#pengantarperpajakan Pengantar Perpajakan, Pajak dan APBN

Summary

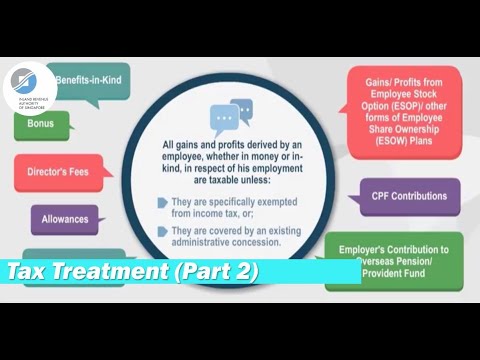

TLDRThis informative video discusses the fundamental aspects of taxation in Indonesia, detailing its legal definition as a mandatory contribution to the state without direct compensation. It distinguishes between direct and indirect taxes and outlines the responsibilities of taxpayers in reporting and paying their dues. The relationship between tax revenue and the state budget (APBN) is explored, emphasizing the role of taxes in funding public services and infrastructure. The video highlights the importance of monitoring tax expenditures to ensure accountability, ultimately underscoring how effective tax collection benefits societal welfare.

Takeaways

- 😀 Tax is a mandatory contribution to the state from individuals or entities, enforced by law and used for public welfare.

- 📜 The definition of tax emphasizes that it must be based on legal frameworks to prevent arbitrary enforcement.

- 💡 Taxpayers are responsible for registering, calculating their tax obligations, and submitting tax reports to the authorities.

- 🔍 The tax authority oversees compliance to ensure that revenue targets for public programs are met.

- 🪙 Taxes can be classified into direct taxes (e.g., income tax) that cannot be transferred and indirect taxes (e.g., sales tax) that can be passed on to consumers.

- 👤 Subjective taxes focus on the taxpayer’s personal circumstances, while objective taxes are based on the nature of the taxed entity.

- 🏛️ Central taxes are managed by the national government, while regional taxes are collected by local authorities.

- 📊 Tax revenues play a crucial role in funding public services, infrastructure, and social welfare programs within the national budget (APBN).

- 👥 Public awareness and oversight are essential to ensure that tax funds are utilized effectively and transparently.

- ✅ Understanding taxation empowers citizens to engage in discussions about fiscal policies and their impact on communities.

Q & A

What are the initial steps to become a specialist doctor in Australia?

-The initial steps include completing a medical degree, which typically takes five to six years, followed by an internship year to gain practical experience.

How does the internship year contribute to a doctor's training?

-The internship year is crucial as it allows new doctors to work in various medical settings, gaining exposure to different specialties and practical skills required for their future careers.

What is the role of the Australian Medical Council (AMC) in the specialization process?

-The AMC assesses the qualifications of international medical graduates and ensures they meet the necessary standards to practice medicine in Australia, playing a vital role in the entry to specialty training.

How long does the specialty training process typically last?

-Specialty training can last anywhere from three to seven years, depending on the specific area of medicine and the training program requirements.

What are some common challenges faced by doctors during specialty training?

-Doctors may face challenges such as high competition for training positions, the demanding nature of the training programs, and the need for resilience and dedication throughout the process.

What types of specialties can doctors choose to pursue in Australia?

-Doctors can choose from a wide range of specialties, including but not limited to cardiology, pediatrics, surgery, psychiatry, and general practice.

Are there any examinations required to enter specialty training?

-Yes, doctors often need to pass exams specific to their chosen specialty, which assess their knowledge and readiness to undertake advanced training.

What support systems are available for doctors during their specialty training?

-Support systems include mentorship programs, peer networks, and access to resources provided by medical colleges and training organizations to help doctors navigate their training.

What is the significance of continuing medical education (CME) for specialists?

-CME is essential for specialists as it ensures they stay updated with the latest medical advancements, maintain their competencies, and fulfill registration requirements.

What career opportunities exist after completing specialty training?

-After completing specialty training, doctors can work in various settings such as hospitals, private practice, academic institutions, and research facilities, often leading to roles in leadership and education within the medical field.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

Pajak dan Hukum Pajak | MOOC | Materi Pengantar Perpajakan Seri 2

Tax Treatment of Remuneration Components (Part 2)

Ruang Lingkup Pajak - Fajriani Ismail

Bela Negara dan Dasar Hukum Bela Negara | CPNS 2023

MATERI PAI SMP BAB 5 HAJI DAN UMRAH

Pengenalan Konstitusi Bagian I: Pengertian, Tujuan dan Jenis Konstitusi

5.0 / 5 (0 votes)