A Warning from the Past...

Summary

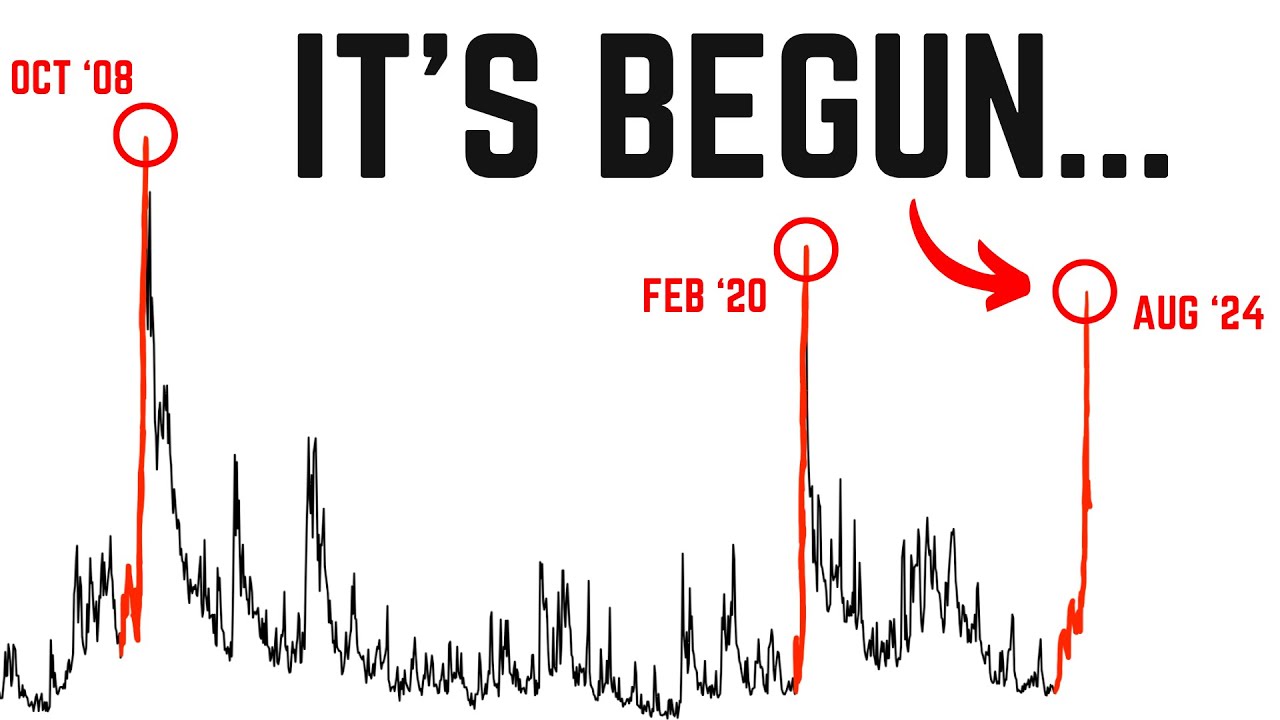

TLDRIn this stock market analysis, the presenter discusses the steepening of the university yield curve and its historical correlation with market volatility and recessions. They highlight the inverted 10-year, 3-month yield curve, which has historically preceded economic downturns. The video also reviews the performance of the S&P 500 sectors, suggesting early signs of economic contraction. The presenter examines historical instances of the 3-month yield surpassing long-term yields and their impact on commodities like oil and copper, noting similar patterns emerging. They conclude with trading insights, focusing on key support levels and the importance of monitoring market indicators for potential shifts.

Takeaways

- 📈 The stock market has been experiencing volatility, with the yield curve steepening and potentially signaling economic shifts.

- 📉 The 10-year and 3-month yield curve remains inverted, which historically has been associated with economic recessions.

- 🔍 The presenter highlights the importance of monitoring the 3-month yield, which closely tracks the federal funds rate, for economic indicators.

- 🏢 Sector performance in the S&P 500 shows strength in real estate, utilities, and consumer staples, suggesting a potential early sign of economic contraction.

- 📊 The presenter reviews historical data, noting that when the 3-month yield was above the 10, 20, and 30-year yields for extended periods, it preceded market turbulence and recessions.

- ⏳ The script discusses the upcoming Federal Reserve rate decision, with market expectations shifting towards a 50 basis point cut rather than a 25 basis point cut.

- 📉 Commodity prices, particularly oil and copper, have shown significant drops recently, which historically have coincided with economic downturns.

- 📊 The presenter analyzes various market indices, noting that they are currently above their short-term moving averages, indicating a positive short-term trend.

- 📍 Key support and resistance levels are identified for the S&P 500 and other indices, which will be crucial for market direction in the coming sessions.

- 🔎 The presenter emphasizes the importance of monitoring economic commodities and yield curves for signs of potential market movements and economic shifts.

Q & A

What is the significance of the university yield curve in the stock market?

-The university yield curve is significant in the stock market as it has historically been an indicator of economic conditions. Its steepening and inversion have been linked to increased market volatility and have sometimes preceded recessions.

What does the 10-year 3-month yield curve indicate about the economy?

-The 10-year 3-month yield curve, also known as the fed staple yield curve, is an economic indicator that reflects the difference in yields between 10-year and 3-month U.S. Treasury securities. An inversion of this curve can signal potential economic slowdowns or recessions.

How does the speaker analyze the stock market sectors' performance in relation to the S&P 500?

-The speaker analyzes the performance of the 11 sectors that make up the S&P 500, noting which sectors are in the green and how they align with the stock market cycle and economic cycle. This analysis helps to identify potential shifts in market trends and economic conditions.

What does the speaker find interesting about the longer-term chart of the 10-year 3-month yield curve?

-The speaker finds it interesting that the 10-year 3-month yield curve is still inverted despite the overall market being at highs. This observation is significant because historical data shows that such inversions have often preceded economic downturns.

What historical patterns does the speaker observe regarding the 3-month yield and its relation to economic recessions?

-The speaker observes that during periods of economic recessions, such as in 2000-2001 and 2007-2008, the 3-month yield has been above the 10-year, 20-year, and 30-year yields for several months. This pattern suggests that prolonged inversions of the 3-month yield relative to longer-term yields may precede economic downturns.

How does the speaker use economic commodities like oil and copper to support their analysis?

-The speaker uses the performance of economic commodities like oil and copper to support their analysis by noting significant price drops in these commodities prior to rate cuts and economic downturns. These drops are seen as potential indicators of economic stress.

What is the speaker's stance on trading during periods of market uncertainty?

-The speaker suggests a cautious approach to trading during periods of market uncertainty, focusing on key support and resistance levels, and being prepared for potential market movements based on historical patterns and current economic indicators.

What technical analysis tools does the speaker use to evaluate the market's short-term trends?

-The speaker uses technical analysis tools such as the 5-day moving average on an intraday time frame and the month-to-date anchored volume-weighted average price to evaluate the market's short-term trends and to identify potential entry and exit points for trades.

How does the speaker interpret the gamma structure in the context of market volatility?

-The speaker interprets the gamma structure as an indicator of market volatility. Being in positive gamma territory suggests that dealers are more likely to buy the dip and sell the rip, which can suppress volatility. Key levels identified from the gamma structure are used to gauge market sentiment and potential price movements.

What are the key levels the speaker suggests to monitor for potential market movements?

-The speaker suggests monitoring key levels such as 5600 and 5650 for the S&P 500 index, as these levels have been significant in past market movements and can provide insight into potential future trends.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

The Yield Curve is Un-Inverting (Stocks Crash Every Time)

The 2024 Recession Just Started... (Do THIS Now)

Bitcoin Will Shock Investors in the Next 8 Months.

WARNING: Brace for a Flood of Stock Market Crash Videos

Nobody Sees This Coming.

TODO EN MÁXIMOS: ¿Qué PASARÁ en los Mercados? (Análisis de Mercado)

5.0 / 5 (0 votes)