How The Mother Of All Market Rallies Would End | Chris Vermeulen

Summary

TLDRIn this financial discussion, the participants delve into market patterns, retracements, and potential corrections. They explore the use of Fibonacci extensions and retracements to predict market movements and discuss the current state of various assets, including stocks, gold, Bitcoin, and real estate. The conversation highlights the importance of understanding market trends and being mentally prepared for potential shifts. The guests share their strategies for navigating the markets, emphasizing the significance of risk management and the ability to adapt to changing conditions.

Takeaways

- 📉 Markets often exhibit patterns of correction to certain levels or percentages, such as 38%, 50%, or 68% retracements.

- 📈 The use of Fibonacci extensions and retracements can help determine potential market momentum and selling pressure.

- 💹 Despite general market optimism, not all sectors are performing well, with small-cap stocks lagging behind tech-heavy indexes.

- 🔄 The concept of market rotation suggests that money flows from one asset class to another, impacting overall market trends.

- 📊 Technical analysis, including trend following, can provide insights into market strength and potential turning points.

- 📈 Some assets, like gold and Bitcoin, have shown the tendency to reach new all-time highs, but history shows they often face significant corrections.

- 🏠 The real estate sector, including home builders and related industries, may be facing a high-risk period due to market over饱和和 and potential slowdown.

- 💰 A balanced portfolio strategy involves holding cash and assets, adjusting based on market conditions and risk tolerance.

- 🌐 Global economic factors, such as central bank policies and currency movements, can influence market directions and investor sentiment.

- 🔮 Seasonality patterns in the stock market suggest potential market stalls or declines after May, based on historical averages.

Q & A

What does the speaker suggest about market patterns and corrections?

-The speaker suggests that markets do exhibit patterns and often correct to certain levels or percentages, such as 38%, 50%, or 68% of the initial rally. Fibonacci retracement is a method used to predict these corrections.

How does the speaker view the current state of the stock market?

-The speaker believes that while certain indexes like the NASDAQ and S&P 500 may appear to be hitting new all-time highs, a deeper analysis reveals that many sectors are struggling and the market is in a topping phase, potentially leading to a significant correction.

What is the speaker's stance on small-cap stocks?

-The speaker is not optimistic about small-cap stocks, specifically the Russell 2000, as it is currently at a major resistance area and他认为 it is part of a false rally.

What does the speaker think about the role of technical analysis in trading?

-The speaker values technical analysis for its ability to identify trends, power, and strength behind market moves, and to understand money flows between different asset classes. It helps in following the market trend and making informed decisions.

What is the speaker's view on the potential for a market correction in the future?

-The speaker is bearish on the market in the long term and believes that a significant correction is likely, possibly starting as a topping phase, but still sees potential for short-term rallies.

How does the speaker approach asset allocation in his strategy?

-The speaker follows an asset rotation strategy, focusing on owning one asset at a time that is moving up and in favor of their risk tolerance, while also holding a portion of the portfolio in cash or short-term treasury notes for safety and income.

What is the speaker's opinion on the current performance of real estate and related sectors?

-The speaker is bearish on real estate, believing that the market is softening and that sectors like home builders and lumber are at risk of a significant downturn.

How does the speaker use Fibonacci extension and retracement in his analysis?

-The speaker uses Fibonacci extension to identify potential upside momentum and Fibonacci retracement to predict selling pressure and market corrections. These tools help to determine potential support and resistance levels.

What is the speaker's view on Bitcoin's recent performance?

-The speaker is cautious about Bitcoin's parabolic rise, viewing it as a fear-based rally driven by FOMO. He notes that such sharp upward movements are often followed by significant corrections.

What does the speaker suggest about the US dollar trade?

-The speaker expresses interest in a potential US dollar trade, as he observes that the US dollar is slowly building a base on the monthly chart, which could indicate an upcoming bullish movement.

What is the speaker's strategy for managing market risks?

-The speaker's strategy involves being mentally prepared for potential market outcomes, managing positions carefully, and not trying to predict tops or bottoms. He emphasizes the importance of staying with the trend until it clearly reverses.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

Every Trading Strategy Explained in 12 Minutes

Is the cycle ending early? Reasons to sell Bitcoin, crypto, stocks (my response)

System Functions

MicroStrategy Deep Dive w/ Jeff Walton (BTC175)

Lyn Alden on Japan's Unwinding, US Recession & Social Unrest

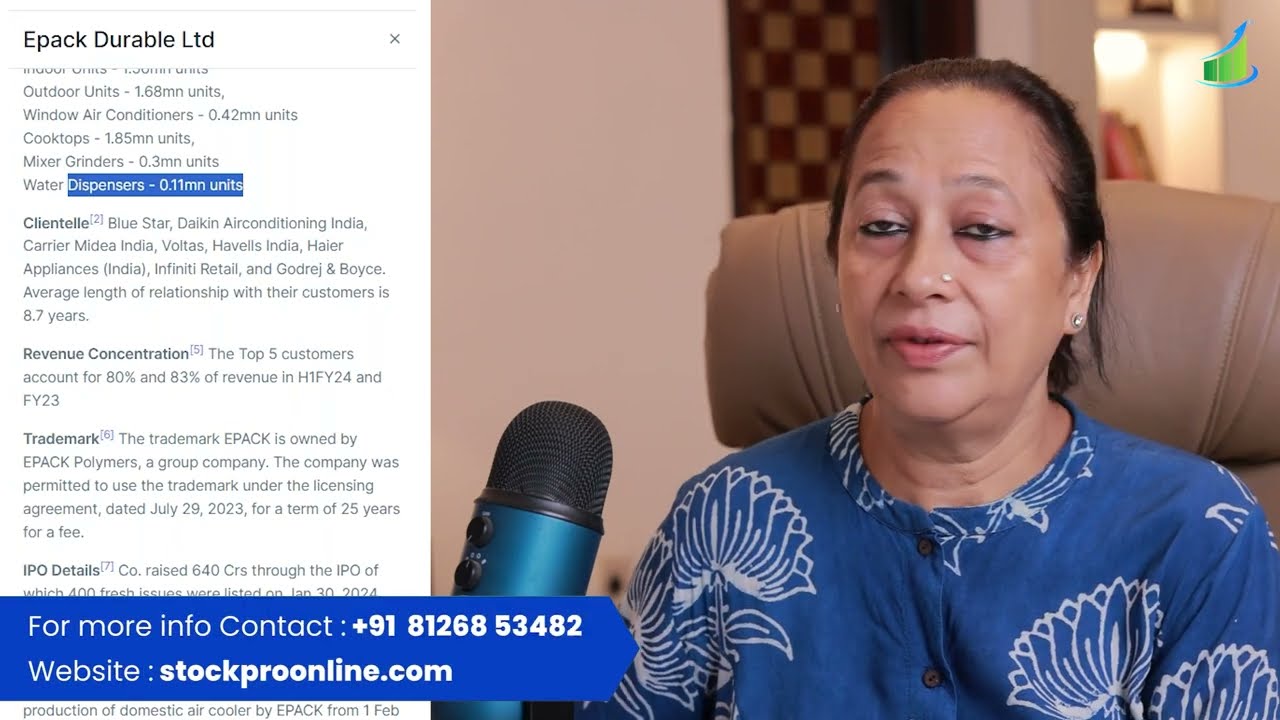

StockPro | 4 IPO STOCKS WITH STRONG BUILDUP'S ON RADAR

5.0 / 5 (0 votes)