Kerangka Dasar Laporan Keuangan

Summary

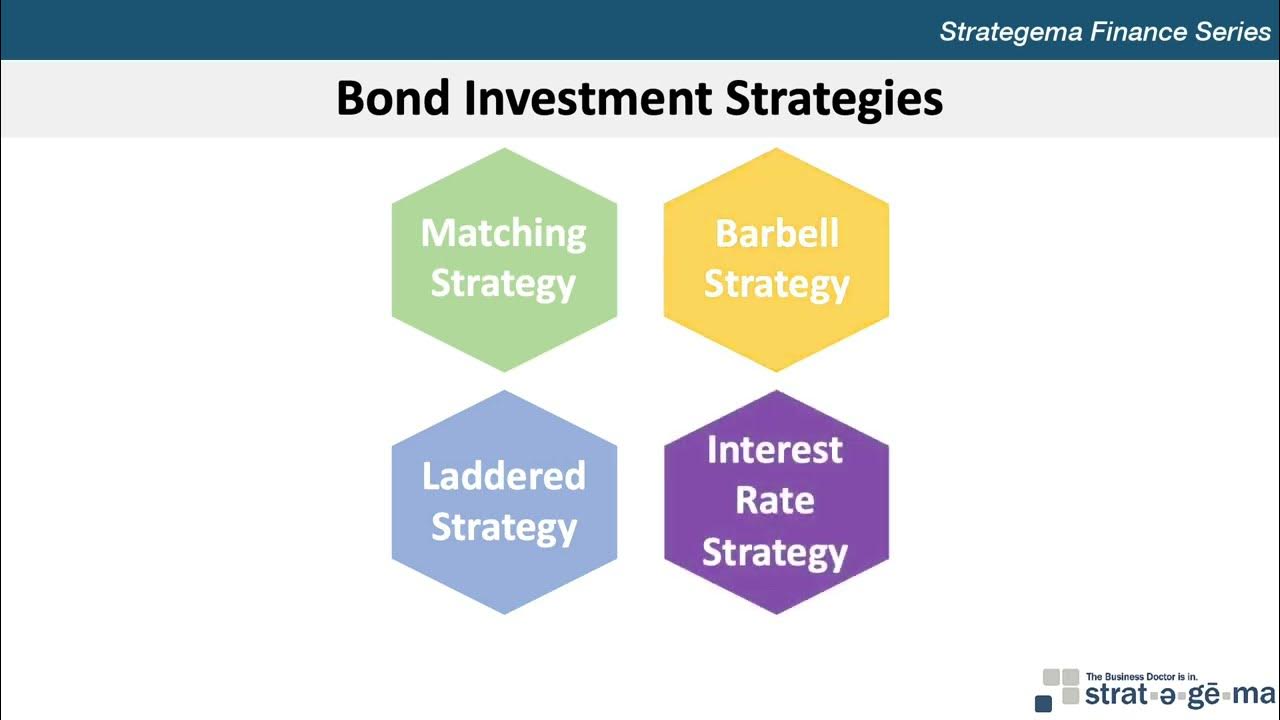

TLDRThis transcript discusses various methods of financial measurement, using examples such as land purchase, sale, and bond valuation. It explores concepts like historical cost, market value, realization value, and present value, highlighting how these are applied to transactions like land sales and bond investments. The script emphasizes the importance of understanding these financial measurements in the context of business and investment, drawing attention to the impact of time value of money. Additionally, it touches on the concepts of capital maintenance from both financial and Islamic perspectives.

Takeaways

- 😀 The script discusses the different methods for valuing transactions in accounting, including historical cost, fair value, and realizable value.

- 😀 It uses the example of land purchased in 2001 for 10 million and its changing value over time to demonstrate the application of these valuation methods.

- 😀 Historical cost is used for reporting the land's original price (10 million) in the financial statements as of 2020.

- 😀 Fair value is highlighted with an example where the land's market price in 2020 is 25 million, showing how current market conditions affect asset value.

- 😀 Realized value is explained by a transaction in 2022 where the land is sold for 18 million, showing the actual selling price of the asset.

- 😀 The importance of present value is discussed, especially in the context of buying bonds with future payments over an extended period (e.g., 20 years).

- 😀 Present value accounts for the time value of money, indicating that the current value of a future 20 million debt is less than its nominal value due to inflation and interest rates.

- 😀 The concept of capital maintenance is explored, with a focus on the value of assets owned by a company beyond just cash, including physical assets like machinery.

- 😀 The script mentions the Islamic finance perspective, emphasizing fairness, ethical transactions, and the role of syariah principles in business practices.

- 😀 It highlights the importance of understanding both financial and physical assets in a company’s valuation and overall capital maintenance strategy.

- 😀 There is also a mention of public and non-public transactions, touching on the regulatory frameworks in Islamic finance for non-public businesses.

Q & A

What is the concept of historical cost in accounting?

-Historical cost refers to the original price paid for an asset at the time of purchase. In the example, the land bought in 2001 for 10 million is reported at this original cost in the 2020 financial statements, regardless of any changes in its market value over time.

How does fair value differ from historical cost?

-Fair value reflects the current market price of an asset, as opposed to historical cost which only accounts for the original purchase price. For instance, while the land purchased in 2001 for 10 million has a fair value of 25 million in 2020, fair value adjusts to market conditions, unlike historical cost which remains fixed.

What is realization value and when is it used?

-Realization value is the actual amount that a company receives from selling an asset. It is the value at which the asset is transacted. In the case of the land, despite its fair market value being 25 million in 2020, the land was actually sold for 18 million in 2022, making the realization value 18 million.

Why is present value important in financial accounting?

-Present value is crucial because it calculates the current worth of future cash flows, adjusting for the time value of money. For example, if a company buys a 20 million bond with a 2% interest rate to be paid over 10 years, the present value would be less than 20 million, reflecting the decrease in value over time.

How does the time value of money affect asset valuation?

-The time value of money means that money today is worth more than the same amount in the future due to its potential to earn returns. Therefore, future amounts are discounted to reflect their reduced present value. This concept is used to assess the present value of assets or liabilities like bonds or long-term investments.

What example is provided to illustrate historical cost in the transcript?

-The example provided is a piece of land purchased by the company in 2001 for 10 million. When the company prepares its financial statement in 2020, the land is still listed at the original purchase price of 10 million, which is the historical cost.

What does fair value imply about an asset's market condition?

-Fair value reflects an asset's current market price. It indicates the amount a seller could expect to receive if the asset were sold at that moment. In the example, although the land was purchased for 10 million in 2001, its fair value in 2020 is 25 million based on current market conditions.

How does the concept of capital maintenance differ from just measuring money in the company?

-Capital maintenance looks beyond just the money owned by the company. It includes the ability of the company to effectively use its assets, such as machinery or production equipment, to generate value. This reflects not only financial resources but also the productive capacity of the company.

What role does Islamic finance play in the context of asset management and transactions?

-Islamic finance principles emphasize fairness, justice, and mutual benefit in transactions. It stresses the importance of not only monetary value but also the ethical considerations in managing assets. The system encourages companies to consider both financial and social benefits when conducting business.

How does the present value calculation apply to long-term debt like bonds?

-For long-term debt such as bonds, present value is used to determine the current worth of the bond's future payments, discounted by interest rates. In the example, a bond with a nominal value of 20 million and a 2% interest rate over 10 years would have a present value less than 20 million due to the time value of money.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

MGT201 Short lectures || MGT2021 GUESS PAPER || Mgt201 new syllabus short lectures | Mgt201 lectures

Bond Valuation and Risk

Tips Hukum: Yang Perlu Diperhatikan Ketika Membeli Tanah dan Bangunan

Simulasi Transaksi Akad Jual Beli Tanah Berbasis Syariah (akad mudrabahah) oleh Kelompok 2

How to BUY your First Home in 2025

What is Company Valuation? || How to Calculate Company Valuation? || Company Valuation in Hindi

5.0 / 5 (0 votes)