Session 3: The Risk Free Rate

Summary

TLDRThis session delves into the concept of the risk-free rate, a fundamental component in asset valuation. It emphasizes the importance of selecting a risk-free rate that aligns with the investment's time horizon and currency, and discusses the challenges of identifying truly risk-free investments. The transcript guides through the process of estimating a risk-free rate, considering factors like government bond rates, default risk, and reinvestment risk, ultimately highlighting the need for a nuanced approach when dealing with different currencies and economic contexts.

Takeaways

- 📈 The risk-free rate is a fundamental concept in asset valuation, representing the return on an investment with no risk of default.

- 🔍 Estimating a risk-free rate often starts with looking at government bond rates, but one must ensure the issuing entity has no default risk.

- 🌐 Different currencies may have different risk-free rates due to varying perceptions of default risk among governments.

- 💡 Discount rates are important in cash flow valuation, but the focus should be more on estimating cash flows accurately rather than just on the discount rate.

- 💰 The cost of equity should be higher for riskier investments compared to safer ones, reflecting the additional risk undertaken by investors.

- 📊 Traditional finance measures risk using statistical measures like standard deviation and volatility, often based on stock prices.

- 🌟 The marginal investor, typically a diversified investor with significant holdings, sets the stock price and perceives the company's risk.

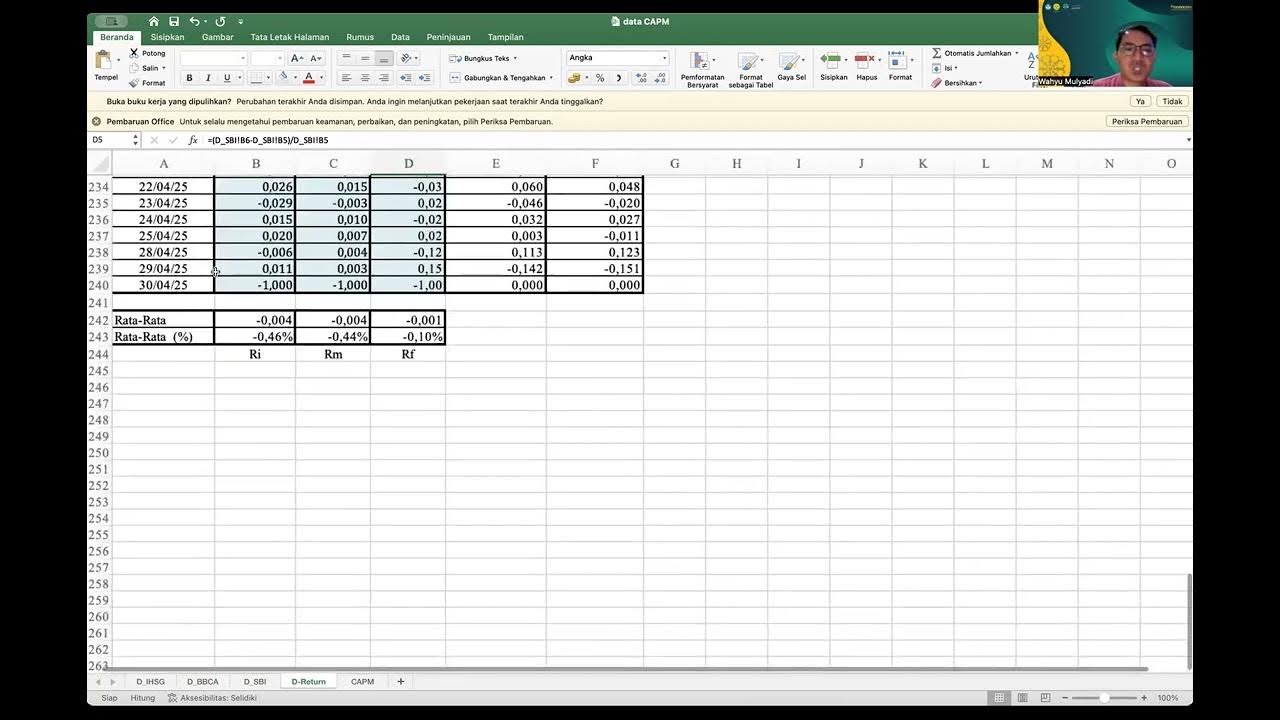

- 📚 Risk and return models, such as the Capital Asset Pricing Model (CAPM), Arbitrage Pricing Model (APM), and multi-factor models, all require a risk-free rate as a base input.

- 🏦 For a security to be considered risk-free, it must have no default risk and no reinvestment risk, matching the time horizon of the cash flows being discounted.

- 💼 The choice of risk-free rate should align with the currency and time horizon of the cash flows being evaluated in a valuation.

- 🔑 Converting a government bond rate to a risk-free rate involves estimating a default spread, which can be derived from dollar-denominated bonds, credit default swaps, or sovereign ratings.

Q & A

What is the fundamental question to answer when valuing an asset?

-The fundamental question is 'What can you make on a guaranteed investment?' The answer to this question is known as the risk-free rate.

Why is the risk-free rate important in valuation?

-The risk-free rate is important because it serves as the base rate from which the expected return on any investment is calculated, especially in the context of cash flow valuation.

What is the common approach to estimate the risk-free rate?

-The common approach is to look up a government bond rate, such as the US Treasury bond rate, as a proxy for the risk-free rate.

Why might using a government bond rate be insufficient to determine a risk-free rate?

-Using a government bond rate might be insufficient because it assumes the issuing entity has no default risk, which may not always be the case, especially in different parts of the world.

What are the two consistency principles mentioned in the script for valuation?

-The two consistency principles are: 1) If you have cash flows to equity, ensure your discount rate is the cost of equity. 2) If you have cash flows to the business, ensure the discount rate used is the cost of capital.

What does it mean to evaluate cash flows in 'real terms'?

-Evaluating cash flows in 'real terms' means ignoring inflation, so when forecasting cash flows, the price is assumed not to go up even if there's inflation.

Why is the currency important when estimating cash flows?

-The currency is important because it affects the nominal cash flows and the corresponding discount rate. Once the currency for cash flows is chosen, the discount rate must be in the same currency.

How do you measure risk in traditional finance models?

-In traditional finance models, risk is often measured using statistical measures such as standard deviation, volatility, and beta, which are based on stock prices.

What are the characteristics needed for an investment to be considered risk-free?

-For an investment to be risk-free, the issuing entity must have no default risk, and there should be no reinvestment risk associated with the investment.

Why might the 10-year government bond rate be preferred over the 30-year bond rate for estimating the risk-free rate?

-The 10-year government bond rate might be preferred because it is easier to find other inputs for the valuation model, such as default spreads and equity risk premiums, which are more readily available for the 10-year maturity.

How can you estimate a default spread for a country without a CDS spread or dollar-denominated bonds?

-If a country does not have a CDS spread or dollar-denominated bonds, you can use a lookup table based on sovereign ratings to estimate the default spread, which can then be used to adjust the government bond rate to a risk-free rate.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

Session 5: Estimating Hurdle Rates - The Risk free Rate

Session 2: Intrinsic Value - Foundation

Teori Portofolio dan Analisis Investasi sesi 12 ( Menghitung Capital Aset Pricing Model)

Understanding Risk in Business Valuation

Sponsorship Valuation Templates

Risk Return & Portfolio Management | CA Final SFM (New Syllabus) Classes & Video Lectures

5.0 / 5 (0 votes)