►How To Value a Startup: Calculate Valuation - RossBlankenship.com

Summary

TLDRIn this episode of The Billion Dollar Startup Series, the Angel Kings demystify startup valuations, outlining five primary methods for investors. They introduce The Berkus Method, Comparable Method, Risk Factor Method, Discounted Cash Flow, and Asset Based Valuation Method. Emphasizing a comprehensive approach, they advocate for a 'best in class' scenario that combines various methods, focusing on metrics like user valuation in the public market. The episode encourages investors to adopt a systematic methodology in evaluating startups, reinforcing that understanding the people, product, execution, and timing is key to successful investing.

Takeaways

- 😀 Understanding startup valuations is crucial for investors and can be challenging.

- 💡 The Berkus Method estimates a startup's worth based on expected growth, aiming for around $20 million in five years.

- 🏠 The Comparable Method values startups by comparing them to similar businesses, much like assessing real estate.

- ⚠️ The Risk Factor Method evaluates various risks associated with a startup, including management and exit strategies.

- 📊 Discounted Cash Flow (DCF) is less commonly used for startups due to the need for extensive historical data.

- 💰 The Asset Based Valuation Method focuses on the startup's tangible assets for valuation.

- 🔍 Angel Kings recommends a 'best in class' approach, combining insights from various methods for accurate valuations.

- 📈 Investors should look at the final exit strategy of startups to gauge potential future value.

- 🛠️ A consistent methodology is essential when valuing startups; improvisation is not advised.

- 🌐 For further information and resources, investors can visit AngelKings.com.

Q & A

What is the primary focus of The Billion Dollar Startup Series?

-The series aims to educate viewers on how to become better investors, particularly in the context of startup valuations.

What are the five primary methods of valuing startups mentioned in the script?

-The five methods are: The Berkus Method, The Comparable Method, The Risk Factor Method, Discounted Cash Flow (DCF), and Asset Based Valuation Method.

What is The Berkus Method and its significance?

-The Berkus Method, developed by Mr. Berkus, posits that valuations are estimations, generally suggesting that companies should be valued at around 20 million dollars within five years.

How does The Comparable Method work in startup valuation?

-The Comparable Method involves comparing the enterprise value of a startup to its sales, similar to how real estate appraisals are conducted by comparing properties in the same area.

What does the Risk Factor Method assess?

-The Risk Factor Method evaluates multiple metrics related to the startup's risk, including management risk and exit strategy.

Why is Discounted Cash Flow (DCF) less commonly used for startups?

-DCF requires substantial historical data to accurately determine a startup's value, making it more applicable to publicly traded companies than to early-stage startups.

What is the Asset Based Valuation Method?

-The Asset Based Valuation Method focuses on the startup's tangible and intangible assets to determine its worth.

What is the 'best in class' scenario for valuing startups at Angel Kings?

-The 'best in class' scenario combines several valuation methods, particularly by analyzing comparable startups and considering their final exit strategies.

What metrics does Angel Kings consider when investing in user-based growth companies?

-They look at metrics such as the value of monthly active users and other performance indicators of the company in the public market.

What advice does the script offer to investors regarding startup valuation?

-Investors are encouraged to adopt a systematic approach to valuation, utilizing the methodologies discussed, rather than making arbitrary estimations.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

La Startup Italiana da 1 MILIARDO Che Può Battere OpenAI e DeepSeek? 🤖 Uljan Sharka, Founder iGenius

Starting A Company? The Key Terms You Should Know | Startup School

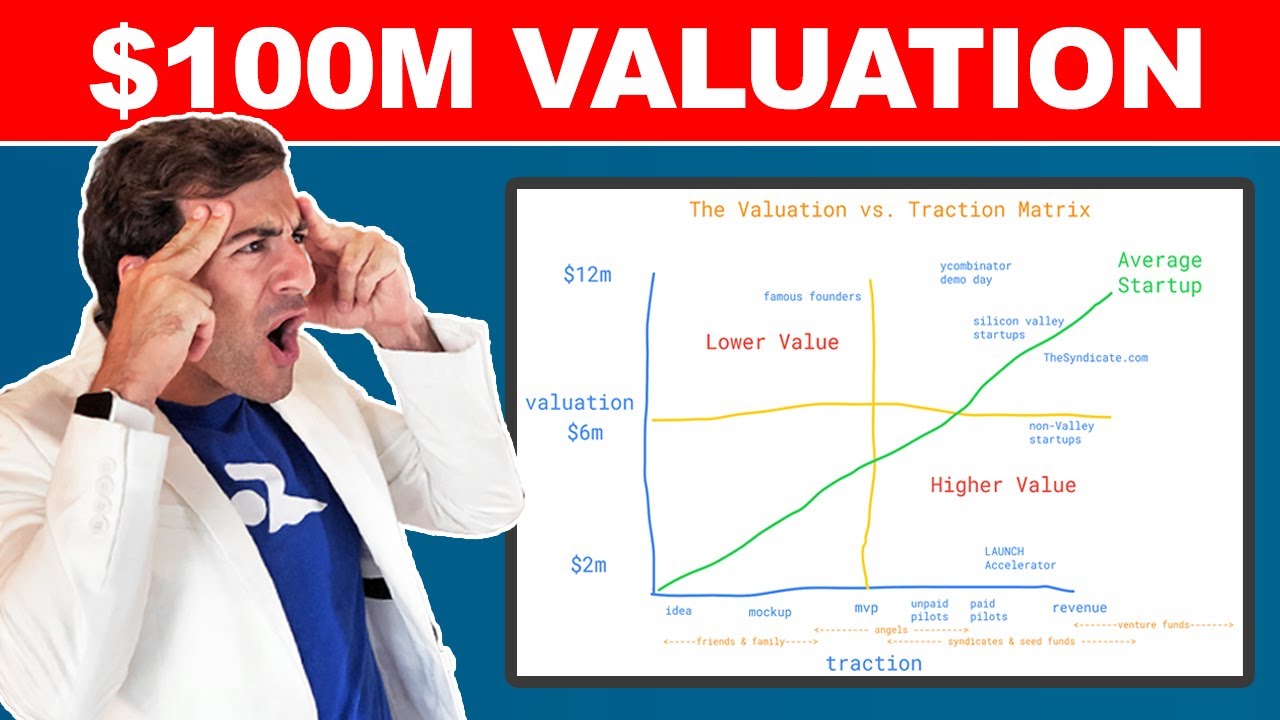

How To Value A Startup Pre-Revenue (Valuation vs. Traction Matrix)

VC vs Angel Investors vs Accelerators: What's The Difference

PRIVATE VIDEO**

Zerodha Case Study: Bootstrapped to Billion dollar valuation startup without advertisements!

5.0 / 5 (0 votes)