Option Trading For Beginners | CA Rachana Ranade

Summary

TLDRThis video script appears to be a tutorial on options trading, specifically focusing on Reliance Industries. It discusses various aspects of options, including call and put options, and their applications in trading. The speaker provides insights on how to approach options trading, emphasizing the importance of understanding the concept of 'at the money', 'in the money', and 'out of the money'. The tutorial also touches on strategies to maximize profits and minimize losses, using Reliance Industries as a case study. The script is filled with technical jargon and seems aimed at an audience with some knowledge of financial trading.

Takeaways

- 😀 The script discusses various financial instruments, specifically focusing on options trading and its strategies.

- 📈 It mentions the importance of understanding the concept of options, including call and put options, for trading in the financial market.

- 💼 The video script seems to be part of a tutorial or lecture series on financial analysis, possibly related to a specific company like Reliance Industries.

- 📊 There's an emphasis on the significance of 'at-the-money', 'in-the-money', and 'out-of-the-money' options, which are crucial for understanding option pricing and strategies.

- 🔍 The script talks about the process of analyzing options related to a specific stock, suggesting a deep dive into the financial data of companies.

- 📝 It highlights the need for understanding the terminology and the mechanics of options trading, which is essential for investors and traders.

- 📉 The discussion includes the concept of 'premium' in options trading, which is the price paid for the option contract.

- 💬 There's a mention of a 'liquidity' aspect in options, which is important for the ease of trading and the ability to enter and exit positions.

- 📱 The script references a call to action for viewers to subscribe to a channel and hit the bell for notifications, indicating it's part of a video content series.

- 📚 It suggests that the content is educational, aiming to teach viewers about financial concepts and possibly specific to a sector like insurance or a company like Reliance Industries.

Q & A

What is the main topic discussed in the video script?

-The main topic discussed in the video script appears to be related to options trading, specifically focusing on strategies and concepts associated with trading in the financial market, with a particular emphasis on Reliance Industries.

What does the acronym 'ITM' stand for in the context of the script?

-In the context of the script, 'ITM' likely stands for 'In The Money,' which is a term used in options trading to describe an option that has intrinsic value, meaning the option's strike price is favorable for immediate exercise.

What is meant by 'Out of the Money' (OTM) options as mentioned in the script?

-Out of the Money (OTM) options are those where the strike price is not favorable for immediate exercise. For call options, this means the strike price is higher than the current market price, and for put options, it means the strike price is lower than the current market price.

What is the significance of the '20-day moving average' mentioned in the script?

-The '20-day moving average' is a technical analysis tool used to smooth out price data over a 20-day period. It helps traders identify trends and potential reversal points in the price of a security, such as Reliance Industries' stock.

What is the purpose of discussing 'premium' in the context of options trading?

-The 'premium' in options trading refers to the price paid to the seller of the option by the buyer. It represents the cost of the option contract and is influenced by factors like volatility, time until expiration, and the strike price of the option.

What does the term 'liquidity' imply in the financial market as discussed in the script?

-In the financial market, 'liquidity' refers to the ease with which an asset can be bought or sold without affecting its price. High liquidity indicates that there are many buyers and sellers, allowing for smooth trading.

What is the role of 'volatility' in options trading as alluded to in the script?

-Volatility in options trading refers to the fluctuation in the price of the underlying asset. It is a crucial factor because it affects the price of options and their potential profitability. Higher volatility often leads to higher option premiums.

What is the significance of 'strike price' in the context of the script?

-The 'strike price' is the fixed price at which an option contract can be exercised to buy or sell the underlying asset. It is a key component of an option's value and determines whether the option is in-the-money, at-the-money, or out-of-the-money.

Why is 'time decay' important for options traders as mentioned in the script?

-Time decay, also known as theta, is important for options traders because it refers to the loss of value in an option's premium as the expiration date approaches. This concept is crucial for understanding the rate at which an option's value decreases over time.

What is the advice given for managing risk in options trading according to the script?

-The script advises options traders to manage risk by understanding the concepts of options, such as call and put options, and by using strategies that limit potential losses, like setting stop-loss orders or using a diversified trading approach.

What is the relevance of 'Reliance Industries' in the script's discussion?

-Reliance Industries is used as a case study or example in the script's discussion to illustrate options trading strategies and concepts. It provides a real-world context for the theoretical aspects of options trading discussed in the video.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

Sigma Comparator working animation.

IELTS Listening MCQ - Simple & Easy Trick

Plane Sailing | Navigation

20. Moving Average Indicator சுலபமாக Trading செய்வது எப்படி? | MMM | TAMIL

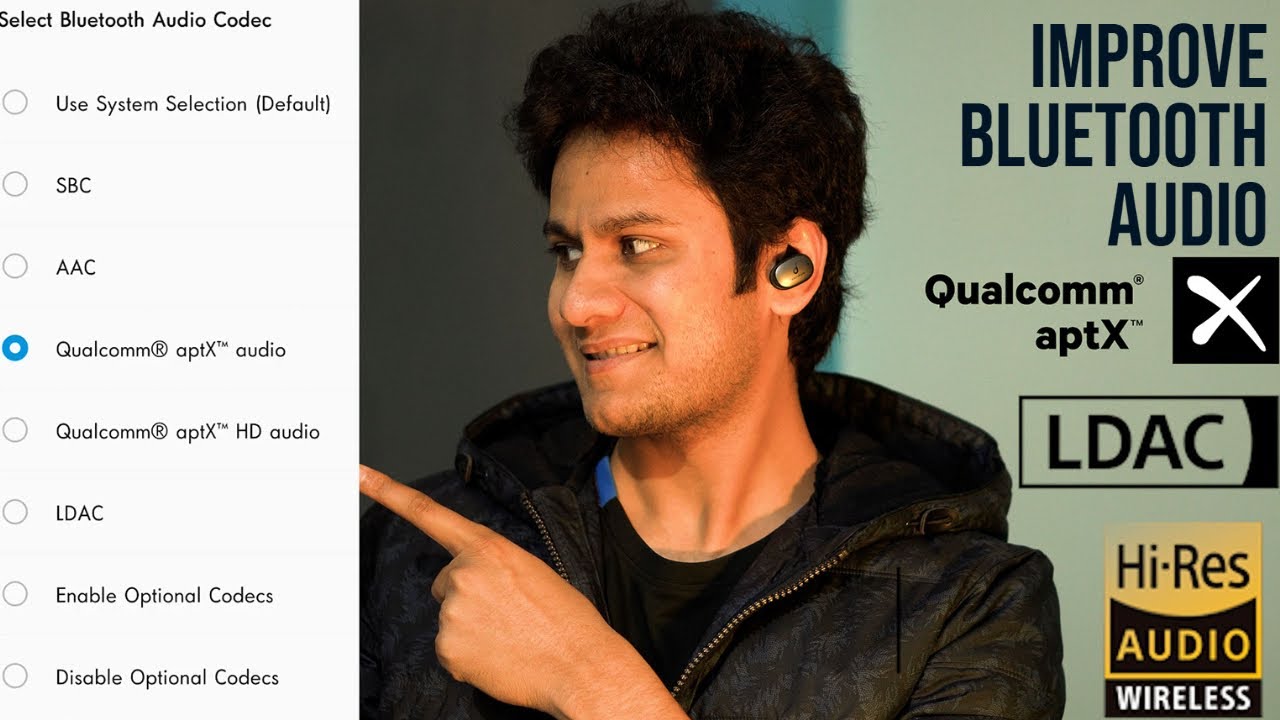

Enable AptX HD, LDAC Bluetooth Codecs & Improve Audio Quality😃!! Android

Get 4X Money with MTF | What is MTF? | How to Invest using Margin Trading Financing | Share Market

5.0 / 5 (0 votes)