Why Shares of Meta Are Sinking After Earnings Report

Summary

TLDRThe market reacts negatively to Medicare's stock, down over 12% due to disappointing Q2 revenue guidance and increased CapEx. Despite strong top-line growth of 25-27%, investors are concerned by the company's loosening cost controls. The digital ad space, especially for Meta, is expected to grow, boosted by AI initiatives and the upcoming election year. However, there's a looming challenge with attracting younger audiences, as platforms like Snapchat and TikTok gain popularity among Gen-Z.

Takeaways

- 📉 The market's perception of Medicare's performance is negative, with its stock price down by more than 12%.

- 📊 The company's Q1 results show a top-line growth of 25-27%, outpacing competitors in digital ads.

- 😕 The Q2 revenue guidance is disappointing, not meeting expectations.

- 🚩 A significant concern is the increase in capital expenditure (CapEx), which was a surprise to investors.

- 📈 Despite the slowdown in growth, the company has been successful in maintaining cost controls and quality.

- 🔍 The expectation was for the company to keep costs in check, but this does not seem to be the case.

- 📅 Traders are concerned about the company's efficiency and cost control measures, especially looking ahead to 2025.

- 💼 There's a focus on the company's cost and CapEx related to AI, which is a significant area of investment.

- 📈 The advertising business, especially during an election year, is expected to benefit, potentially boosting growth.

- 👥 There's a potential generational issue with the user base, as younger users are moving towards platforms like Snapchat and TikTok.

- 🌐 The company is trying to engage younger audiences with features like Instagram Reels to counter the shift towards other platforms.

Q & A

What is the current market sentiment regarding Medicare's stock?

-The market sentiment is negative, with Medicare's stock being off by more than 12%.

What are the two main concerns discussed in the script?

-The two main concerns are the revenue outlook for Q2 and the significant increase in CapEx and expenditures.

What is the speaker's view on the company's quarterly performance?

-The speaker views the quarterly performance as pretty good, with top-line growth of about 25 to 27%.

Why is the company's CapEx increase seen as a disappointment?

-The company has been able to maintain momentum by keeping quality control tight and costs in check, but the CapEx increase indicates that this may not continue, which is concerning for investors.

What is the expectation regarding the company's growth into the second half of the year and beyond?

-Growth is expected to start decelerating into Q2 and the second half of the year due to more difficult comparisons, but the exact expectations are not clear and are awaiting further commentary from the company.

How does the speaker view the company's efficiency?

-The speaker suggests that the year of efficiency might be over for the company, which is concerning to traders.

What is the potential impact of a TikTok ban or divestiture on other social media platforms?

-A TikTok ban or divestiture might actually help other social media platforms like Meta's platforms by benefiting advertisers.

What is the speaker's outlook for Meta's digital ad space growth?

-The speaker believes Meta will be able to grow almost double through 2025 in the digital ad space.

What is the speaker's opinion on Meta's ability to maintain its position in the advertising business during an election year?

-The speaker thinks that being in an election year typically benefits advertisers, which could help Meta's advertising business.

What challenges does the speaker see for Meta in terms of user demographics?

-The speaker sees a potential generation problem with Meta's user base, as younger users are increasingly moving towards platforms like Snapchat, Discord, and TikTok.

How does the speaker think Meta might address the generational shift in user preferences?

-The speaker suggests that Meta might improve its ecosystem with new tools and initiatives, such as Reels, to attract younger users.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

Why Did Asian Paints Crashed 8% & PFC Soared 7% | Special Announcement | CA Rachana Ranade

" Today Reliance AGM & NVIDIA down 6.5%" Pre-Market Report , Nifty & Bank Nifty 29 Aug 2024 Range

" US Inflation &TCS Q2 Results " Nifty & Bank Nifty, Pre Market Report, Analysis 11 Oct 2024, Range.

BULLISH NVIDA EARNINGS. BEARISH STOCK MARKET REACTION.

Som Distilleries & Breweries Earnings Call for Q1FY25

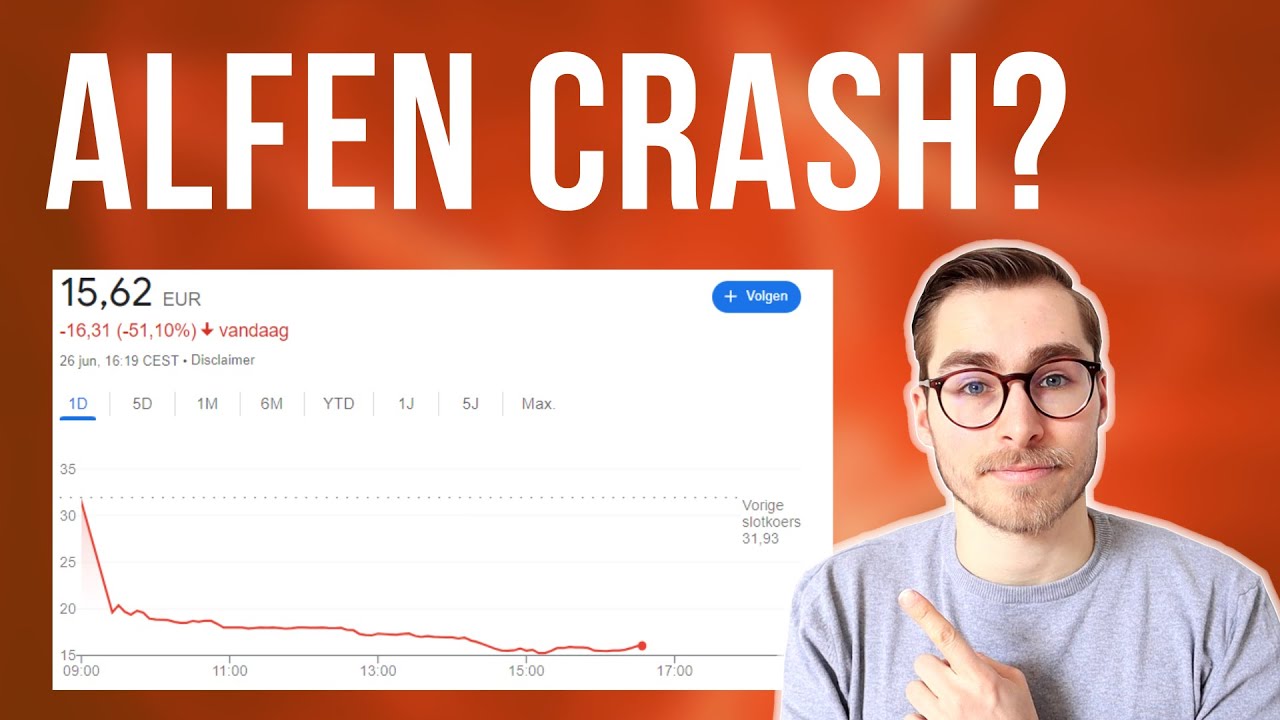

Wat is er aan de hand met ALFEN?

5.0 / 5 (0 votes)