POR QUE A FORD SAIU DO BRASIL? (Sergio Habib explica) | PrimoCast 330

Summary

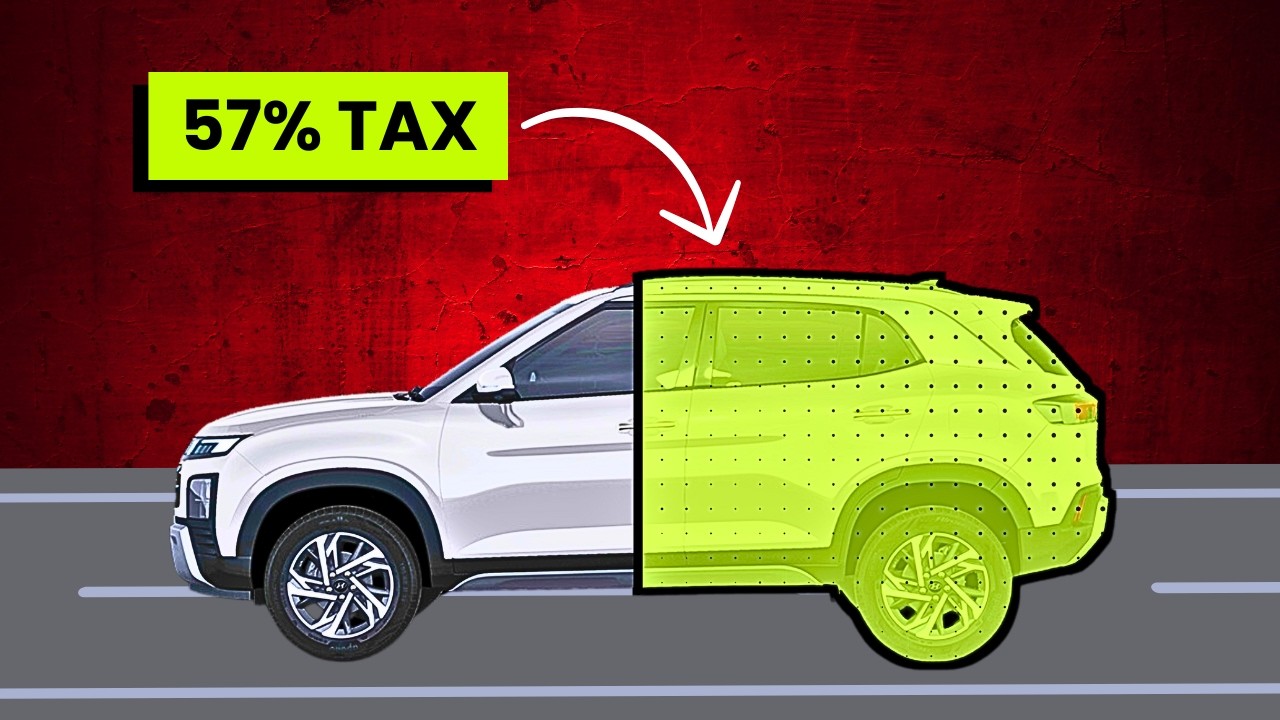

TLDRThe video discusses the high cost of cars in Brazil due to heavy taxation on consumption rather than income. This tax structure impacts the price of goods, including cars, making them more expensive for consumers. Comparisons are made with other countries like the U.S., Japan, and France, where tax systems differ, affecting car prices. The conversation also touches on Brazil's public spending, inefficient taxation, and the challenges of reforming the tax system, which burdens consumers more than manufacturers, leading companies like Ford to leave the country.

Takeaways

- 💸 Brazil has one of the highest tax burdens on cars globally, leading to high car prices despite lower production costs.

- 🚗 Ford left Brazil due to the inability to make profits in a heavily taxed market, despite car sales.

- 📊 Brazil taxes consumption more than income, with 42% of government revenue coming from consumption taxes, compared to 16% in the U.S.

- ⚖️ Consumption taxes are seen as unfair since both low- and high-income individuals pay the same amount when purchasing cars.

- 🏭 Cars, along with cigarettes and alcohol, are considered harmful goods and are heavily taxed in Brazil under proposed reforms.

- 💰 The current tax reform aims to introduce a Value-Added Tax (VAT) of around 26-27%, the highest in the world, which could reduce car prices by about 10%.

- 🚙 While Brazilian car manufacturers receive less revenue than those in other countries, Brazilian consumers pay significantly more due to taxes.

- 📉 Toyota Corolla, for example, costs less for manufacturers in Brazil compared to the U.S. and Europe, but is more expensive for Brazilian buyers.

- 🧮 Reforming Brazil’s tax system is challenging, as raising income taxes is politically unpopular among high-income earners, including lawmakers.

- 🇧🇷 The Brazilian tax system is considered inefficient, with a need to shift focus from consumption to income and wealth taxes for fairness.

Q & A

Why did Ford leave Brazil according to the speaker?

-Ford left Brazil because it was not profitable for them to continue operating there due to the high taxation on cars, making it difficult for automakers to earn sufficient profits.

How does the Brazilian tax system differ from other countries like the United States?

-Brazil heavily taxes consumption, with 42% of government revenue coming from consumption taxes, while the United States primarily taxes income and has no VAT (Value Added Tax) on cars.

What percentage of Brazil's GDP is collected and spent by the government?

-Brazil collects and spends 36% of its GDP, which is higher than the U.S., where the government collects and spends about 35% of GDP, with a large portion allocated to military expenses.

Why is consumption tax considered unfair according to the speaker?

-Consumption tax is seen as unfair because it affects everyone equally, regardless of income. Both a person earning R$1,000 and someone earning much more pay the same tax rate when purchasing the same product, such as a car.

What is the expected rate of the new VAT (IVA) in Brazil under the tax reform?

-The new VAT in Brazil under the proposed tax reform is expected to be between 26% and 27.5%, which would be the highest rate in the world.

How does car taxation in Brazil compare to other countries?

-In Brazil, cars are subject to a tax rate of 37% for popular models and 44% for higher-end models. This is significantly higher than in many other countries like the U.S., where there is no VAT on cars, and European countries where VAT is typically around 20%.

What impact would a lower VAT have on car prices in Brazil?

-If the VAT on cars were reduced to 26-27%, car prices could drop by around 10%, which would likely increase sales. However, this would reduce government revenue, so additional taxes might be imposed to compensate.

Why does the speaker argue that Brazil spends inefficiently?

-The speaker believes Brazil spends inefficiently because, despite collecting a large percentage of GDP, the quality of public services such as education, healthcare, and pensions does not compare favorably to countries like France, which spends a similar amount.

How does the price of a Toyota Corolla compare between Brazil and other countries?

-In Brazil, a Toyota Corolla costs R$185,000, with a large portion being taxes. In comparison, the same model costs $27,900 in the U.S., €38,000 in France (with VAT), and ¥3 million in Japan. Despite the high consumer price, the manufacturer receives less profit in Brazil due to heavy taxes.

Why is it difficult to reform income tax in Brazil?

-Income tax reform is difficult in Brazil because those who would be affected the most, including high-income individuals and members of Congress, would be responsible for passing such reforms, and they are unlikely to vote in favor of increasing their own taxes.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

Why are Cars so expensive? | Truth about Indian Car Prices

Como um Carro te deixa POBRE?!

4 dados que mostram por que Brasil é um dos países mais desiguais do mundo

'Diplomacia de mafiosos', avalia Rubens Ricupero sobre tarifaço de Trump | Jornal Gente

O SONHO DA CASA PRÓPRIA - 5 Passos para Financiar um Imóvel e Juntar 1 Milhão de Reais | Me poupe!

Should we tax the rich more?

5.0 / 5 (0 votes)