It’s Happening Again.

Summary

TLDRThe video script highlights how U.S. presidential elections have often coincided with significant turning points in financial markets, particularly in 1928, 1972, and 2000, all of which were followed by major recessions. It examines the current market environment leading into the 2024 election, marked by a strong stock market but depressed consumer sentiment. While presidents can influence market trends through policies like tax cuts and deregulation, historical patterns suggest that they cannot prevent inevitable economic downturns. The video explores whether the 2024 election will follow the same pattern of optimism followed by market decline.

Takeaways

- 😀 Herbert Hoover's election in 1928 coincided with one of the strongest US Stock Market rallies in history, which eventually led to the Great Depression.

- 😀 The 1972 election of Richard Nixon occurred right before a peak in the S&P 500, followed by a long downturn.

- 😀 George W. Bush's election in 2000 also marked the peak of the dot-com bubble, followed by a 10-year market decline.

- 😀 The 1928, 1972, and 2000 elections all marked significant turning points for financial markets, ending long periods of prosperity and starting economic downturns.

- 😀 Despite strong stock market rallies in the lead-up to the 2024 election, consumer sentiment in the US remains highly depressed, similar to pre-recession periods in the past.

- 😀 US consumer sentiment has been at some of its lowest levels since the Great Financial Crisis, indicating concerns about the future of the economy.

- 😀 Donald Trump's economic policies, including tax cuts and deregulation, are being touted as potential ways to avoid a recession, similar to policies in past elections.

- 😀 The Federal Reserve's interest rates are currently at levels similar to those in 1928, 1972, and 2000, often associated with recessions.

- 😀 The concept of an inverted yield curve, where short-term interest rates exceed long-term rates, has historically preceded economic downturns, as seen in all three key election years.

- 😀 Despite optimism around tax cuts and deregulation, Presidents like Hoover, Nixon, and Bush were unable to prevent major recessions after their elections, indicating that market downturns are often beyond their control.

- 😀 The 2024 market environment, with low inflation and stable economic growth, is ideal for the stock market to thrive, potentially allowing further market growth even post-election.

Q & A

What was the significance of Herbert Hoover's election in 1928 in relation to the stock market?

-Herbert Hoover's election in 1928 occurred during one of the strongest stock market rallies in U.S. history, after a decade of strong performance. However, despite this optimism, it was followed by the stock market crash of 1929 and the onset of the Great Depression.

How did the U.S. stock market behave following the 1972 election of President Nixon?

-Following Nixon's election in 1972, the S&P 500 reached a peak that wouldn't be revisited for eight years, marking a significant turning point before the market entered a long period of decline.

What was the relationship between President Bush's election in 2000 and the dot-com bubble?

-President Bush was elected in 2000, which coincided with the peak of the dot-com bubble. This marked the end of a decade of rising stock prices, followed by a prolonged market downturn.

What do the years 1928, 1972, and 2000 have in common in terms of financial markets?

-All three years—1928, 1972, and 2000—marked significant turning points in the financial markets, ending extended periods of economic prosperity and preceding major market downturns and recessions.

How does the current U.S. consumer sentiment compare to past recessions?

-U.S. consumer sentiment, as measured by the University of Michigan, is currently at one of its lowest points since the Great Financial Crisis. Historically, such levels of consumer pessimism have been associated with upcoming recessions.

What role did consumer sentiment play in Donald Trump’s 2016 presidential win?

-Donald Trump's 2016 victory was likely influenced by widespread dissatisfaction with the economy, as many voters were drawn to his promises of stronger economic growth amid low consumer confidence.

What are the common economic conditions in the U.S. during 1928, 1972, 2000, and 2024?

-In all four cases—1928, 1972, 2000, and 2024—the Federal Reserve raised interest rates to around 5%. Additionally, an inverted yield curve, which often signals an upcoming recession, was present in these periods.

How does Trump’s economic policy compare to Herbert Hoover's in terms of market effects?

-Both Trump and Hoover favored policies such as tax cuts and deregulation to stimulate economic growth. However, despite these similar policies, both Hoover and Bush were unable to prevent major recessions following their respective presidencies.

Can presidents directly control the timing of recessions or market crashes?

-Presidents can't directly control the timing of recessions or market crashes. While their policies can influence the duration and severity of economic cycles, they cannot prevent recessions altogether.

What does the S&P 500 chart suggest about the market’s trajectory heading into 2024?

-The S&P 500 is currently testing a key trend line resistance. If it breaks through, it could lead to significant gains, with the potential to reach 6,500 points by the end of the year, assuming current market conditions hold.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

How would you go about solving this? Limit of x/sqrt(x^2+1) as x goes to infinity. Reddit inf/inf

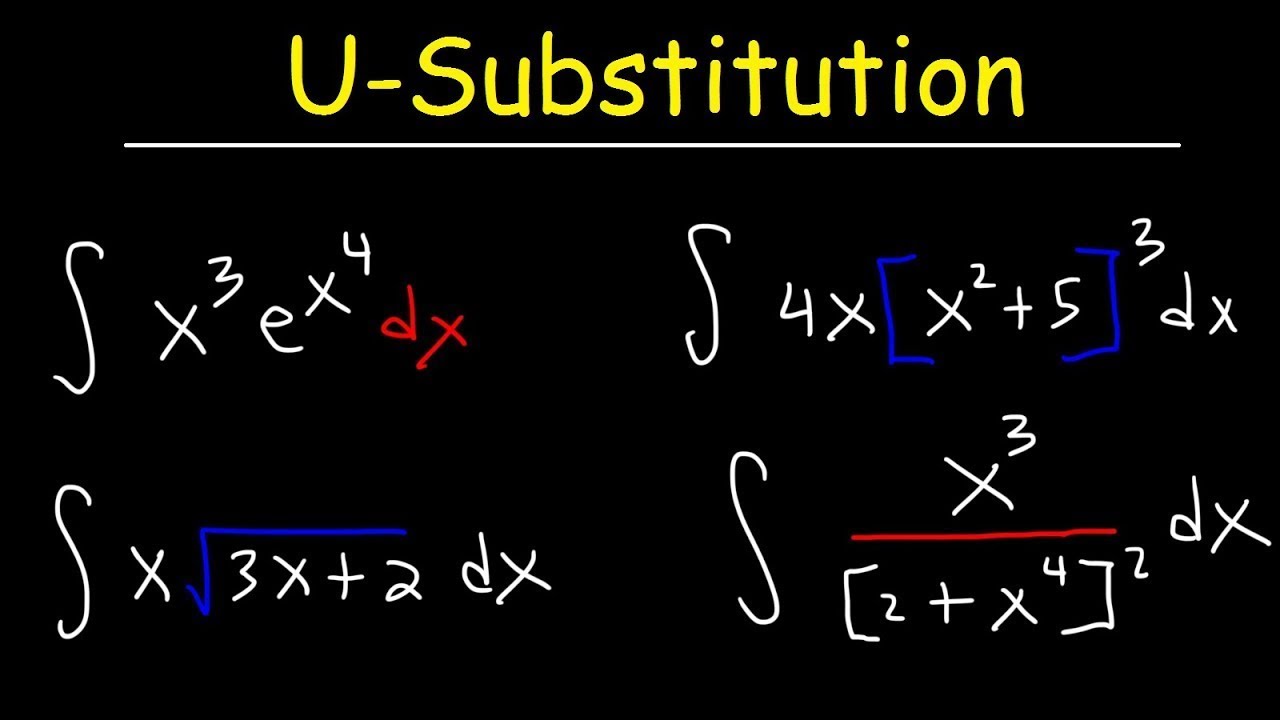

How To Integrate Using U-Substitution

How to Diagnose and Replace Universal Joints (ULTIMATE Guide)

For Oom Piet - Poem Analysis

Embedded Linux | Introduction To U-Boot | Beginners

Apresiasi Usai Timnas Juara Piala AFF U-19 2024 - iNews Pagi 01/08

Replacing a drive shaft U joint

5.0 / 5 (0 votes)