My Incredibly Easy 20 Pips a Day Trading Strategy

Summary

TLDRThis video introduces an easy Forex trading strategy targeting 20 Pips daily profits using the Euro USD currency pair on a 50-minute chart. It emphasizes the importance of account size in risk management, advocating for a 1:2 risk-to-reward ratio. The presenter demonstrates how to use a Forex calculator to determine the appropriate lot size for trades. The strategy relies on the Chaikin Money Flow (CMF) indicator and the 100-period moving average for entry and exit signals, showcasing how these indicators can be used to identify buying and selling opportunities in the market.

Takeaways

- 😉 An easy trading strategy is presented for making hundreds of dollars daily in the Forex market, targeting 20 Pips.

- 💰 Account size significantly impacts trading decisions, with risk management being crucial regardless of the account balance.

- 📉 Risking 2% of the trading account is suggested, with potential losses varying based on the account size: $2 for $100, $20 for $1,000, and $200 for $10,000.

- 🎯 Profit targets should be at least double the risk, aiming for 4% profit to maintain a 1:2 risk-to-reward ratio for sustainability.

- 🔢 The Forex Time.com calculator is highlighted as a useful tool to determine the appropriate lot size for trades based on pip goals and account size.

- 📊 The Chen Money Flow (CMF) indicator and the 100-period moving average are the key technical indicators used in this strategy for trade confirmation.

- 📈 CMF crossing above zero signals buying pressure, while crossing below indicates selling pressure, used in conjunction with the 100-period moving average for trend confirmation.

- 📉 A bearish market example is given, detailing how to identify a selling opportunity using the CMF indicator and price action relative to the moving average.

- 📈 A bullish market scenario is also described, explaining the conditions for a buying opportunity and the importance of analyzing higher time frames.

- 🚀 The script includes a live trade example demonstrating the strategy's effectiveness, resulting in a 20 Pip profit and $200 gain.

- 🔗 The video encourages viewers to join a trading community for further insights and support, with a link provided in the description.

Q & A

What is the proposed trading strategy in the script?

-The proposed trading strategy is an easy method to make hundreds of dollars a day in the Forex market, specifically targeting 20 Pips with the Euro USD on a 50-minute chart.

Why is account size important in Forex trading?

-Account size is important because it directly influences trading decisions and risk management, particularly when targeting specific Pips like 20 a day.

What does risking 2% of the trading account mean in terms of potential loss per trade?

-Risking 2% of the trading account means the potential loss per trade would be $2 for a $100 account, $20 for a $1,000 account, or $200 for a $10,000 account.

What is the profit objective based on the risk percentage mentioned in the script?

-The profit objective should be at least double the risk percentage, aiming for a 4% profit if risking 2% of the account.

How does the script suggest determining the lot size for trades?

-The script suggests using a Forex time.com calculator to determine the lot size by entering the number of Pips and adjusting the trade size until the desired profit amount is shown.

What indicators are used in the described trading strategy?

-The indicators used in the trading strategy are the Chaikin Money Flow (CMF) and the 100-period moving average.

How does the Chaikin Money Flow (CMF) indicator help in capturing trading opportunities?

-The CMF indicator measures the flow of money into and out of currency pairs, reflecting market buying and selling pressure, and helps in identifying strong buying or selling signals when it crosses above or below zero.

What role does the 100-period moving average play in the trading strategy?

-The 100-period moving average helps in confirming the trend direction, providing an additional signal for entering trades when the price is above the moving average for an uptrend or below for a downtrend.

Can you provide an example of how the trading strategy was applied in a real trade?

-In one example, the trader noticed a bearish overall market direction with the price making lower highs and lows, and a squeeze pattern on the 50-minute chart. The trade was entered when the CMF indicator dropped below zero and the price broke an uptrend line, aiming for a 20 Pip profit.

What is the significance of the 1:2 risk-to-reward ratio mentioned in the script?

-The 1:2 risk-to-reward ratio is significant as it ensures that the trading strategy is focused on sustainability and growth, always targeting a reward worth twice the risk taken.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

How to Calculate Pips in Forex

Best Scalping Strategy For Day Trading Forex (with backtest)

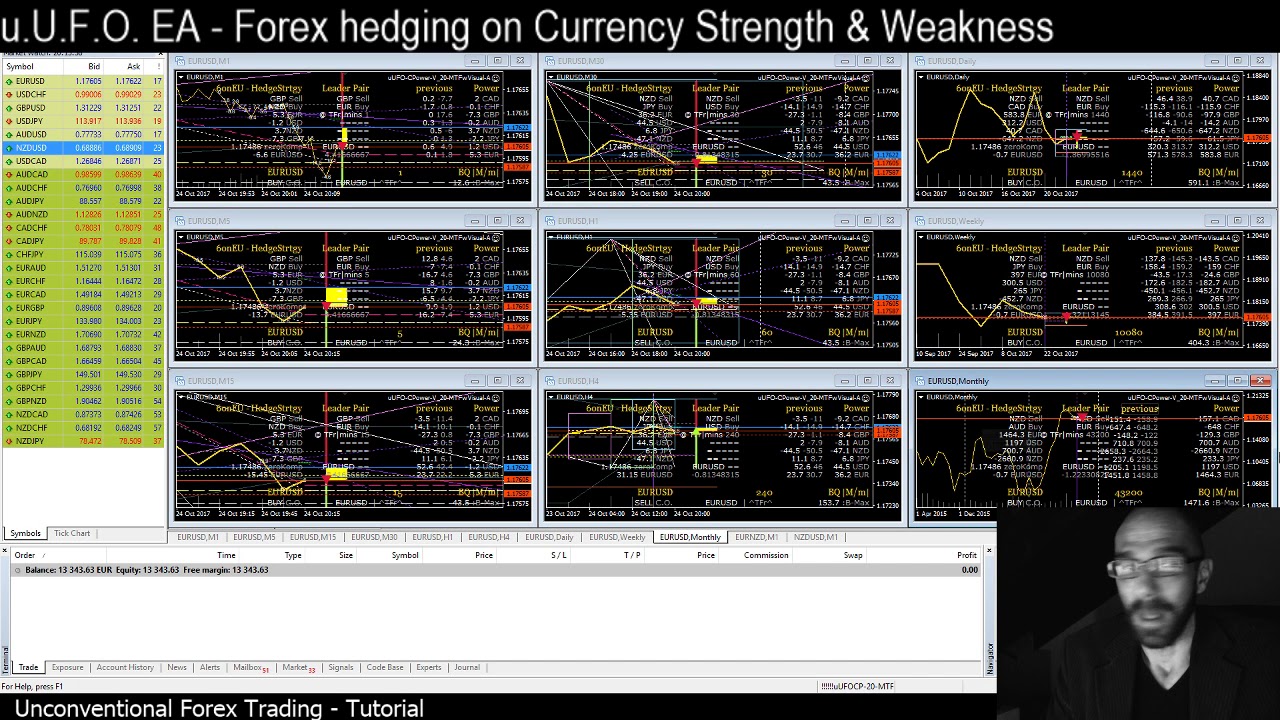

Forex math based formula application - MT4 - uUFO-EA: foreign currency hedging strategy explained.

Grid Trading Strategy! Always Win Strategy? Good or Bad? All you need to know

How To Trade Forex For Beginners in 2024 | Full Tutorial

(PART 1) PANDUAN TERLENGKAP TRADING FOREX UNTUK PEMULA

5.0 / 5 (0 votes)