BCG Matrix (Growth Market Share Matrix) | Hindi

Summary

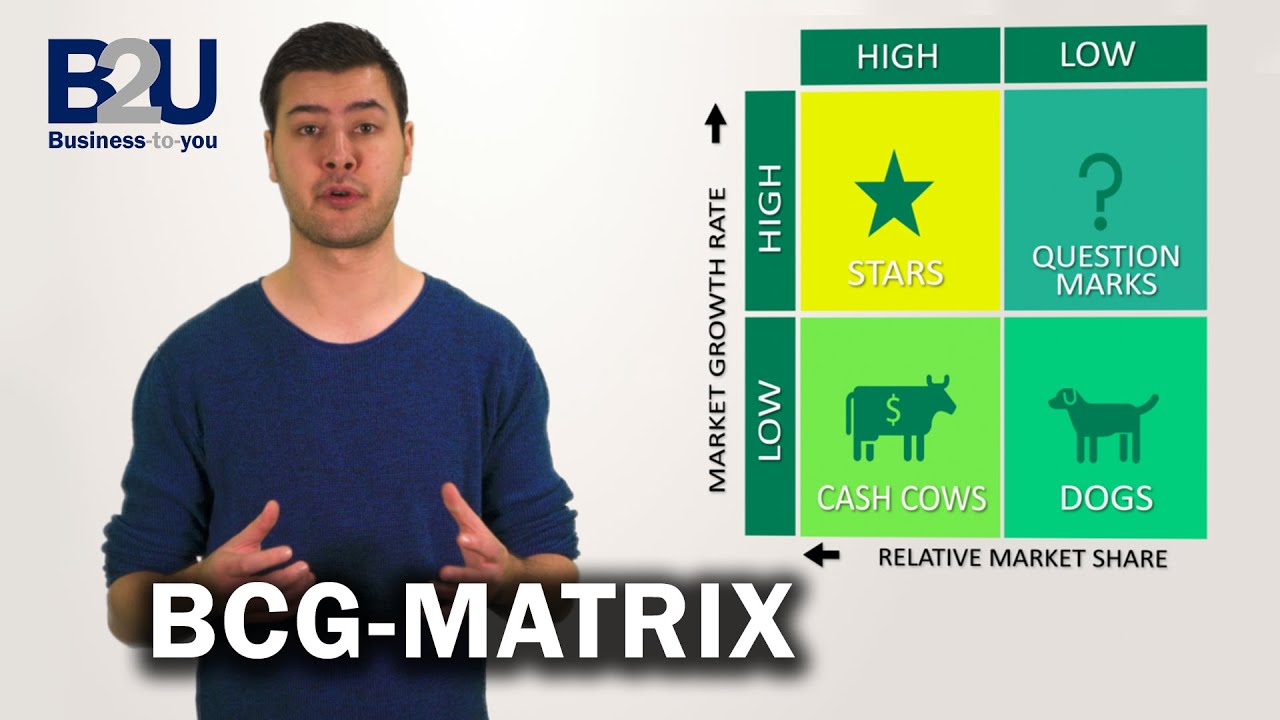

TLDRThe video script by Sahil Khanna from Intellectual Indies explains the BCG Matrix, a tool for evaluating a company's product lines based on market share and growth rate. It categorizes products into Stars, Question Marks, Cash Cows, and Dogs, guiding businesses on investment strategies. Stars, with high growth and market share, are profitable but costly, while Cash Cows offer steady returns with low growth. Question Marks have potential but are uncertain. Dogs lack both growth and market share and are typically not worth investing in. The matrix helps in strategic planning to maximize profits and avoid unproductive investments.

Takeaways

- 🔔 Subscribe to Intellectual Indies and press the bell icon to never miss an update.

- 📊 The BCG Matrix helps identify and categorize product lines based on market share and growth rate.

- ⭐ High market share and high growth rate products are called Stars, which are profitable but also require high investment.

- ❓ Products with low market share but high growth rate are called Question Marks, as their future performance is uncertain.

- 💵 Cash Cows have high market share but low growth rate, providing steady income with minimal investment needed.

- 🐶 Products with low market share and low growth rate are termed Dogs, and it's generally advised not to invest in them.

- 💸 Investing in Stars can be beneficial, but it comes with high expenses.

- 📈 Cash Cows generate revenue that can be reinvested into other products.

- 📉 Dogs are often in the declining phase of the product life cycle and are not worth further investment.

- 🔄 Question Marks have the potential to become Stars with increased investment and growth.

- 📦 The BCG Matrix is different from the product life cycle as it considers all product lines together, not just one product.

- 🚀 New products start as Question Marks and may transition to Stars if they perform well in the market.

Q & A

What is the BCG matrix and what does it represent?

-The BCG matrix, also known as the Boston Consulting Group matrix, is a tool for portfolio analysis and planning that helps businesses to understand the market position of their product lines. It represents a graph of growth rate and market share, categorizing products into Stars, Question Marks, Cash Cows, and Dogs.

What are the four categories of products in the BCG matrix?

-The four categories are Stars, which have high market share and growth rate; Question Marks, which have low market share but high growth rate; Cash Cows, which have high market share but low growth rate; and Dogs, which have low market share and low growth rate.

Why are products with high growth rate and low market share called Question Marks?

-Products are called Question Marks because their future performance is uncertain. They have high potential for growth but are not yet well-established in the market, hence the need for further investment and observation.

What does the term 'Cash Cow' imply in the context of the BCG matrix?

-In the BCG matrix, 'Cash Cow' refers to products that have a high market share but are in a slow or stagnant growth phase. These products generate steady cash flow that can be reinvested in other areas of the business.

How does a company decide whether to invest in a product that falls under the Dog category?

-According to the script, products in the Dog category should generally not be invested in because they have low market share and growth rate, indicating a lack of interest from consumers. It's better to remove such products from the product line.

What is the ultimate goal of a company in terms of its product lines according to the BCG matrix?

-The ultimate goal is to have as many products as possible in the Star category, as these products are both profitable and have high growth potential, although they may require high expenses.

How can a company identify which product line should be invested in or not, using the BCG matrix?

-The BCG matrix helps identify the position of each product line and suggests whether to invest in it based on its market share and growth rate. Products in the Star and Question Mark categories may require investment to grow, while Cash Cows can provide funds for reinvestment.

What is the potential trajectory of a product categorized as a Question Mark in the BCG matrix?

-A product in the Question Mark category has the potential to move to the Star category if it receives the necessary investment and successfully increases its market share while maintaining high growth rate.

How does the BCG matrix differ from the product life cycle?

-The BCG matrix focuses on the entire product line and their market positions in terms of growth rate and market share, while the product life cycle looks at the stages of a single product's life from introduction to decline.

What advice does the speaker give regarding products in the Dog category, specifically in the context of the Indian market?

-The speaker suggests avoiding products in the Dog category for the Indian market, as there is no niche market large enough to justify the investment in such products, which typically have low market share and growth rate.

What is the speaker's final recommendation for viewers who have doubts about the BCG matrix?

-The speaker encourages viewers with doubts to ask questions in the comments section of the video, and also invites them to like, share, and engage with the content.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

5.0 / 5 (0 votes)