12 Easy Ways To MAXIMISE Your Australian Tax Return in 2024

Summary

TLDRThis video offers 12 strategies to legally reduce tax in Australia, including utilizing progressive tax rates, maximizing deductions for work from home, vehicles, and tools, and understanding capital gains tax rules. It also covers the benefits of extra super contributions, spouse super contributions, debt recycling, negative gearing, private health insurance, instant asset write-off for small businesses, and consulting a tax accountant. As a bonus, the First Home Super Saver scheme is introduced to help first-time homebuyers save for a deposit while saving on tax.

Takeaways

- 📊 Utilize Australia's progressive tax system to save on tax by investing under the name of the partner with lower income to benefit from lower tax brackets.

- 💹 Take advantage of the new FY 25 tax rate changes announced by the Australian government, which will decrease tax rates for the second and third brackets and increase thresholds for higher brackets.

- 🏠 Claim work from home deductions by using the revised fixed rate method (67 cents per hour) or the actual cost method, ensuring to keep accurate records of additional expenses incurred.

- 🚗 Save tax by claiming motor vehicle deductions for work-related trips, using either the cents per kilometer method or the log book method, depending on which provides a better refund.

- 🔧 Claim deductions for tools, computers, and other work-related items, ensuring not to double dip on expenses already claimed under other categories.

- 💼 Maximize tax savings with occupation-specific deductions and keep records organized using the my deductions tool on the ATO app.

- 🏦 Understand capital gains tax rules, including the 50% discount for assets held over 12 months and strategies like tax loss harvesting to offset gains with losses.

- 💪 Make extra super contributions to save tax, with the new annual concessional contribution cap of $30,000 effective from July 2024.

- 🤝 Consider spouse super contributions to save tax and boost your spouse's superannuation, especially if their income is less than $40,000.

- 🏡 Explore debt recycling to save tax by making extra repayments on a non-tax deductible home loan and then drawing money back out to invest, turning the interest payments into tax deductible.

- 💡 Utilize negative gearing for investment properties to reduce taxable income, but be aware of the risks and potential law changes affecting this strategy.

Q & A

How can utilizing Australia's progressive tax system help save on taxes?

-By investing under the name of the partner with a lower income, the tax on investments like shares can be calculated at a lower rate, resulting in significant tax savings.

What changes to individual income tax rates are expected starting from FY25 in Australia?

-Starting from July 2024, the tax rate for the second and third brackets will decrease, and the thresholds for the fourth and fifth brackets will also increase, which will benefit most Australians by allowing them to retain more of their income.

How can working from home affect your tax deductions?

-If you work from home, you may be eligible to claim deductions for additional running expenses such as home and mobile internet, phone usage, electricity, gas, stationary, and computer consumables, using either the revised fixed rate method or the actual cost method.

What are the two methods to calculate deductions for car expenses when using your vehicle for work?

-The two methods are the cents per kilometer method, where you can claim 85 cents per kilometer for work-related travel, and the log book method, where you record your work-related trips for at least 12 weeks to calculate the deduction.

What is the significance of the 50% capital gains discount in Australia?

-The 50% capital gains discount applies when you sell an asset that has increased in value, provided you've held the asset for more than 12 months. This significantly reduces the capital gains tax payable.

How can making extra super contributions lead to tax savings?

-Making additional payments into your superannuation account can result in tax savings because concessional contributions are taxed at a lower rate of 15%, which is typically lower than most people's marginal tax rates.

What is the benefit of spouse super contributions in terms of tax savings?

-Contributing to your spouse's superannuation fund can save tax, especially if their income is less than $40,000. You could claim a tax offset of up to $540 by contributing $3,000 to their super.

How does debt recycling work as a tax-saving strategy?

-Debt recycling involves making extra repayments into a non-tax-deductible home loan and then drawing money back out to invest. The interest on the portion of the loan used for investment becomes tax-deductible, potentially saving on taxes.

What is negative gearing and how can it be used to reduce tax?

-Negative gearing occurs when the expenses associated with an investment asset are greater than the income from that asset. The resulting loss can be used to lower the investor's taxable income, providing a tax benefit.

How can private health insurance help in saving tax in Australia?

-Having an appropriate level of private hospital cover can help avoid the Medicare Levy Surcharge, which is an additional tax applied to those earning over certain income thresholds.

What is the instant asset write-off rule for small businesses in Australia?

-The instant asset write-off rule allows small businesses with a turnover of less than $10 million to deduct the full cost of eligible assets costing less than $20,000, provided they are first used or ready for use between 1st of July 2023 and 30th of June 2025.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

18 DEDUCTIONS to MAXIMISE REFUND & Pay Less Tax in 2025 (Australia)

Do this To Legally Pay LESS TAXES in Australia

1 1 5 Different Direct Tax Laws 2

Gain from Stock market? Pay Zero tax | LTCG | STCG | Save Capital Gain Tax on Stock market gain

How The Australian Tax System Works in 2024 (Explained in 5 Minutes)

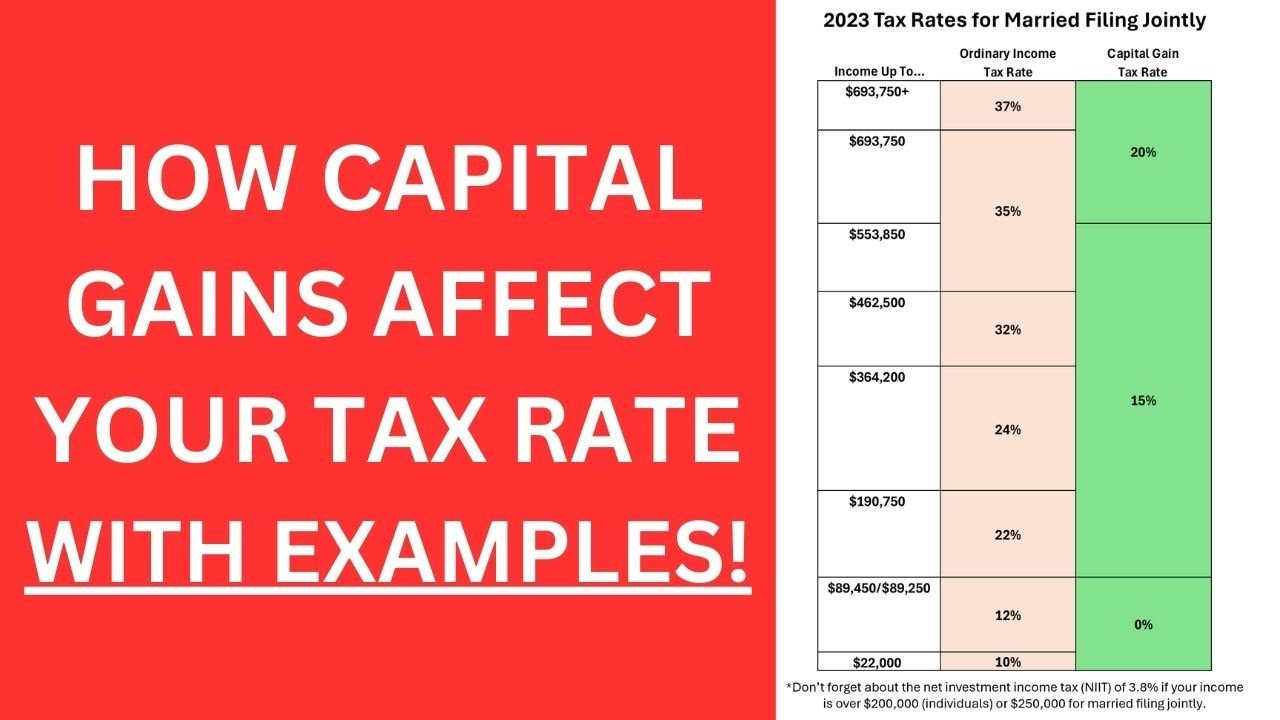

NEW! - Can Capital Gains Push Me Into a Higher Tax Bracket?

5.0 / 5 (0 votes)