Neng Ida Soniawati–Ekonomi XII-SMAN 1 Babakan Madang-Jurnal Penutup & Pembalik – Nov2022#pgtkjabar

Summary

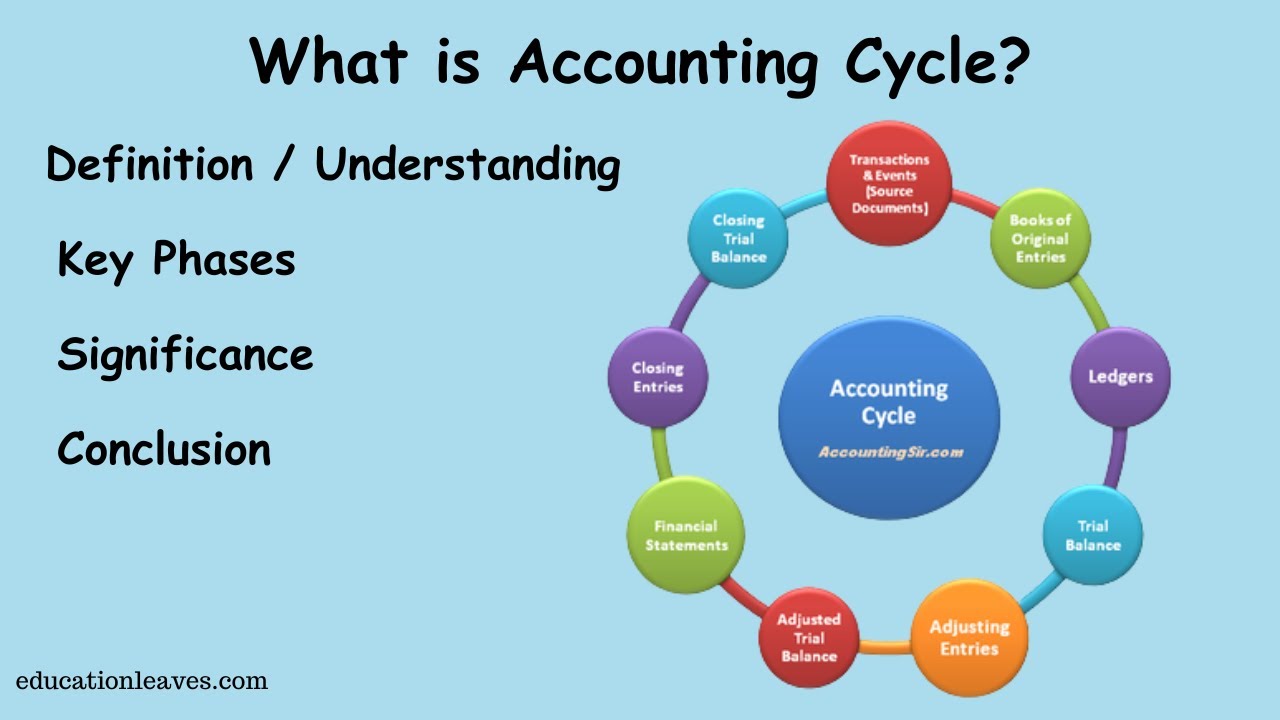

TLDRIn this educational video, the instructor explores the accounting cycle for service companies, focusing on the preparation of closing journal entries, the creation of a post-closing trial balance, and the implementation of reversing entries. The closing entries are vital for resetting temporary accounts like revenues and expenses, ensuring accurate tracking for the new accounting period. The post-closing trial balance verifies that debits equal credits, maintaining financial integrity. Finally, reversing entries simplify future transactions by negating certain adjustments from the previous period, enhancing efficiency in bookkeeping. This comprehensive overview provides essential insights for students in accounting.

Takeaways

- 📚 Closing entries are essential in the accounting cycle, made at the end of the accounting period to transfer balances from temporary accounts to the owner's equity.

- 💵 Temporary accounts include revenue, expenses, and withdrawals, all of which must be closed at the end of each period.

- 📈 Revenue accounts record income earned by the business, categorized as operating revenue (from core activities) and non-operating revenue (from external activities).

- 💸 Expense accounts reflect costs incurred to generate revenue, divided into operating expenses (like salaries and rent) and non-operating expenses.

- 📝 The income summary account is used to summarize revenues and expenses, helping determine if the business made a profit or loss during the period.

- 🔄 The closing process involves four main steps: closing revenue accounts, closing expense accounts, transferring income summary to capital, and closing the withdrawals account.

- 📊 A post-closing trial balance ensures that total debits equal total credits after the closing entries, confirming the accuracy of the general ledger.

- 🔁 Reversing entries are made at the beginning of the new period to simplify accounting for accrued and deferred items from the previous period.

- ⚖️ Not all adjusting entries need reversing; common examples include prepaid expenses and unearned revenues.

- 🎓 Understanding these concepts helps navigate the accounting cycle effectively, particularly for service-oriented businesses.

Q & A

What is the purpose of the closing journal in an accounting cycle?

-The closing journal is created at the end of the accounting period to transfer, normalize, or zero out temporary accounts such as revenues, expenses, and owner's withdrawals.

What types of accounts are considered temporary accounts?

-Temporary accounts include revenue accounts, expense accounts, and the owner's withdrawal account.

How are revenues classified in the accounting cycle?

-Revenues are classified as either operating revenues, earned from the primary business activities, or non-operating revenues, earned from activities outside the core business, such as interest or rent income.

What role does the income summary account play during the closing process?

-The income summary account is used to close out temporary accounts like revenues and expenses, helping to determine whether the company has made a profit or incurred a loss during the accounting period.

What steps are involved in preparing closing journals?

-The steps include closing all revenue accounts by debiting them and crediting the income summary, closing all expense accounts by debiting the income summary and crediting them, closing the income summary to the capital account if there is a profit or to the owner's withdrawals if there is a loss.

What is the purpose of preparing a post-closing trial balance?

-The post-closing trial balance is prepared to ensure that the total debits equal total credits after closing entries, confirming that the permanent accounts are accurately reflected before the next accounting period begins.

What is a reversing entry, and when is it used?

-A reversing entry is the opposite of an adjusting entry and is made at the beginning of the new accounting period. It simplifies the accounting process by canceling out certain adjustments from the previous period.

Can you give an example of when a reversing entry is necessary?

-Reversing entries are necessary when expenses have been prepaid and recorded as assets. For instance, if a company pays for insurance in advance, the expense may need to be reversed at the start of the next period.

What happens to the balances of nominal accounts after the closing process?

-After the closing process, the balances of nominal accounts (revenues and expenses) are reset to zero, while the balances of real accounts (assets, liabilities, and owner's equity) carry forward to the next period.

What is the significance of the post-closing trial balance in accounting?

-The post-closing trial balance is significant because it verifies that all temporary accounts have been closed properly and that the remaining balances in the permanent accounts are correct before beginning the next accounting cycle.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

Jurnal Penutup, Buku besar setelah penutupan, Neraca saldo setelah penutupan | PART 3

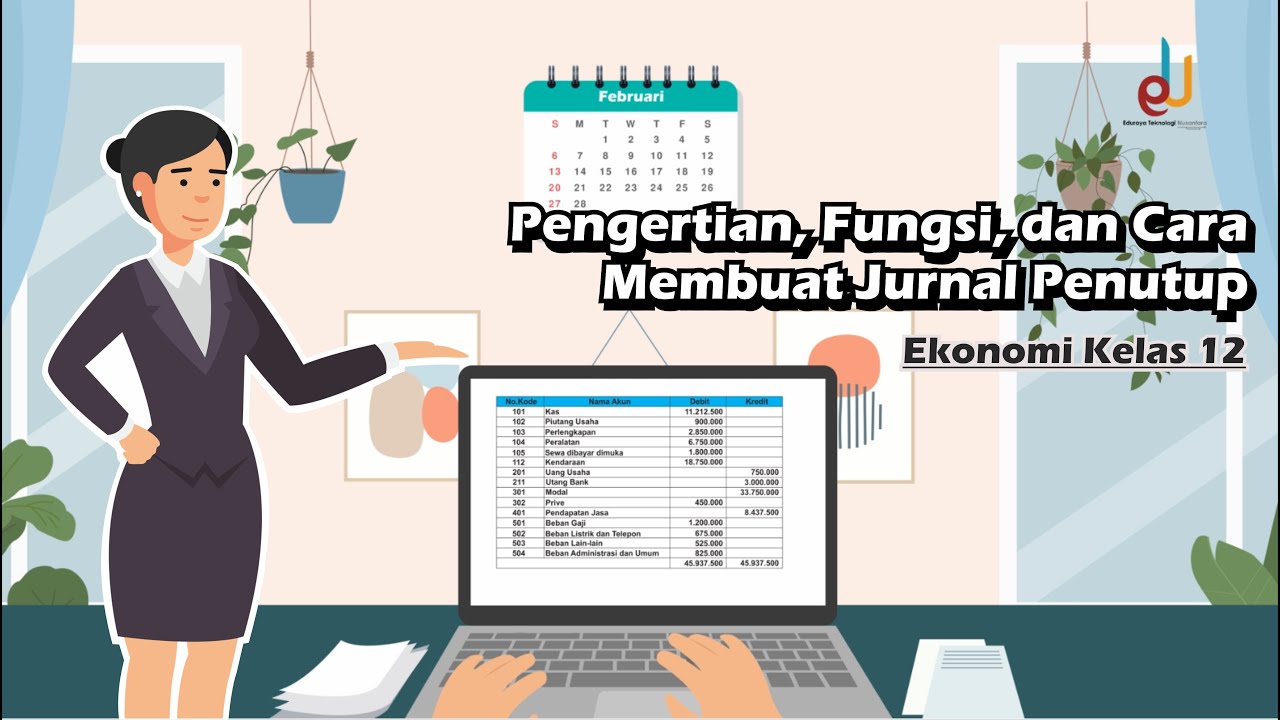

Pengertian, Fungsi, dan Cara Membuat Jurnal Penutup | Ekonomi Kelas 12 - EDURAYA MENGAJAR

What is Accounting cycle? | Key phase, Significance of Accounting cycle

Accounting Cycle Step 1: Analyze Transactions

CLOSING ENTRIES: Everything You Need To Know

TRIAL BALANCE CHAPTER -14 T.S.Grewal Solution question number -2 Class-11 accounts session (2022)

5.0 / 5 (0 votes)