ICT Mentorship Core Content - Month 1 - Impulse Price Swings & Market Protraction

Summary

TLDRThe script discusses the concepts of impulse price swings versus market protraction. Impulse price swings refer to high-low price movements irrespective of time. Market protraction refers to manipulation-driven price swings timed around key sessions to mislead traders. Examples are shown of protraction around midnight NY, 7am NY, and London closes. The goal is to blend analysis of impulse swings with protraction timing signals as context for anticipating turns. This can aid session trading by revealing when impulses at set times are likely contrary signals rather than true turns.

Takeaways

- 😀 Impulse price swings show directional price movement from high to low to high.

- 😯 Market protraction involves time-sensitive impulse price swings used for manipulation.

- ⏰ There are 3 key daily times for market protraction: 0 GMT, 7 AM NY, & 8 PM NY.

- 🔼 Protraction often involves a counter-directional price swing to trick traders.

- ↕️ Blending impulse swings & time can identify manipulative protraction moves.

- 😠 Protractionary moves aim to reach for liquidity and take out stops.

- 🕑 A protractionary judas swing fakes traders into thinking a reversal.

- ⌛ You can use protraction concepts to anticipate moves around key times.

- 📈 Impulse swings show overall direction; protraction adds time context.

- 🤯 Protraction moves faster as it seeks liquidity from previous swing lows.

Q & A

What is an impulse price swing?

-An impulse price swing is a price movement from a high point to a low point and back to a high point, illustrating volatility and momentum in the market.

How is market protraction different from impulse price swings?

-Market protraction involves time-sensitive impulse price swings that occur at specific times of day, such as 0 GMT, when the London session opens, or 7 AM New York time. The goal is to manipulate trader sentiment at those key trading times.

What are the three primary protractionary market moves?

-The three primary protractionary moves are: 1) A 'raid' at 0 GMT, 2) A move after the London open, and 3) A move after 7 AM New York time when the US session opens.

What is the purpose of the initial move after midnight New York time?

-The initial move after midnight New York is meant to fake out traders who chase that initial move, drawing them into the wrong side of the market so liquidity can be reached.

How can you identify the London open protractionary move?

-If the market has moved lower in London, watch for a retracement higher right after the London open. This false rally is meant to manipulate sentiment.

What signals the New York protractionary move?

-A 'round up' off the London high right after 7 AM signals a protraction where price rallies to reach for liquidity before reversing down.

How can you trade protractionary moves?

-Anticipate the false move and trade in the opposite direction, selling into temporary strength or buying into temporary weakness.

Why does combining impulse swings and time help traders?

-It provides context - impulse swings show momentum while timed protraction reveals when manipulation is likely occurring.

Where can you apply these concepts?

-Session trading and session drills benefit from anticipating these moves. It builds price action skills.

What is the key difference between impulse swings and protraction?

-Protraction adds a time element - it anticipates manipulative moves at specific times of day, while impulse swings show general momentum.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

ICT Mentorship Core Content - Month 1 - Equilibrium Vs. Discount

MMXM Mentorship Episode 3: Failure Swings

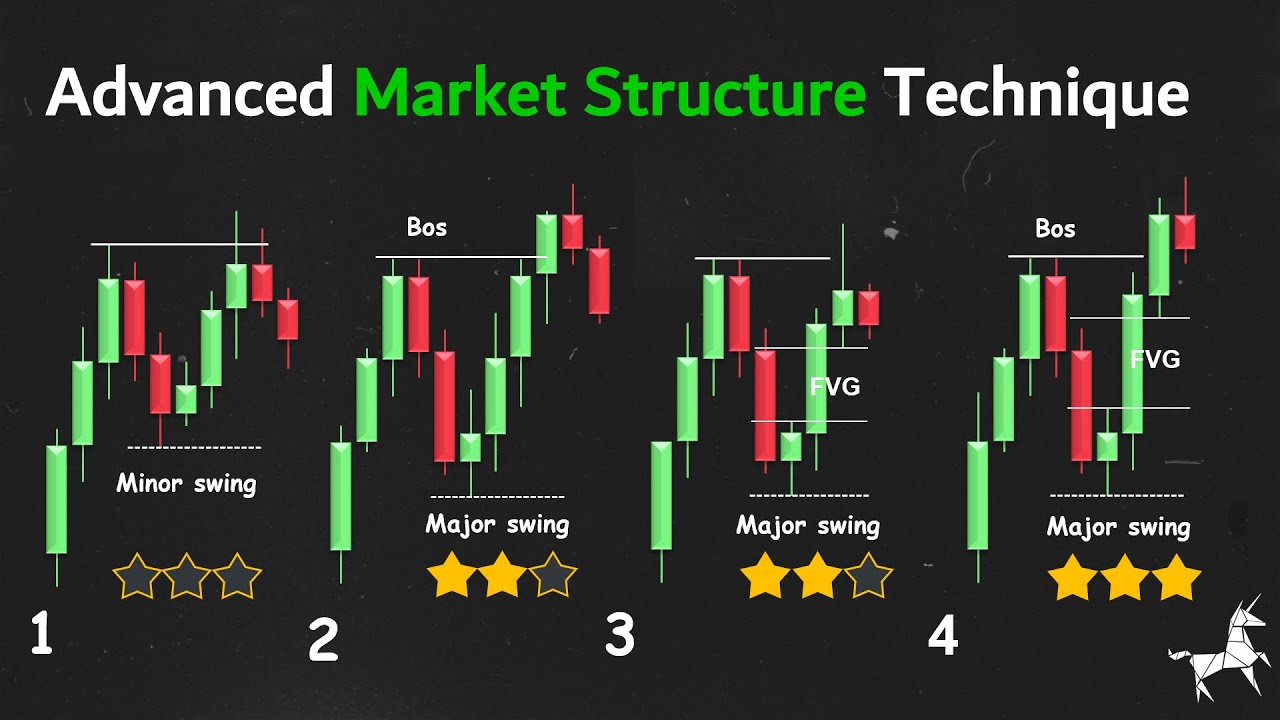

I Discovered Best Market Structure Analysis (Premium Video)

ICT Mentorship Core Content - Month 1 - Equilibrium Vs. Premium

How to project standard deviations

ICT Mentorship Core Content - Month 08 - Intraday Profiles

5.0 / 5 (0 votes)