Banking 3: Fractional Reserve Banking

Summary

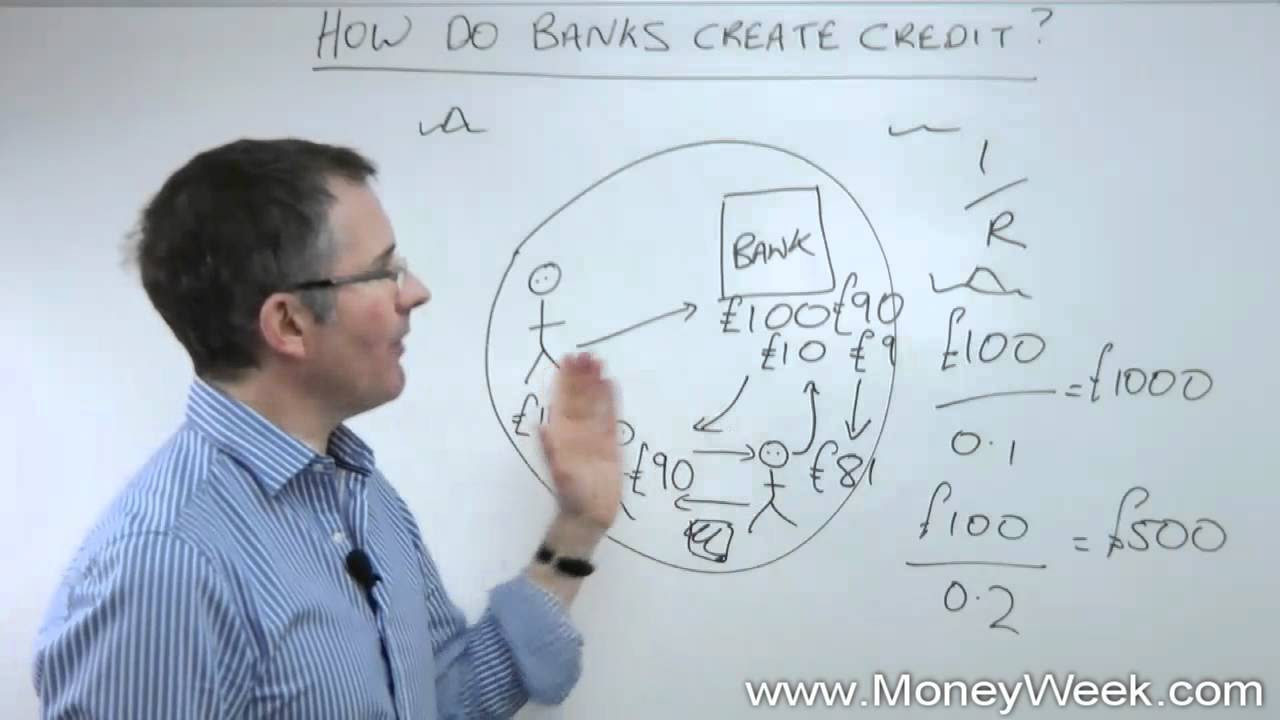

TLDRThis video explores the concept of money creation through a simplified banking scenario. Using gold coins as currency, it illustrates how a bank can accept deposits from farmers and then lend out a portion of those deposits to fund projects like irrigation and factories. This fractional reserve banking system leads to a multiplier effect, where the perceived money supply increases from the original 1,000 gold pieces to 2,710 gold pieces due to the loans generated. The video emphasizes the distinction between the physical money supply (M0) and the broader perception of money in the economy (M1).

Takeaways

- 😀 The banking system is essential for utilizing idle funds and promoting economic development.

- 💰 Farmers initially store their 1,000 gold pieces, limiting their potential use.

- 🏦 When farmers deposit their gold in the bank, it creates a liability for the bank.

- 🔑 The bank keeps 10% of deposits as reserves to ensure liquidity for withdrawals.

- 🚀 The remaining 90% of deposits can be lent out for productive projects, creating a multiplier effect.

- 👷♂️ Loans are used to pay workers, stimulating economic activity and further deposits.

- 📈 The money supply increases beyond the initial deposits due to the fractional reserve system.

- 💵 m0 represents the total physical gold in the banking system, remaining constant at 1,000 gold pieces.

- 💳 m1 includes all demand deposits, showing the perceived money supply as 2,710 gold pieces.

- 🔍 The next discussion will explore whether the perception of an increased money supply is accurate.

Q & A

What is the primary focus of the video script?

-The video focuses on explaining the concept of money creation within a fractional reserve banking system, using a simplified example involving farmers and a bank.

How do the farmers initially store their gold, and why is this considered inefficient?

-The farmers store their gold under mattresses or in holes, which is inefficient because it prevents the funds from being used for productive investments that could generate economic growth.

What role does the bank play in the example?

-The bank acts as an intermediary that takes deposits from farmers and lends out a portion of those deposits to fund productive projects, thereby facilitating economic activity.

What is meant by the term 'fractional reserve banking'?

-Fractional reserve banking refers to a banking system where banks are required to keep only a fraction of their deposits as reserves and can lend out the remaining amount, effectively creating new money.

How does the bank determine how much money to keep in reserves?

-The bank decides to keep 10% of deposits as reserves, meaning it sets aside a portion of the total deposits to ensure it can meet withdrawal requests from depositors.

What happens to the money that is lent out by the bank?

-The money lent out by the bank goes to fund projects, such as irrigation or factory construction, and is eventually deposited back into the bank by the recipients, continuing the cycle of lending and depositing.

What are 'demand deposits', and how do they relate to the example?

-Demand deposits are funds that depositors can withdraw at any time. In the example, the farmers and workers hold demand deposits in the bank, which are used to calculate the perceived money supply.

What is the difference between M0 and M1 in terms of money supply?

-M0 refers to the total physical gold available in the banking system, while M1 encompasses the total amount of money people believe they have, including demand deposits and other liquid assets.

What is the multiplier effect mentioned in the script?

-The multiplier effect occurs when banks lend out a portion of deposits, creating more money in the economy than originally existed, as subsequent deposits and loans expand the money supply.

How does the speaker plan to address the perception of money supply in the next video?

-In the next video, the speaker intends to discuss whether the public's perception of the expanded money supply created by the fractional reserve banking system is accurate.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

5.0 / 5 (0 votes)