1. Options, Futures and Other Derivatives Ch1: Introduction Part 1

Summary

TLDRThe video introduces the foundational concepts of derivatives, emphasizing their role as financial instruments whose value is derived from underlying variables. It distinguishes between exchange-traded and over-the-counter derivatives, explaining their regulatory environments and the significance of counterparty risk. The video outlines forward contracts and futures, detailing their mechanisms, obligations of parties involved, and the zero-sum nature of derivatives, where one party's gain is another's loss. By simplifying complex topics with real-world insights, the presenter aims to enhance understanding of derivatives in finance.

Takeaways

- 📚 The course is based on the Hall textbook, a standard resource for understanding options, futures, and derivatives in finance.

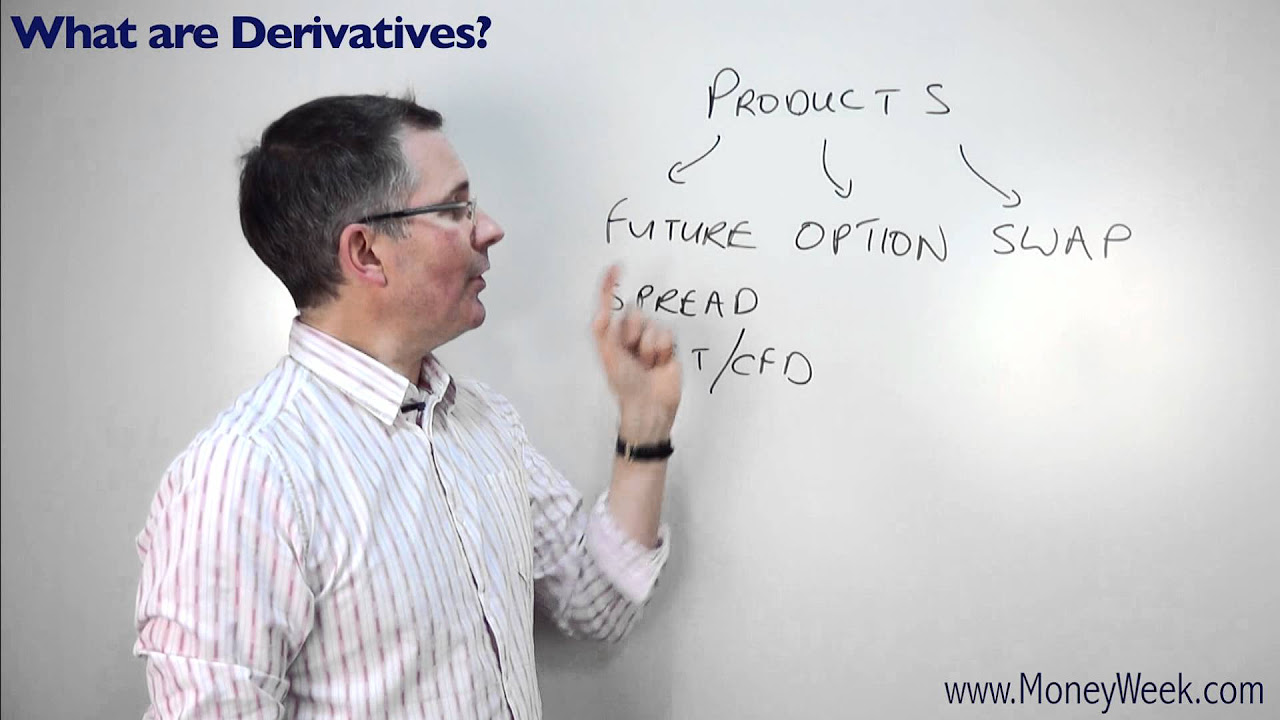

- 🔍 Derivatives are financial instruments whose value is derived from an underlying variable, which can be anything from stocks to events like snowfall.

- ⚖️ Exchange-traded derivatives are highly regulated, involving a clearinghouse that eliminates counterparty risk, while over-the-counter (OTC) derivatives are less regulated and more customizable.

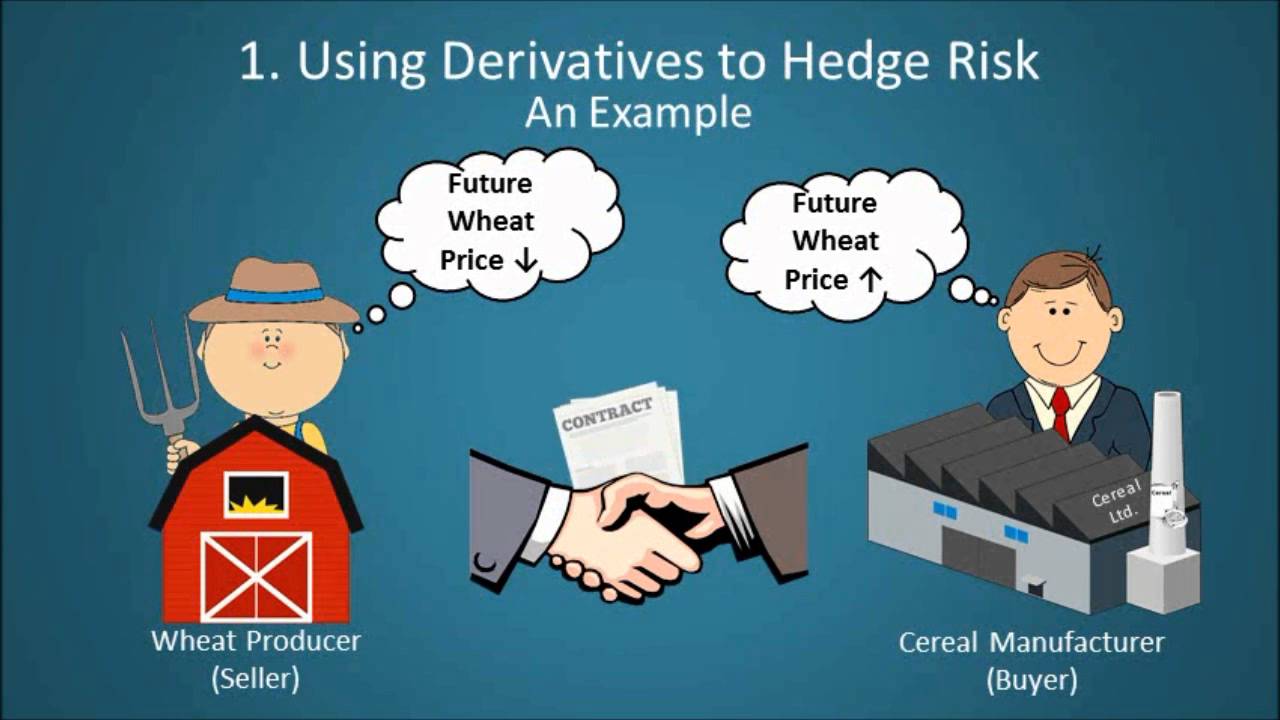

- 🔄 A forward contract is an agreement to buy or sell a specific asset at a predetermined price on a future date, while a futures contract is a standardized version of this that is exchange-traded.

- 💡 In a forward or futures contract, both the buyer and seller are obligated to perform their contractual duties, unlike options, where obligations differ.

- 📊 Payoff graphs illustrate that derivatives are zero-sum; for one party to gain, the other must lose, resulting in no overall wealth creation.

- 💰 The spot price is the current market price at which an asset can be bought or sold, and it is crucial for understanding derivatives trading.

- 📈 The principal value of OTC derivatives is approximately 12 times larger than that of exchange-traded derivatives, reflecting the scale of institutional trading.

- 🛡️ Increasing regulation in the OTC market aims to reduce counterparty risk, encouraging the use of central counterparties for clearing trades.

- 🚀 A solid grasp of the fundamental concepts of forwards, futures, and options is essential for success in the field of finance and derivatives trading.

Q & A

What are derivatives and how are they defined?

-Derivatives are financial instruments whose value is derived from the value of other, more basic underlying variables. These variables can be assets, such as stocks or real estate, or even events like snowfall amounts.

What is the distinction between exchange-traded derivatives and over-the-counter (OTC) derivatives?

-Exchange-traded derivatives are standardized contracts that are highly regulated and clear through a clearing house, eliminating counterparty risk. OTC derivatives, on the other hand, allow for customization and involve direct agreements between buyers and sellers, but are less regulated.

Why are clearing houses important in exchange-traded derivatives?

-Clearing houses act as intermediaries between buyers and sellers, ensuring that both parties meet their contractual obligations and reducing the risk of default, as they are the counterparty to all transactions.

What are forward contracts, and how do they differ from futures contracts?

-Forward contracts are agreements to buy or sell an asset at a specified price at a future date and are traded OTC. Futures contracts are similar but are standardized and traded on exchanges.

What obligations do the buyer and seller have in a forward or futures contract?

-Both the buyer and the seller are obligated to fulfill the terms of the contract, which means the buyer must purchase the asset at the agreed price, and the seller must deliver the asset.

How does the concept of 'zero-sum' relate to derivatives?

-The zero-sum nature of derivatives means that for one party to gain (make money), the other party must lose an equivalent amount. No new wealth is created; wealth is simply transferred between the buyer and the seller.

What role does margin play in futures contracts?

-Margin refers to the amount of money that must be set aside as collateral when entering into a futures contract. However, this money does not exchange hands until the contract is settled.

Why is it important to understand the spot price in derivatives trading?

-The spot price is the current market price at which an asset can be bought or sold. It is crucial for determining the financial outcomes of derivatives contracts, as many contracts settle based on the spot price at expiration.

What is the impact of customization in OTC derivatives?

-Customization in OTC derivatives allows institutions to tailor contracts to their specific needs, providing flexibility in terms of terms and conditions, but it also comes with higher counterparty risk and less regulatory oversight compared to exchange-traded derivatives.

How has regulation of the OTC market changed since the 2008 financial crisis?

-Since the 2008 financial crisis, there has been a push for greater regulation of the OTC derivatives market, including encouraging the use of central counterparties to mitigate counterparty risk and enhance transparency.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenant5.0 / 5 (0 votes)