【三中全会 | 下集】最隐晦的改革:消费税的镰刀 | 中国经济 | 消费税改革 | 新质生产力 | 内卷

Summary

TLDRThis video script discusses the intricate landscape of China's tax reforms, particularly focusing on the shift in consumption tax from production to consumption, and its implications for local governments and the public. It highlights the historical context of the 1994 tax reform, the rise and fall of land-based financing, and the potential challenges of the new tax policies. Additionally, it touches on China's push for high-tech industry self-reliance and critiques the potential inefficiencies and political motives behind such state-driven initiatives, while also hinting at Xi Jinping's potential continued leadership.

Takeaways

- 💄 A woman selling high-end cosmetics and a man selling luxury watches are in a relationship, and the story highlights various taxed items in China.

- 🚬 The script mentions several consumer taxes in China, including taxes on tobacco, alcohol, high-end cosmetics, fuel, and cars.

- ⛽ China's tax system is not transparent, making it difficult for citizens to understand their tax burden.

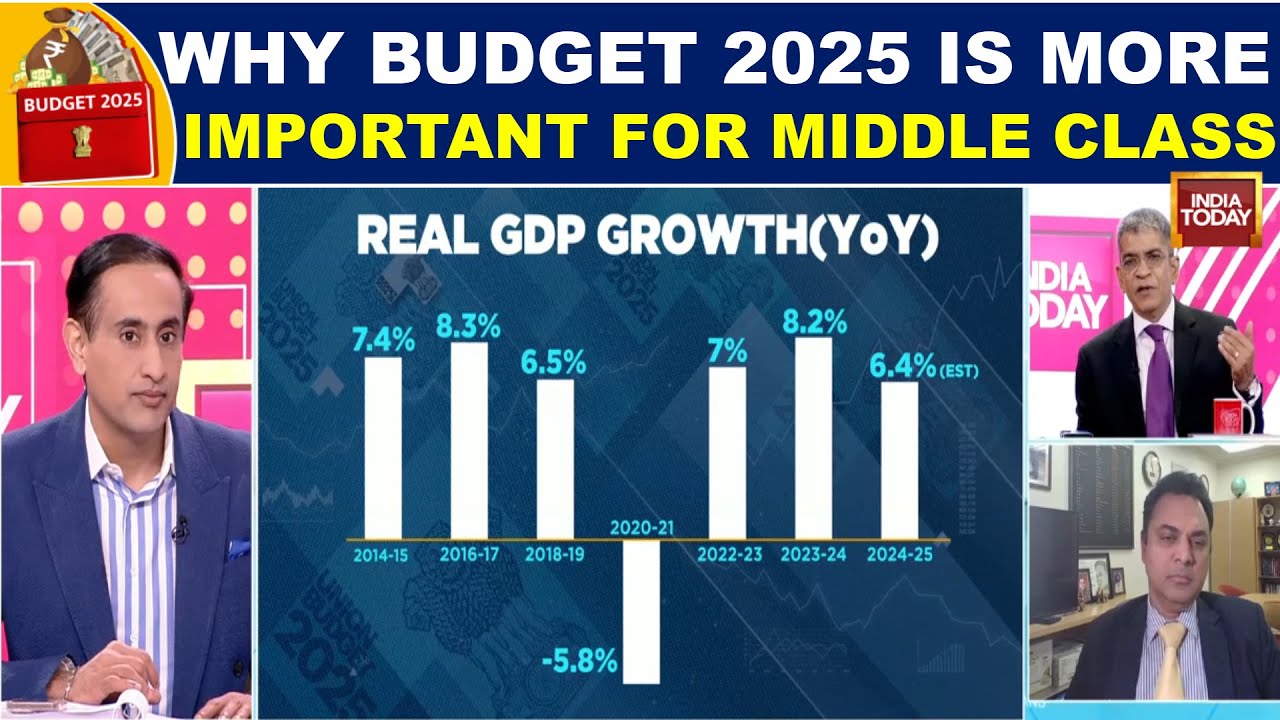

- 📊 The 1994 tax reform in China significantly shifted fiscal power to the central government, causing financial strain on local governments.

- 🏠 Local governments have relied heavily on land sales for revenue, but this source is now declining, affecting their ability to provide services.

- 💸 The new tax reform plans to move the collection of consumption taxes from the production stage to the point of sale and share the revenue between central and local governments.

- 📉 The decline in land sale revenue has put local governments under financial pressure, leading to issues like salary cuts for public service workers.

- 🛢️ The planned consumption tax reform could increase the tax burden on consumers and widen regional fiscal disparities.

- 🔋 The new policies include expanding the scope of consumption taxes to cover luxury services and high-end consumer goods.

- ⚡ The script discusses the government's push for self-sufficiency in high-tech industries, citing the success of the electric vehicle sector as an example.

Q & A

What is the main theme of the provided script?

-The main theme of the script is an analysis of China's fiscal and tax reforms, particularly focusing on consumption tax adjustments and the implications for local and central government finances, as well as the broader economic impact.

How does the story of the couple illustrate China's tax system?

-The story of the couple illustrates China's tax system by highlighting various consumption tax items such as tobacco, alcohol, luxury cosmetics, fuel, cars, batteries, and paints. The narrative shows how these taxes are embedded in everyday activities and expenses, reflecting the hidden nature of taxation in China.

What significant fiscal reform did China implement in 1994?

-In 1994, China implemented the tax-sharing reform, which restructured the fiscal relationship between central and local governments. This reform increased central government revenue significantly while placing substantial spending responsibilities on local governments.

What was the fiscal impact of the 1994 tax-sharing reform on central and local governments?

-The 1994 tax-sharing reform resulted in a significant increase in central government revenue, from 22% to 50% of total revenue by 2015. However, local governments, which received only half of the total revenue, were burdened with 85% of public expenditure responsibilities, leading to fiscal stress.

How did local governments in China respond to the fiscal pressure post-1994 reform?

-In response to fiscal pressure, local governments in China turned to land financing, relying heavily on the sale of land-use rights to generate revenue. This led to a boom in the real estate market and made land sales a crucial source of local government income.

What challenges are Chinese local governments facing with the decline in land sale revenues?

-With the decline in land sale revenues, Chinese local governments are facing significant fiscal challenges, including reduced income, difficulties in funding public services, and paying salaries for government employees. This has led to increased instances of illegal practices to raise funds and maintain operations.

What is the proposed change in the collection of consumption tax in China?

-The proposed change in the collection of consumption tax in China involves shifting the tax collection point from the production to the consumption stage and reallocating the tax revenue from being solely central to being shared between central and local governments.

What potential effects could the consumption tax reform have on different regions in China?

-The consumption tax reform could widen the fiscal disparity between regions. Wealthier, high-consumption provinces like Guangdong and Zhejiang could see increased revenues, while production-heavy, lower-consumption provinces like Hunan and Yunnan might suffer revenue losses.

What are the potential risks of moving consumption tax to the consumption stage?

-The potential risks of moving consumption tax to the consumption stage include the possibility of double taxation (taxing both production and consumption) and exacerbating regional fiscal imbalances, as well as increasing the tax burden on consumers.

What industries does China's new fiscal policy aim to support and why?

-China's new fiscal policy aims to support industries such as new-generation information technology, artificial intelligence, aerospace, new energy, new materials, high-end equipment, biomedicine, and quantum technology. This support is intended to foster innovation, reduce dependence on Western technology, and build a self-reliant industrial and supply chain.

What has been a notable success of China's government-supported industry, and what lessons does it offer?

-A notable success of China's government-supported industry is the rapid growth of the electric vehicle sector, making China the world's largest producer and consumer of electric vehicles. This success highlights the potential benefits of targeted government subsidies but also warns against the risks of trade retaliation and market distortions.

What concerns are associated with China's approach to fostering high-tech industries?

-Concerns associated with China's approach include the risk of creating speculative bubbles, inefficient allocation of resources, and the potential for corruption and fraud, as seen in the semiconductor industry's rapid but unstable growth. These issues reflect the limitations of a planned economy versus market-driven innovation.

How does the script describe the potential impact of the consumption tax reform on ordinary Chinese citizens?

-The script describes the potential impact of the consumption tax reform on ordinary Chinese citizens as likely increasing their tax burden. While intended to boost consumption and local government revenues, the reform may result in higher prices for consumers and deepen economic disparities.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

Should we tax the rich more?

【消費税のウソ】国が憲法違反⁉の可能性〜インボイス導入で見えた本当の目的を丸裸に〜

Chinese economist explains how China's economy works | Keyu Jin and Lex Fridman

Budget Analysis 2025: GST Collections Grow Slower Than GDP, Consumption Patterns Shift In India

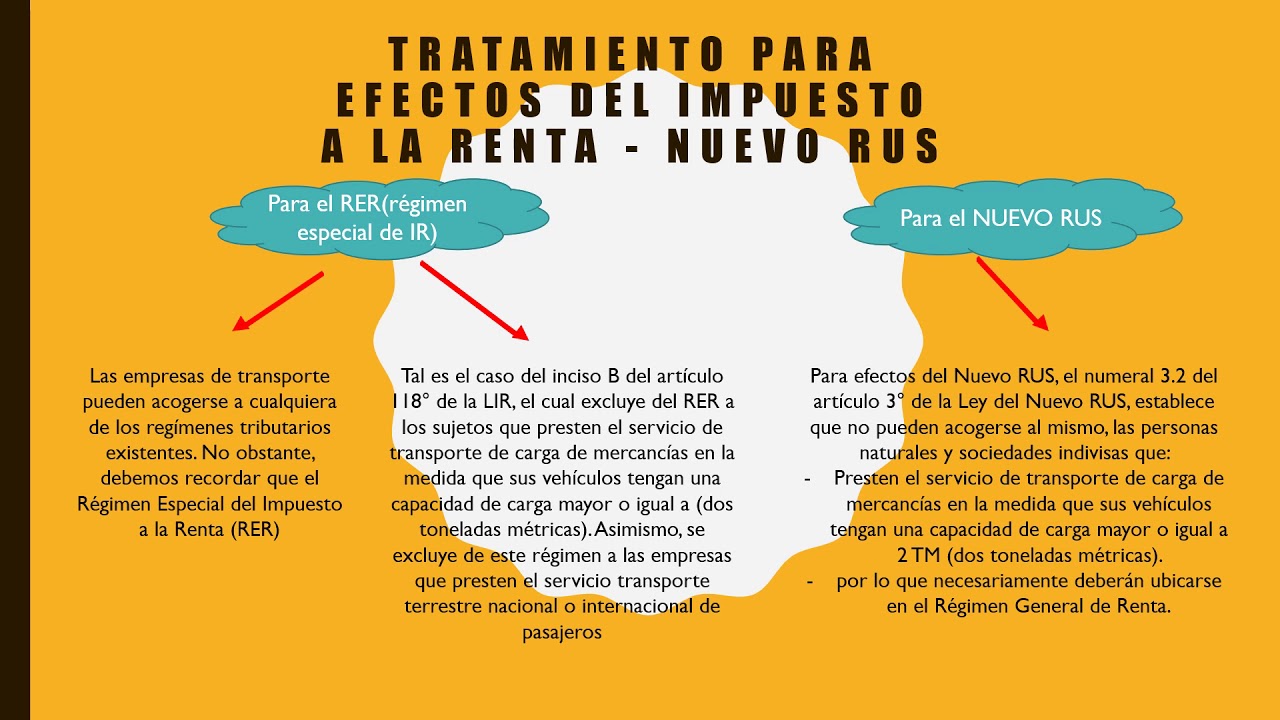

Aspecto tributario de las empresas de transporte

【あと1年半後】全事業者、消費税インボイス改正。大増税で免税事業者は排除へ!廃止論は?【個人事業主・フリーランス・法人/確定申告制度/経過措置・2割特例・簡易・本則/2026/わかりやすく】

5.0 / 5 (0 votes)