formula for Paasche Index is: Paasche Index = (Σ P_t Q_t) / (Σ P_0 Q_t) * 100. The key difference between Paasche and Laspeyres is that Paasche uses current period quantities while Laspeyres uses base period quantities.

How is the Fisher index calculated?

-The Fisher index is a geometric mean of the Laspeyres and Paasche indices, calculated using the formula: Fisher Index = √(Laspeyres Index * Paasche Index). It provides an ideal compromise between the two other indices.

What is the importance of calculating index numbers in real-world applications?

-Index numbers help policymakers, economists, and businesses track economic trends such as inflation, price changes, and production variations, facilitating better decision-making in areas like budgeting, forecasting, and economic planning.

Can you explain an example of calculating an index using rice prices?

-To calculate an index for rice prices between 1998 and 2002, you would use the formula: Index = (Price in 2002 / Price in 1998) * 100. If rice prices increased from 2,500 IDR per kg to 3,100 IDR per kg, the index would be: (3100 / 2500) * 100 = 124%, indicating a 24% price increase.

How are unweighted and weighted index numbers applied differently in economic analysis?

-Unweighted index numbers are simpler and useful when individual items are equally important, while weighted index numbers are more suitable for cases where the importance or quantity of items varies, such as when calculating inflation or production indices for different commodities.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

[Statistik1] Pert 11 Angka Indeks Tak Tertimbang

[Statistik1] Pert 12 Angka Indeks Tak Tertimbang

Economics in 10 mins - GDP Deflator (4/4)

STATISTIKA BISNIS SESI 13 ANGKA INDEKs #2

O que é inflação • IBGE Explica IPCA e INPC

Pasar Input dan Pasar Output: The Circular Flow serta Contoh Soal dan Pembahasan (Part 18)

5.0 / 5 (0 votes)