Bad Spending Habits Rich People Avoid

Summary

TLDRThe video discusses common spending habits that differentiate the wealthy from the poor and middle class. It emphasizes the dangers of emotional and spontaneous purchases, which can lead to debt or deplete savings. Retailers exploit impulse buying, often placing tempting items at checkout counters. The speaker advocates for modest spending, particularly recommending purchasing affordable homes in reasonable neighborhoods to reduce overall costs, such as mortgage, taxes, and repairs. Such prudent financial decisions can create a positive ripple effect on overall spending habits.

Takeaways

- 💔 Emotional purchases can lead to debt and deplete savings. Focus on needs over wants.

- 🛒 Spontaneous purchases at checkout counters often harm financial health. Be mindful of impulse buys.

- 🏠 Choosing a modest home in a modest neighborhood can significantly reduce overall expenses.

- 💡 Smart financial decisions create positive ripple effects in your overall spending habits.

- 📉 Avoiding poor spending habits is essential for achieving financial success and stability.

- 📊 Wealth and financial success are largely influenced by personal habits and choices.

- ⚖️ Strive for a balanced approach to spending, prioritizing essential expenses over luxury items.

- 💪 Cultivating discipline in spending helps build savings and wealth over time.

- 🌟 Understanding how retailers exploit impulse buying can help you resist unnecessary purchases.

- 📅 Long-term financial well-being requires consistent awareness and management of spending habits.

Q & A

What are some bad spending habits that wealthy individuals avoid?

-Wealthy individuals avoid emotional purchases and spontaneous spending, which often lead to debt or depletion of savings.

What is an emotional purchase?

-An emotional purchase is when someone buys something based on feelings rather than necessity, such as a beautiful dress or an expensive car.

How do emotional purchases affect financial health?

-Emotional purchases can lead to significant debt or reduce savings, negatively impacting overall financial health.

Why are checkout counters filled with impulse items?

-Retailers place impulse items at checkout counters to encourage spontaneous purchases, capitalizing on the human tendency to act on impulse.

What are spontaneous purchases?

-Spontaneous purchases are unplanned buying decisions that occur at the moment, often leading to unnecessary expenses.

What is one smart financial decision mentioned in the transcript?

-One smart financial decision is to purchase a modest house in a modest neighborhood, which can lower mortgage and maintenance costs.

What are the benefits of living in a modest neighborhood?

-Living in a modest neighborhood generally results in lower real estate taxes, utility costs, and home repairs, leading to better overall financial stability.

How do bad spending habits impact overall wealth?

-Bad spending habits can create a cycle of debt and prevent individuals from accumulating wealth, as they divert money from savings and investments.

What ripple effects can a good spending decision have?

-A good spending decision, like buying a modest home, can have a positive ripple effect on other expenses and overall financial habits.

What role does emotional spending play in financial behavior?

-Emotional spending often leads individuals to prioritize immediate gratification over long-term financial stability, which can hinder wealth accumulation.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

النفقات لي كتغرق المغاربة بلا ما يحسو

Mindset Matters for Financial Success

अमीर लोगो की 10 आदतें | Rich habit Audiobook Summary in Hindi | Book Summary In Hindi | As BookTuber

Nick Hanauer on inequality

Cara Menjadi Kaya - Rich Dad Poor Dad (Animated Book Summary)

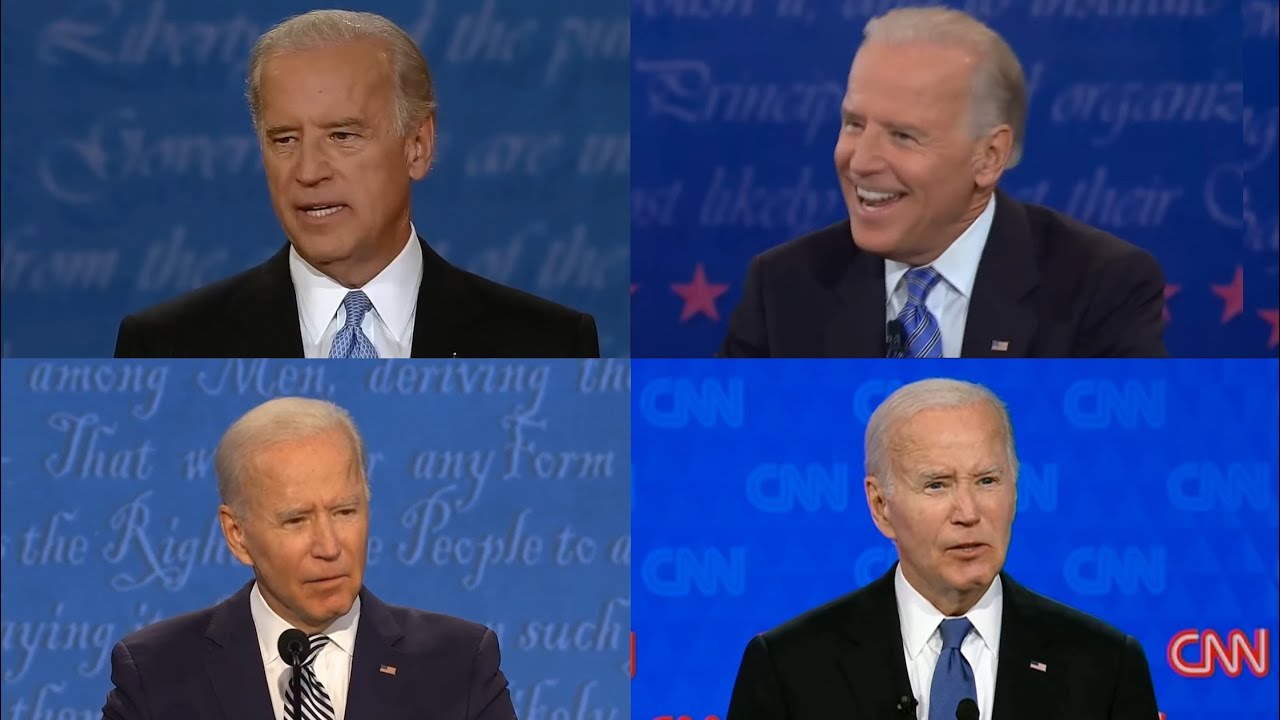

Joe Biden debating tax policy 2008–2024

5.0 / 5 (0 votes)